- The Fed delivered a 25bps rate hike on Wednesday.

- US pay and employment growth picked up in April.

- The services sector in Britain experienced the fastest growth in a year in April.

The GBP/USD weekly forecast is bullish as investors expect a rate hike of 25 bps in the upcoming BOE policy meeting.

Ups and downs of GBP/USD

The pound had a bullish week after several UK and US data releases. The major catalysts of last week’s move included the FOMC meeting, UK PMI data, and Friday’s US jobs data.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

The Fed delivered a 25bps rate hike on Wednesday and hinted that it would soon halt its monetary tightening campaign.

US pay and employment growth increased in April, indicating ongoing strength in the labor market. This might therefore force the Fed to maintain higher rates for longer and keep working to lower inflation.

Meanwhile, the services sector in Britain experienced the fastest growth in a year in April. However, because it transferred the expense of growing wage costs onto consumers, the Bank of England was under more pressure to keep raising interest rates.

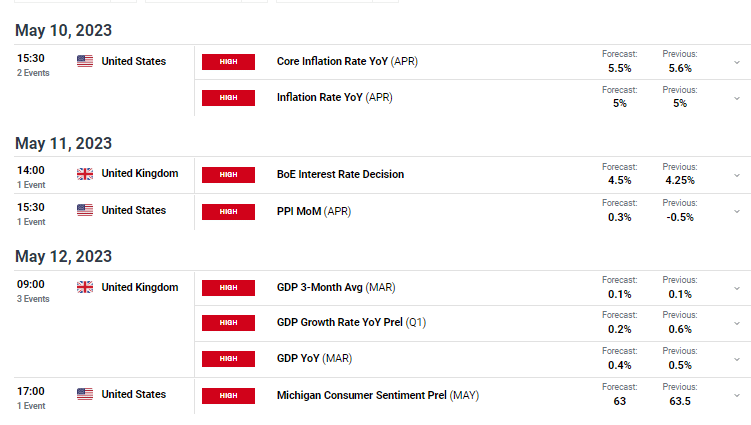

Next week’s key events for GBP/USD

Investors will focus on US inflation data, the BOE policy meeting, and UK GDP data in the coming week. US inflation data will give a clear picture of the impact of high-interest rates in the US. Consequently, it will guide the Fed on pausing rate hikes or continuing.

Additionally, markets expect a rate hike at the BOE meeting next week as the central bank struggles to lower double-digit inflation. The BOE will likely match recent Fed and ECB rate hikes, lifting its rates by 25bps.

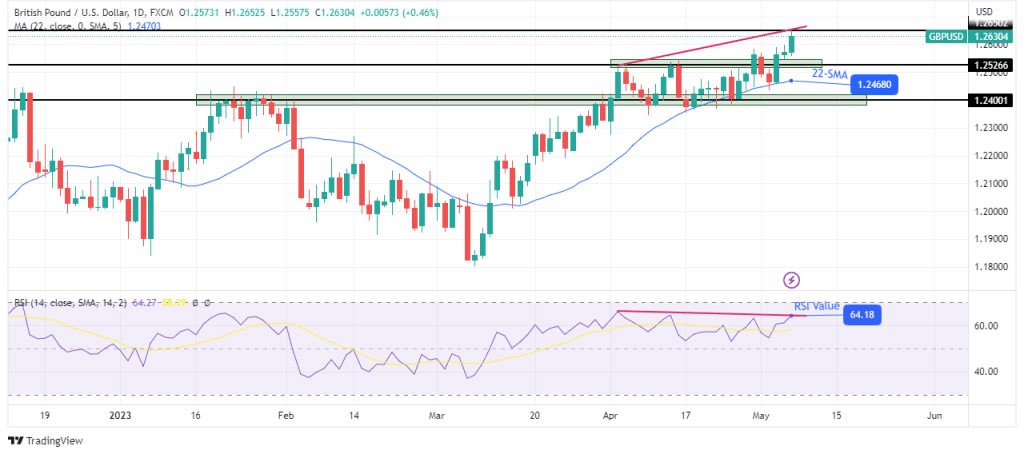

GBP/USD weekly technical forecast: Slight weakness in the uptrend at 1.2650.

In the daily chart, GBP/USD is in an uptrend because the price has consistently raised highs and lows and has respected the 30-SMA as support. Additionally, the RSI is trading above 50, showing strong bullish momentum.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

The bullish move has paused at the 1.2650 resistance level, where bulls are showing some weakness. A closer look at the RSI shows a slight bearish divergence with the price. Although the price made a higher high, the RSI had made a lower one.

This is a sign of weakness in the uptrend. If bulls do not get stronger in the coming week, we might see bears come in for a deeper pullback or a reversal.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.