- The US jobs figures for February showed weaker wage growth.

- PMI data from the UK showed an increase in construction activity.

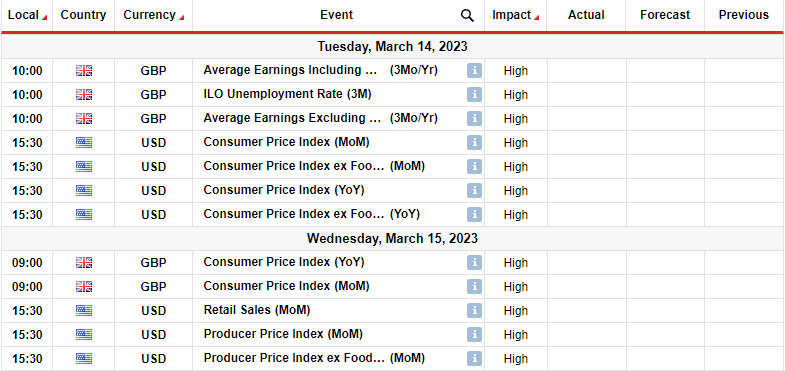

- Investors are expecting inflation figures from the US and the UK.

The GBP/USD weekly forecast is slightly bullish as the US labor market starts showing cracks amid high interest rates.

Ups and downs of GBP/USD

PMI data from the UK showed increased construction activity at its fastest pace in nine months. This eased concerns that the UK economy was tipping into recession.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The US jobs figures for February showed weaker wage growth, suggesting that a decline in inflationary pressures may keep the Federal Reserve’s rate increases modest. The pound rose on Friday as a result.

Although the US economy created jobs swiftly in February, slower pay growth and an increase in the unemployment rate have caused financial markets to drop expectations for a 50-basis point Fed hike.

The dollar was strengthened by Powell’s aggressive congressional remarks earlier in the week. The job postings and private employment data provided more support. However, investors began noticing cracks in the labor market when the initial unemployment claims came in far higher than anticipated.

Next week’s key events for GBP/USD

Investors are expecting employment data from the UK. They will, however, pay more attention to inflation figures from the US and the UK. The mixed US jobs report from Friday dampened hopes for significant rate increases.

A hotter-than-expected consumer price report on Tuesday, though, would revive expectations of big Fed rate hikes like those that rattled the markets last year.

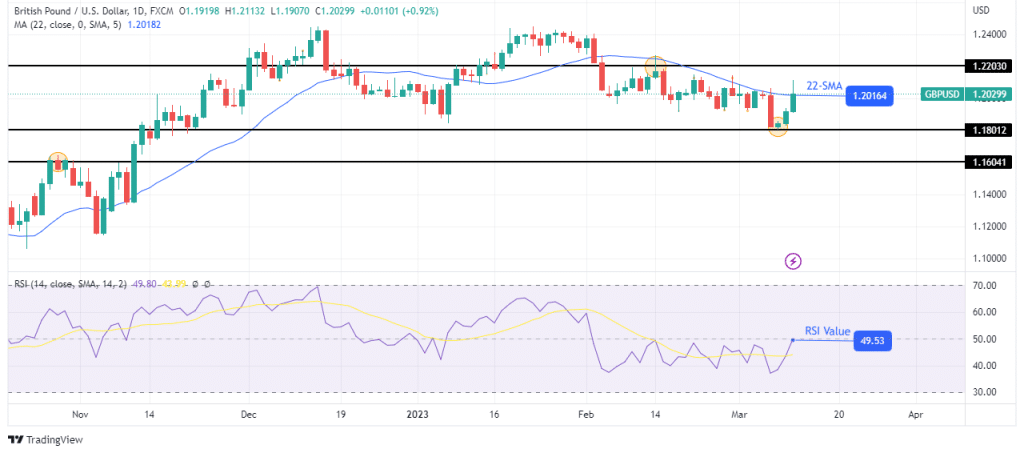

GBP/USD weekly technical forecast: Bulls challenging the weak downtrend

The daily chart shows GBP/USD trading at the 22-SMA with the RSI slightly below 50. This is a sign that bears are still in control but are being challenged by bulls at the 22-SMA. Bears have controlled the market since the price broke below the 22-SMA and the 1.2203 key level.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

However, the price has been choppy and trading close to the SMA. The bears have not yet committed to the new downtrend. Bulls started showing strength when the price got to the 1.1801 support level.

Currently, the bulls are attempting a break above the 22-SMA. Success could mean a shift in sentiment. The bulls need to break above the 1.2203 level to confirm a takeover.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money