Carny made a special appearance and offers easing during the summer as a reaction to Brexit. He makes a heavy hint that they will take a decision in August. This speech was scheduled only yesterday and is seen as part of the damage control.

GBP//USD slips to 1.3330. Update: it already slips to 1.33. Another update: the pound is already down to 1.3260. We wrote yesterday about why the rally happened and why it is set to fall – this was certainly a sell opportunity now worth over 250 pips.

Carney Highlights

The governor of the BOE offers some soothing words for markets and also some action.

With his doubts about ever lower rates, perh

- High level of uncertainty that will last for some time

- Clarity needed on the EU trade deal, regulation

- We have contingency plans and these are working well.

- Liquidity provisions will continue through September.

- Results of the referendum are clear, prospects not so

- Additional measures will be made

- BOE cannot fully mitigate a large economic shock.

- Too low rates can hit bank profitability.

- The efficacy of monetary policy is diminished with ever low interest rates.

- Uncertainty may have more persistent drag on the economy.

- July 14th scheduled rate decision will be the first opportunity to assess the impact

- In August, alongside the Quarterly Inflation Report, the BOE may act.

Carney Q&A

- Fall in the pound is natural and expected

- There is a risk of a spillover to other economies.

- We can act rapidly as needed.

- Order of magnitude of adjustment is significant.

- BOE did its job in identifying the risks of Brexit.

Market reactions to Carney

- A 1% fall in the pound

- 10 year UK bonds at a record low

- FTSE jumps

- Easing is not only about the interest rate. The interest rate hasn’t been changed since March 2009. Brexit is probably not important enough to change the rate.

More: Brexit aftermath – reactions from 15 brokers

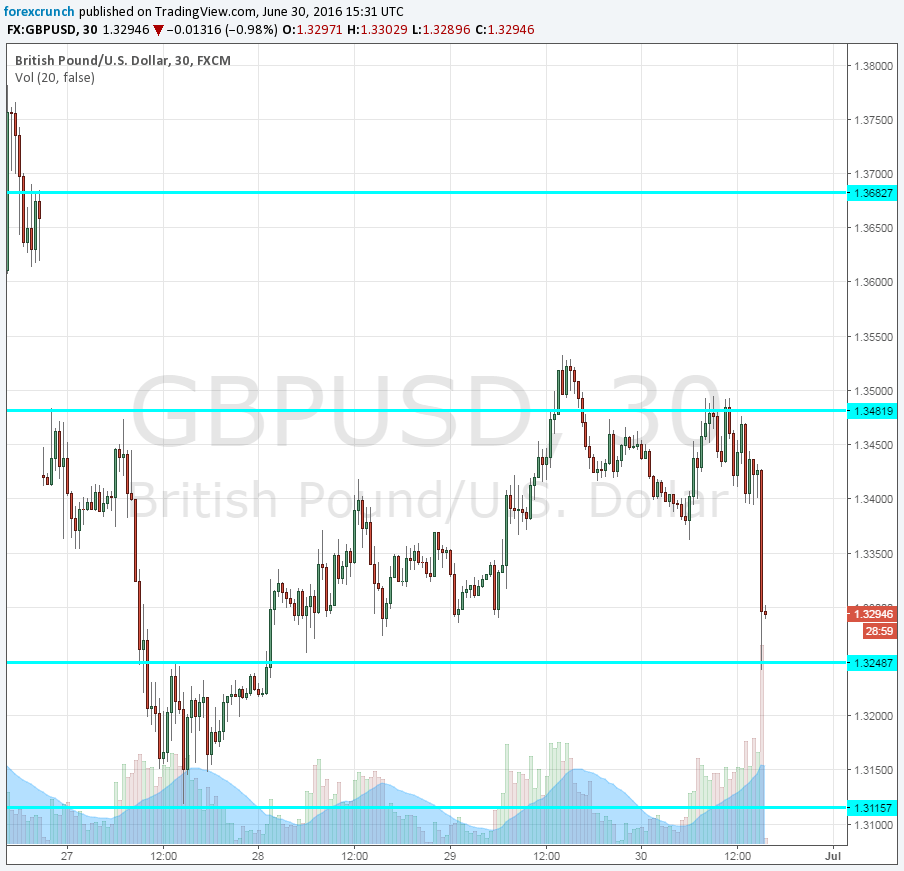

GBP/USD perfect technical behavior

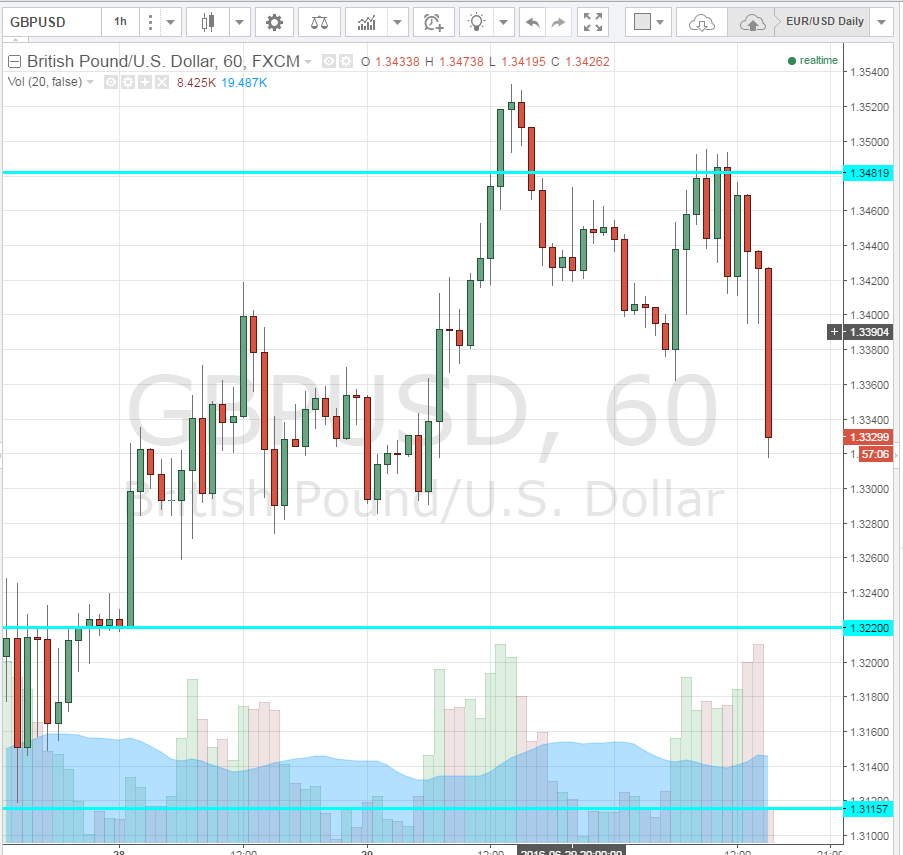

GBP/USD fell to a low of 1.3243, around the upper end of the range the pair experienced on Monday, just after reaching the worst lows since 1985. The pair eventually broke higher on Tuesday and never broke back below this line.

We now fell to support and so far the pair is bouncing to 1.3285 at the time of writing. Resistance awaits at 1.3480, which was the high of Monday. Further support is at the multi-decade low of 1.3115.

More: GBP Still Vulnerable To Further Declines And EUR Won’t Be Immune To That – ANZ

Here is the chart:

Here is how it looks on the chart.