- Britain’s economy contracted by 0.2% less than anticipated in September.

- US consumer prices declined in October, fueling hopes for a Fed pivot.

- Investors are awaiting UK inflation data.

The GBP/USD weekly forecast is bullish as BoE policymakers call for strong action against rising inflation despite the economic downturn.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Ups and downs of GBP/USD

The pound experienced its greatest daily gain against the dollar since Thursday, March 2020, after US consumer prices declined in October. The decline led to anticipation that the Federal Reserve could pause its tightening interest rates.

After Thursday’s US inflation data was released, investors flocked to riskier assets, sending the dollar down and driving US Treasury yields to a five-week low.

However, experts remained wary ahead of the unveiling of the government’s budget plans on November 17 by Prime Minister Rishi Sunak and his finance minister Jeremy Hunt.

The pound rose higher versus a falling dollar on Friday in response to stronger-than-expected British economic data. According to official figures, Britain’s economy contracted by 0.2% less than anticipated in the three months leading up to September. This is likely to signal the beginning of a protracted downturn.

Next week’s key events for GBP/USD

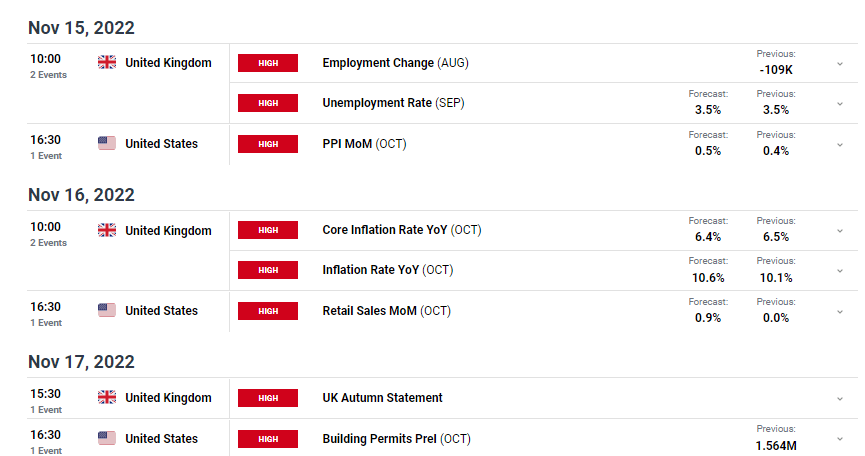

Next week is packed with key news releases from the UK and the US. Investors will pay closer attention to the inflation report, determining the BoE’s next move. The Bank of England’s Jonathan Haskel said the central bank should “stand firm” against the risk of prolonged inflation pressure and that signals of a slowdown in the British economy did not necessarily indicate a need for less tightening monetary policy.

GBP/USD weekly technical outlook: Bulls find their footing with higher highs

Looking at the daily chart, we see the price trading above the 22-SMA and the RSI above 50, showing bulls are in control. Bulls reversed the trend when the price broke above the 22-SMA and rose higher around the 1.1601 level. It then retested the SMA and found support at the 1.1156 level, making a higher low.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

From there, the price broke above the previous high at 1.1601 and is on the way to making a new higher high. This bullish trend will likely go on in the coming week. The bulls will be looking to hit the next resistance at 1.2007 and possibly break above.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.