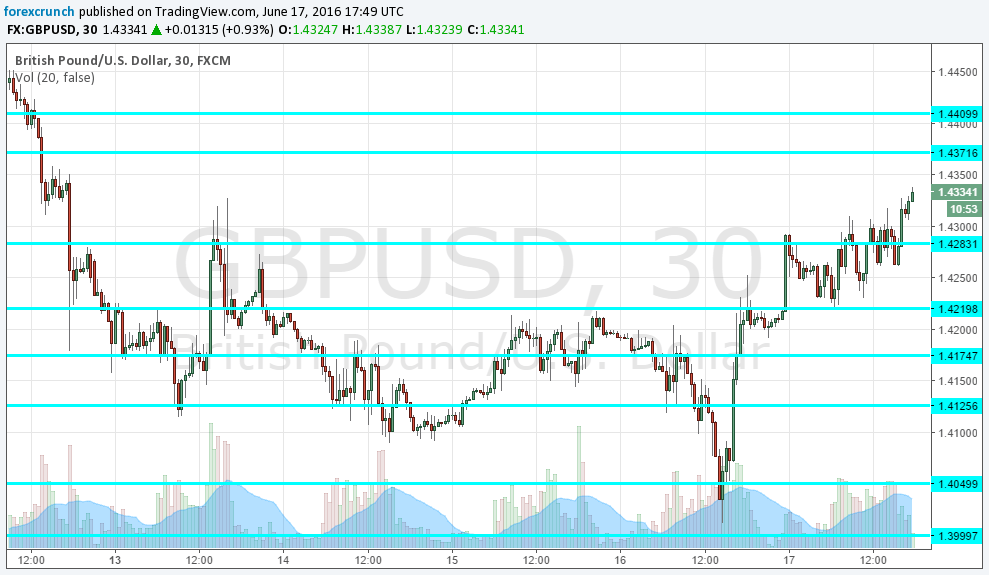

The pound and the euro did turn around and bounce back one week before the big vote and volatility is very high. Towards the last stretch, here are the levels to watch according to SocGen:

Here is their view, courtesy of eFXnews:

The market reaction to the recent apparent momentum towards ‘Leave’ in UK opinion polls suggests that sterling would bounce on a ‘Remain’ decision. We have recently suggested that we would take the opportunity to go short GBP/USD on a bounce to 1.50, as we do not expect sterling strength to be durable even if the UK where to stay in the EU.

By contrast, we have cited GBP/USD 1.30-1.35 as an initial target on a ‘Leave’ decision, with a belief that we will see 1.25 later in due course. That broad range still seems appropriate, but it does mean that in the short term, the risks are pretty symmetrical from current cable spot levels.

In the same vein, we expect a test of EUR/USD 1.06 pretty quickly if ‘Leave’ were to carry the day, but a test of 1.16 on the same horizon under a ‘Remain’ outcome. It’s only the second round reaction to Brexit that would be more clearly negative for sterling (and the euro) than positive in the case of the status quo remaining in place.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.