- GBP/USD managed to gain despite a broadly weaker trend.

- The pair maintains a ranging price behavior.

- BOE is cautious amid slow economic recovery and pandemics.

- Fed’s next meeting is a risk event that can weigh on the pair.

The GBP/USD weekly forecast is mildly bullish as the Friday saw a decent gain amid Dollar sell-off. However, the price is still in a broad range.

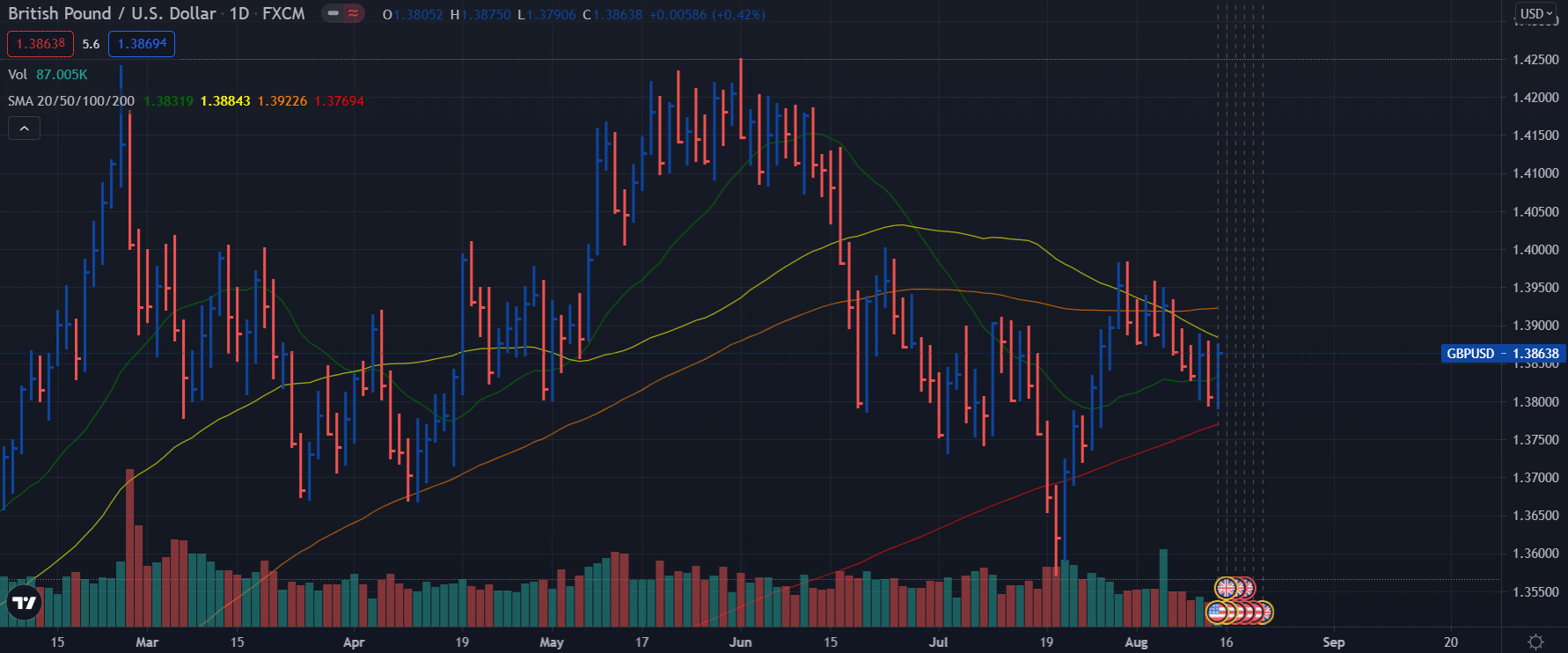

Despite the Pound’s decline for the week, the close of 1.3861, a few pips from the open, did not indicate that the Pound had deviated any more from the ranges of the past six weeks, or more widely the last six months.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

GBP / USD traded between 1.3750 and 1.4000 as of the second week of June, during which there was a brief four-day drop to 1.3600. During February, the range ascended to 1.4000, but the range below is nearly identical at 1.3700. The most active periods were in the range of 1.3800 to 1.4000 except the five weeks of 1.4100 from May 10 to June 15.

Due to the recurrence of the pandemic and the long delay in the UK’s economic recovery, the UK has experienced a long period of relative stagnation.

While the UK has progressed in rebuilding its economy, gains are still held hostage until the pandemic is no longer a public health concern.

Since it is still uncertain whether the pandemic is a threat to the economy, the Bank of England (BOE) maintains its cautious monetary policy. This caution may continue during the winter pandemic season. The consumer price index is going up, but profit margins are still much safer than in the United States.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

During its meeting on September 21-22, the Federal Reserve Board may be compelled to address the issue of global inflation and its profound political implications. This, along with the Jackson Hole symposium on August 26-28, is the main threat to the Pound’s weakening against the dollar.

The UK economy and the British Pound fared well this week. The Gross Domestic Product (GDP) for June and Q2 came in better than expected. In addition, industrial production in June exceeded forecasts for the third consecutive month.

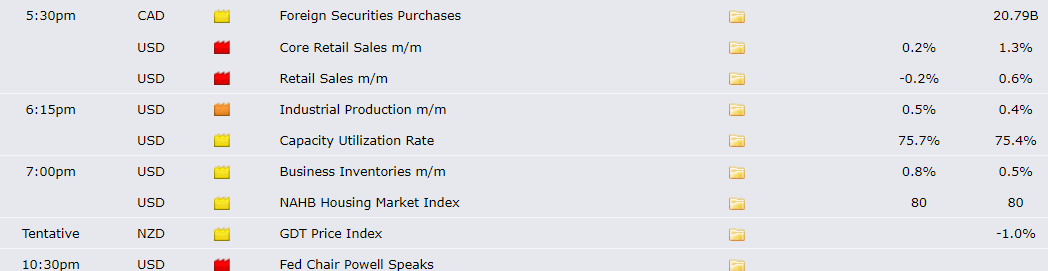

America’s key events during Aug 16-20

Next week, there will be some great macro events. Retail sales in the US are set to decline by 0.2% m/m on Tuesday. In addition, the Federal Reserve minutes of its most recent meeting will be released on Wednesday.

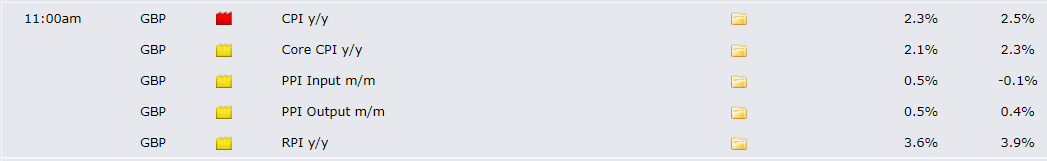

UK’s key events during Aug 16-20

The key event for the British Pound next week is CPI, followed by the PPI figures. We expect a mild decline of CPI to 2.3% y/y. However, if the CPI figures came higher than 2.3%, the Pound would seek strong support against USD and other peers.

GBP/USD weekly technical forecast: Sandwiched between 100 and 200 DMAs

The GBP/USD pair recovered lost ground on Friday, closed the week in neutral. The price found support near the 200-day SMA and managed to close above the 20-day SMA. However, the price is now near the 100-day SMA, which may continue to provide resistance to the pair. Although the volume is positive for the pair, the price has to overcome the 10-day and 50-day SMAs to continue the bullish momentum.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.