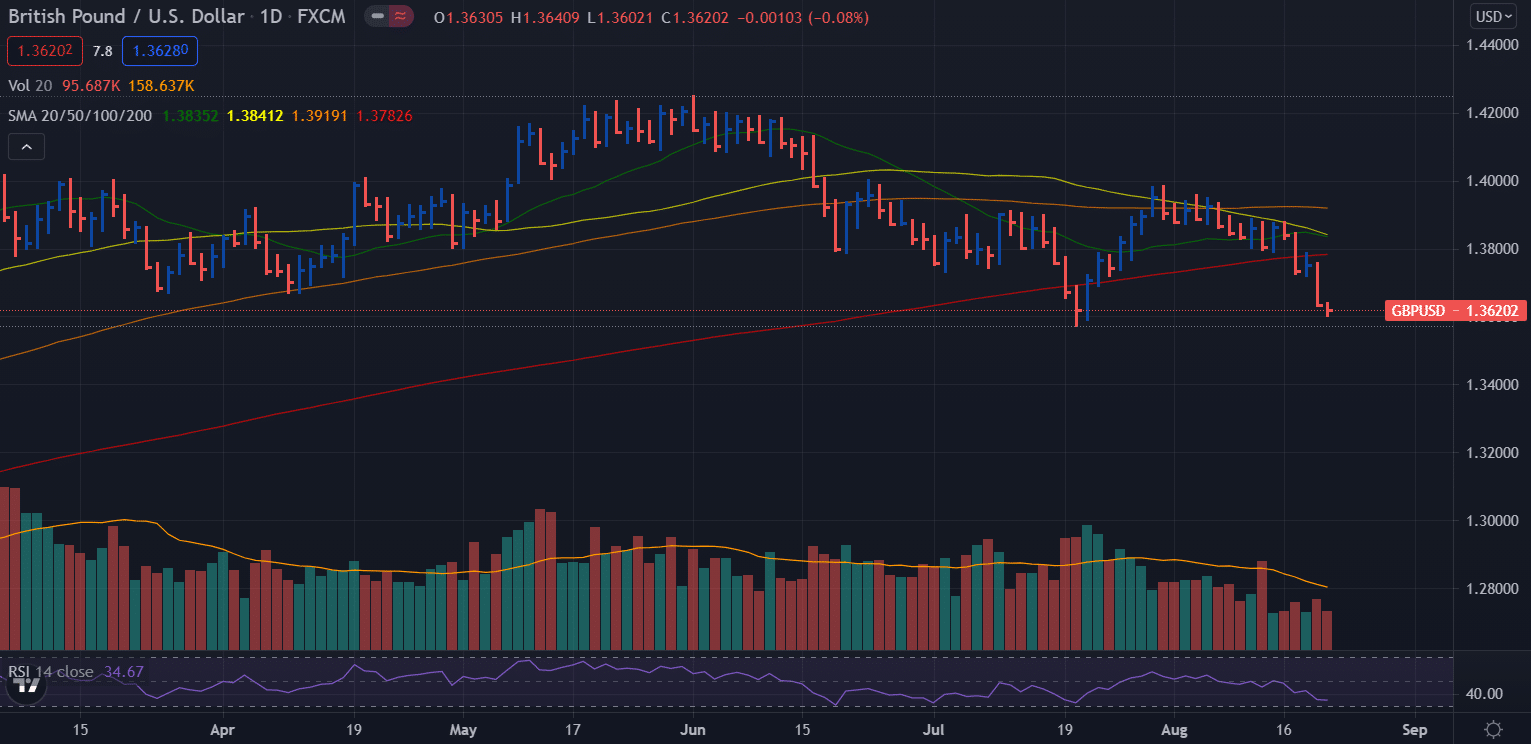

- Last week, the cable plummeted around 200 pips amid broader dollar strength.

- Sustained USD purchasing and poor UK macro data fueled the continuing decline.

- Coming up is the focus on Jackson Hole Symposium.

The GBP/USD weekly forecast suggests a bearish outlook as the US dollar remains strong and the pandemic continues to weigh on the Pound.

Last week, the GBP/USD exchange rate was under a lot of selling pressure. Sterling’s losses were worsened by broad-based US Dollar gain, which drove the cable almost 200 pips lower.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

GBP/USD fundamental forecast

This week, GBP/USD has dropped 200 pips due to a strong move triggered by the Federal Reserve’s meeting minutes, which increased tapering expectations.

Last week, on Friday, the GBP/USD pair extended its hefty losses from the previous day and saw some follow-through selling on the week’s final day. The fourth day in a five-day losing streak for the pair, which brought it down below the 1.3600 level.

Delta COVID concerns in the UK

The pound is being weighed down by the UK’s COVID data, which are far from satisfactory. Vaccination efforts have slowed to a halt, and infections are on the rise. Immunization, particularly of the young, is critical to defeating the virus and regaining consumer trust.

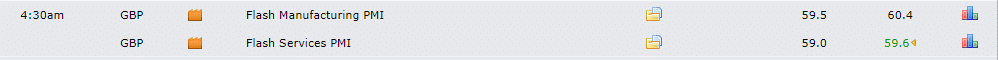

Key Data Releases from the UK during Aug 23-27

The economic calendar for the GBP is light as the summer draws to a close, but Markit’s preliminary Purchasing Managers’ Indexes for August stand out.

Sterling fell when the Services PMI was downgraded in July, and another drop in confidence in the UK’s largest industry would be concerning. Nonetheless, a score of more than 50 indicates expansion and bodes well for future growth.

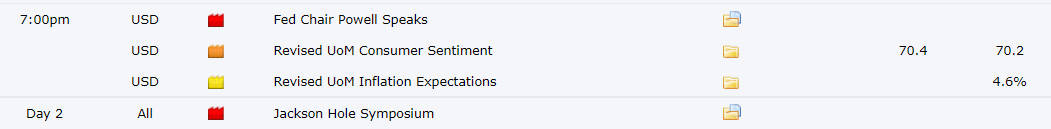

Key Data Releases in the US during Aug 23-27

The best is yet to come on the economic calendar: Federal Reserve Chair Jerome Powell’s address at Jackson Hole. Investors are waiting to see if the world’s most powerful central bank will announce a reduction in its bond-buying program.

GBP/USD technical analysis: key levels in action

The GBP/USD pair has fallen below the 200-day SMA, and the market’s trend has shifted to the negative.

Furthermore, the RSI has remained above 30, indicating that it is no longer oversold. Overall, the picture is negative, but bulls have reason to be optimistic if the price remains above key support.

–Are you interested to learn more about forex signals? Check our detailed guide-

Cable’s make-or-break mark is 1.3560, which was the bottom in July and the lowest since February when it bounced off the same region.

However, holding above that level may lead to recovery within the broad range, with the price rising as high as 1.40, the summer’s high.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.