Two explosions at the Brussels Airport and another at the Maalbeck metro station in the Belgian capital left at least 13 dead and dozens injured. The events also triggered flight diversions, a shutdown of the metro and a high state of alert.

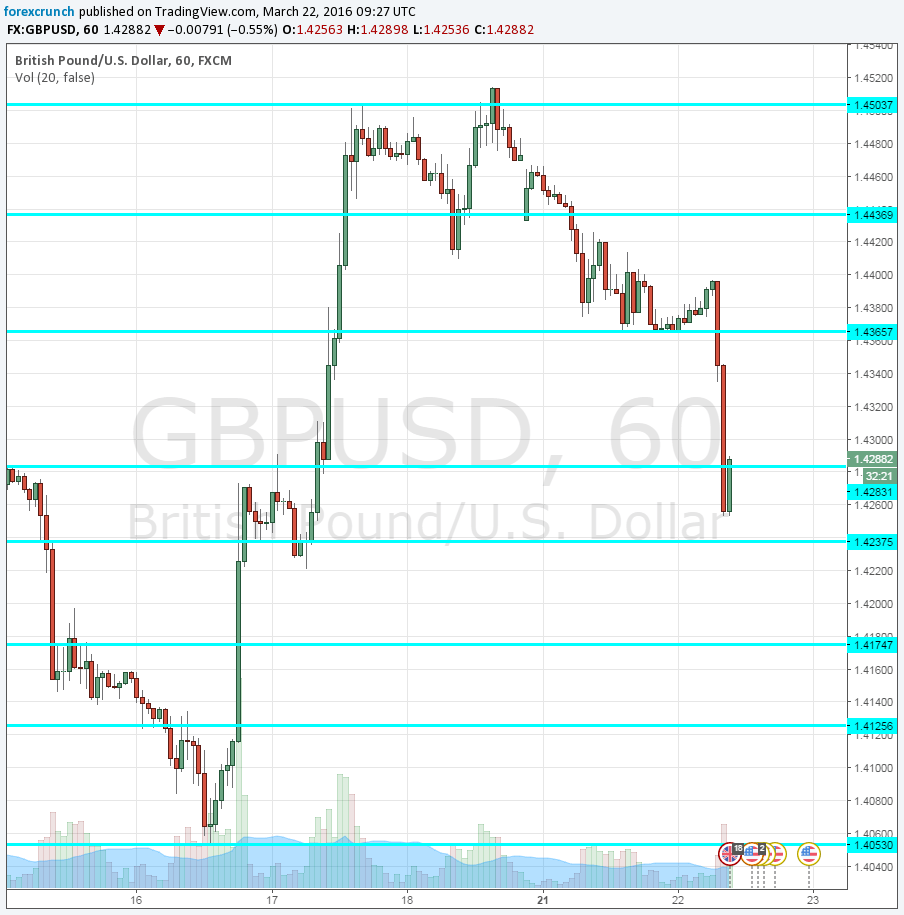

The depressing events also took their toll on markets, with a general risk off sentiment benefiting the yen and hurting most currencies, such the euro. Yet perhaps one of the biggest drops in currency markets is seen in the British pound, and perhaps for a good reason.

Brits will go to the polls in 3 months and one day to decide if the UK will remain in the European Union, headquartered in Brussels, or leave. The metro bombing happened very close to the European Commission building, the target of loath for many Brits frustrated with the reckless spending and the complicated regulation, but the reason why this attack raises Brexit risks is not related to the exact location of the bombing.

The terror attack, coming just days after the mastermind of the November Paris attacks was captured, is another proof of European incompetence to deal with terror. Apart from the Paris attacks, there were previous attacks back in January also in the French capital, as well as some failed attempts.

But it’s not only security incompetence that triggers resentment. Also the UK suffered terror attacks. The bigger issue is immigration, a top topic in the Brexit debate.

While the attackers in Paris and probably here did not originate in the recent wave of refugees originating in the Syrian civil war, the fact that these people are different, Muslims that look differently and speak a foreign language, raises the fear factor and the xenophobic demons.

Proponents of a Brexit could use this attacks reject the EU’s immigration policies, reject the security cooperation and repeat the message that “we’re better off alone”.

For business, this is bad news: if the UK leaves, there is potential for less trade with the biggest trade partners.

The debate rages on with polls showing a tight race. There still is a better chance for Brits sticking with the devil that they know over a devil they don’t. But between the unknown devils of leaving and the devil terrorists, the choice is becoming tougher for too many.

More: GBP: Trading Brexit: The Long & Short Of It – CIBC