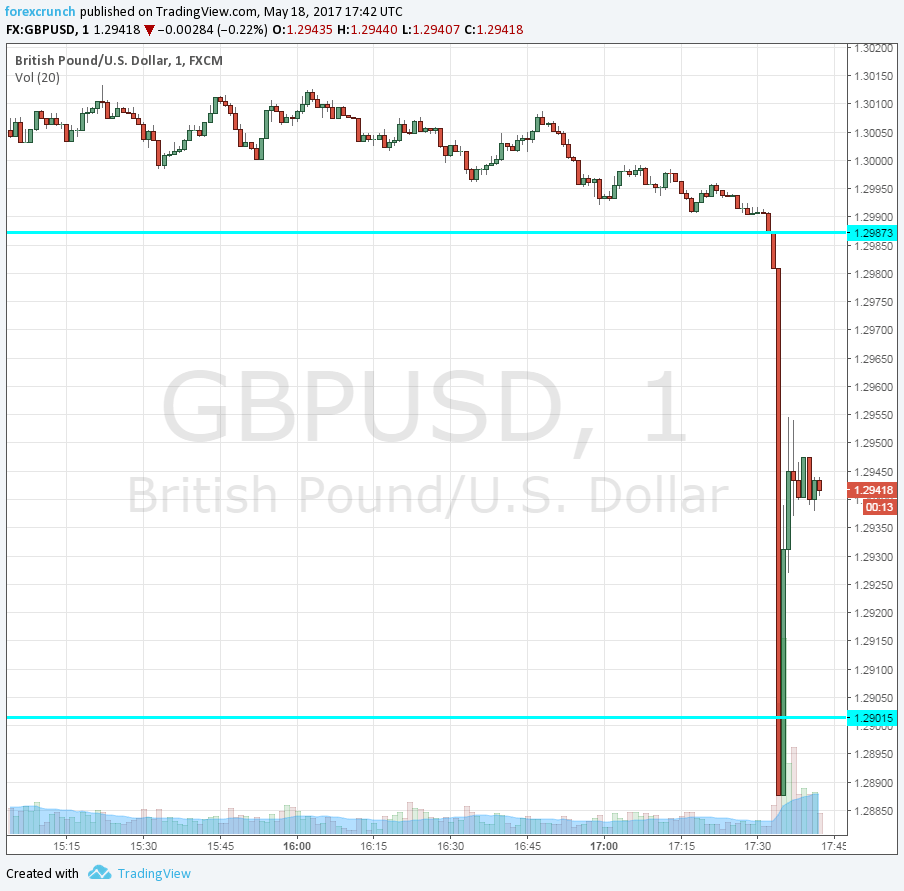

Volatility is certainly back. The pound struggled to break above 1.30 and when it finally succeeded on the back of strong retail sales, the move is followed by a violent crash. The pair fell some 100 pips and bounced back 60. As with bungee jumping, the bounce is smaller than the free fall.

Contrary to the huge plunge in October, the scale is smaller, perhaps thanks to higher liquidity during the US session. Trading volume is not as high as in the US morning / European afternoon, but still above the thin trading hours of the very early hours in Asia, after the US is closed for the day.

According to Adam Button of Forex Live, the whole move lasted only 12 seconds. We are now back to stability, but this will have reverberations. One of the reasons for low volatility is the abundance of liquidity, thanks to central banks pouring cash into markets. Apparently, there are air pockets even in the liquid hours.

This is how it looks on the 1-minute chart. The pair was already struggling and slipped below the 1.30 level, but the move down all the way to 1.2880 and the bounce back to 1.2940 is not something we see every day. Perhaps every 6 months or so.

Update: after the big crash and bounce, the pair is leaning lower, trading at 1.2920.