The British pound flash crashed and remained at the lows. The team at Goldman Sachs analyzes the next moves:

Here is their view, courtesy of eFXnews:

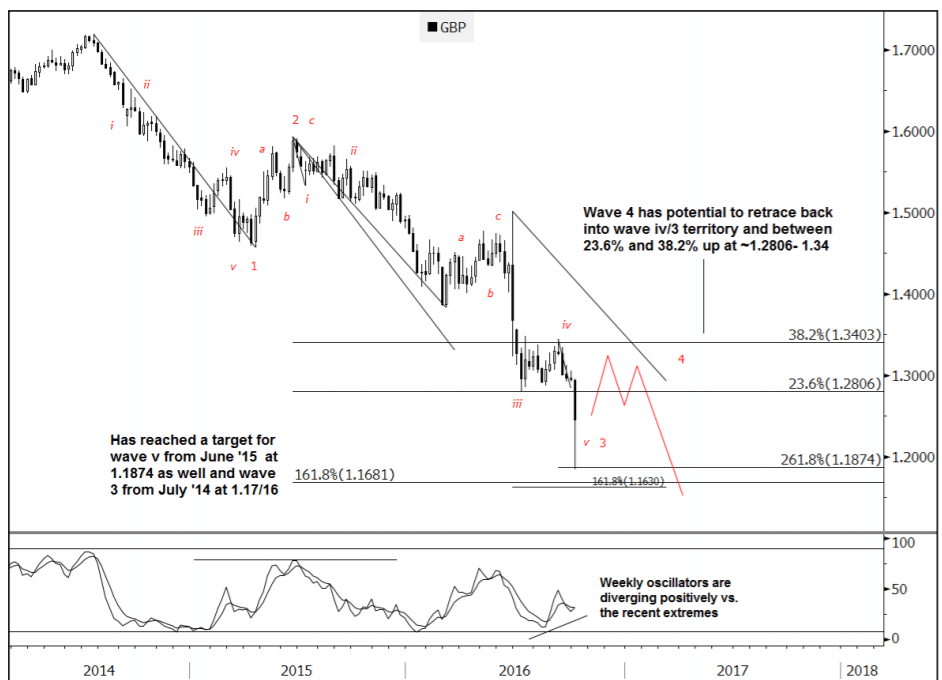

GBP was front and center last week as the currency has broken a primary trendline formed across the lows since ’93 (1.2788)

Going back even further, GBPUSD started a multi-year corrective process at the peak in ’07, within which it is currently in the later stages of a final C wave. Because of the impulsive nature of wave A (from ’07 through ’08), it’s actually not too surprising to see an equally impulsive sell-off in wave C (since Jun. ’14).

In the nearer term, it may have just recently completed a 3 rd of 5-waves from Jun. ’14 (i.e. within the larger degree C leg). It has come close enough to reaching the ideal target at 1.1681 (1.618 from Jul. ’15). ‘

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

As such, a period of counter-trend corrective price action seems likely, before the next leg lower. Put another way, it’s now likely based and started a corrective process/ 4 th wave.

A 4 th wave typically retraces back into wave iv/3 territory; in this case 1.2798-1.3445. It also often retraces between 23.6% and 38.2% of the length of wave 3; also ~1.28 and 1.34.

Bottom line, GBPUSD may consolidate in the near-term, but it is likely to continue declining over time.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.