- Central banks are heading to a more restrictive policy

- The FED and the BOE are paving the way to leaving the emergency measures behind

- Inflation is the main issue for the economic calendar

By the end of the week, the GBP recovered some pips to close at 1.38367, thus avoiding its lowest point of the last seven months. The fear of the Delta variant and the expectations about the FED tapering support the USD during the week. The GBP/USD weekly forecast remains bullish however, the focus will remain on the fundamental events from the UK economy.

The BOE and the FED are moving towards a change in their policies to reduce and eliminate the emergency strategies since the beginning of the pandemic. On the UK side, the prime minister’s plan to increase taxes is paving the way to it. Last week was disappointing in terms of the UK’s PBI since its growth in July was only 0.1%, far from the 0.6% expected by most experts and the lowest level since January.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

In the US, we can expect an increase in inflation for August since last week the Producer Price Index increased 8,3%.

Upcoming Events

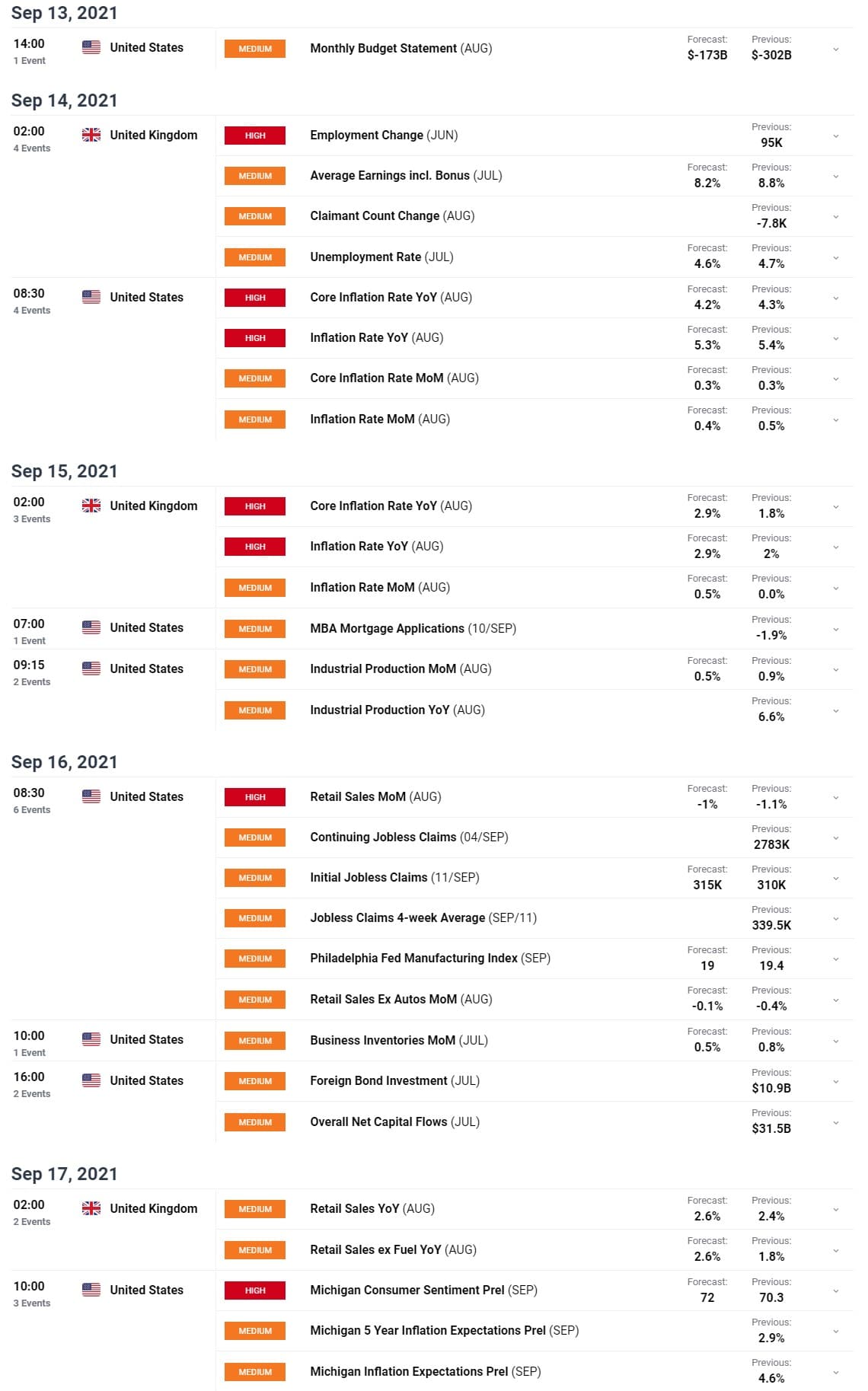

Next week the UK will release data about the employment change on Tuesday, the inflation and core inflation rate on Wednesday, and the forecast for both cases is 2.9%. In the United States, the eyes will also be on the inflation rates. Both inflation rates and core inflation rates data will be released on Tuesday, and its forecast is 5.2% for the Inflation rate and 4.3% for the core inflation rate in August.

GBP/USD Technical Analysis: MACD and RSI indicates a bullish trend

From the technical perspective, the MACD has a bullish trend, and so it has the RSI, which is bouncing from the 30% level signaling a possible bullish trend in the next few days. During the last few days, we have seen the pair bounce from the 1,3700 level, so it looks like traders will try to buy near to this level, and take advantage of the weakness of the USD. However, this could lead to the price getting in a bullish trend that could get near to the psychological level of 1.40.

GBP/USD Next week Forecast

We expect a modest bullish trend for next week fuelled by the USD weakness. The price level should be close to 1.3900, and beyond that, it could challenge the 1.4000 level. In case the price falls, the support level is at 1.3765, which is the seven-month low.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.