The pound has suffered the fears of a Brexit, but rides higher on the dovish words of Yellen. And what about the oil connection?

Here is their view, courtesy of eFXnews:

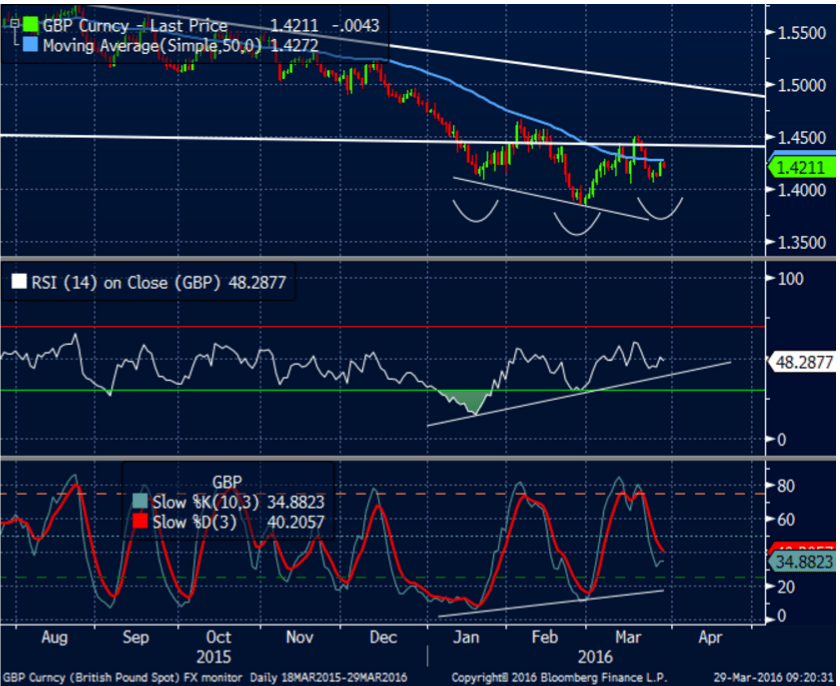

The GBP has lost almost 10% since the autumn peak in effective terms and stabilised somewhat in March, supported by global risk sentiment and higher oil prices. We have seen the worst by now.

GBP/USD has bottomed with oil

Interestingly, GBP/USD has been trading closely with oil prices. This can be partly explained by the USD side – oil is priced in USD. But part of the story is also the GBP global exposure: the over 4% current account deficit leaves it vulnerable if global risk appetite worsens.

Risk appetite has mainly been driven by oil prices over the past year. Naturally, with oil prices lower, the major oil producers – and world’s largest reserve holders – are weakened. This threatens the flow into the UK (equities, housing market etc.) needed to finance the current account deficit. With our forecast that oil prices have bottomed and should climb towards USD 50/bbl, GBP/USD should have seen the lows, too.

Sticking to firmer GBP in the forecast horizon

The worst-case scenario for EUR/GBP after the June referendum could be levels around 0.82. But these are not to be sustained. The bias for EUR/GBP should still be down towards 0.76-0.75 in the coming months. As for GBP/USD, should oil prices not fall further and the BoE get repriced back closer to the Fed (our forecast is a hike in Q4 2016) and GBP/USD should recover and move towards 1.46-1.48.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.