GBP/USD made another move tot he upside but was forced to retreat on the BOE’s bearishness. Will it remain the loser? The upcoming week features a mix of figures from all sectors. Here are the key events and an updated technical analysis for GBP/USD.

The BOE left interest rates unchanged with only two members voting for a hike. In addition, Governor Carney did not seem eager to raise interest rates. “Super Thursday” hit the pound more than anything else, with the losses more pronounced against the euro and the yen. In the US, the political chaos in the White House extended the losses of the dollar, while economic data was mixed. Things turned in favor of the dollar on Friday: the OK jobs report boosted the greenback and the pound was quite vulnerable.

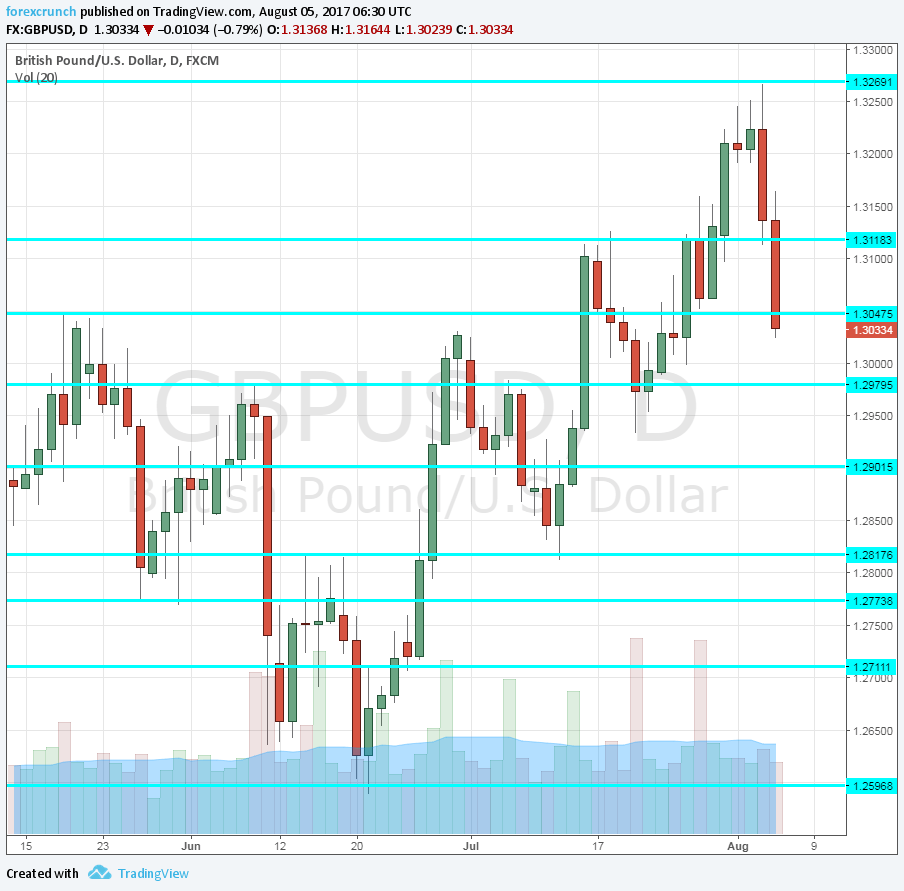

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily chart with resistance and support lines on it. Click to enlarge:

- Halifax HPI: Monday, 7:30. House prices have soared for quite a few years, but are now showing signs of weakness. Back in June, Halifax reported a significant drop of 1% in prices. Will they bounce now? A rise of 0.3% is on the cards.

- BRC Retail Sales Monitor: Monday, 23:01. The British Retail Consortium provides another look at retail sales, coming out before the official retail sales numbers. Back in June, sales increased by 1.2% after a slide beforehand.

- RICS House Price Balance: Wednesday, 23:01. The Royal Institution of Chartered Surveyors monitors the balance between areas enjoying price increases with those showing decreases. After long months in positive double digits, the most recent report for June showed a sharp drop to 7%. A small increase to 9% is predicted.

- Manufacturing Production: Thursday, 8:30. The level of manufacturing output is watched closely despite its small share of the economy. It dropped by 0.2% in May and a flat read is on the cards for June. The wider industrial output slipped by 0.1% and a rise of the same scale is forecast now.

- Goods Trade Balance: Thursday, 8:30. Britain has a wide trade deficit that is weighing on the pound. This deficit stood at 11.9 billion pounds in May and may squeeze now. A narrower deficit of 11 billion is estimated.

- Construction Output: Thursday, 8:30. The housing sector is monitored via prices and also via the output of the construction sector. A big drop of 1.2% was seen in May and we may see a bounce now. An increase of 1.2% is on the cards.

- NIESR GDP Estimate: Thursday, 12:00. The National Institute of Economic and Social Research is a highly regarded Think-Tank. Most recently, they published upbeat assessments about the economy. looking to the second half of 2017. However, month over month, they have shown slow growth for the three months ending in June, 0.3%, in line with official numbers that were published later on.

GBP/USD Technical Analysis

Pound/dollar began the week on a high note, reaching a new cycle high of 1.3270. However, it could not hold on these levels and fell back down.

Technical lines from top to bottom:

1.35 was the post-Brexit high and remains the top level. It is followed by 1.3370 which capped the pair several times in 2016.

The 2017 high (so far) of 1.3270 is the next barrier. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I am bearish on GBP/USD

The economy is going nowhere fast and nor is the BOE in terms of rates. While the US dollar remains under pressure due to Trump, Brexit is probably worse, with high uncertainty taking its toll on Sterling.

Our latest podcast is titled Draghi Dud and the Petrol Pendulum

Follow us on Sticher or iTunes

Safe trading!