The British pound took a tumble last week, as GBP/USD slipped 270 points. There are 10 events on the schedule. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

In the US, retail sales and inflation numbers were weak, but consumer confidence levels beat expectations. British Manufacturing Production posted a second straight decline, and the BOE held the course, keeping interest levels at 0.50%.

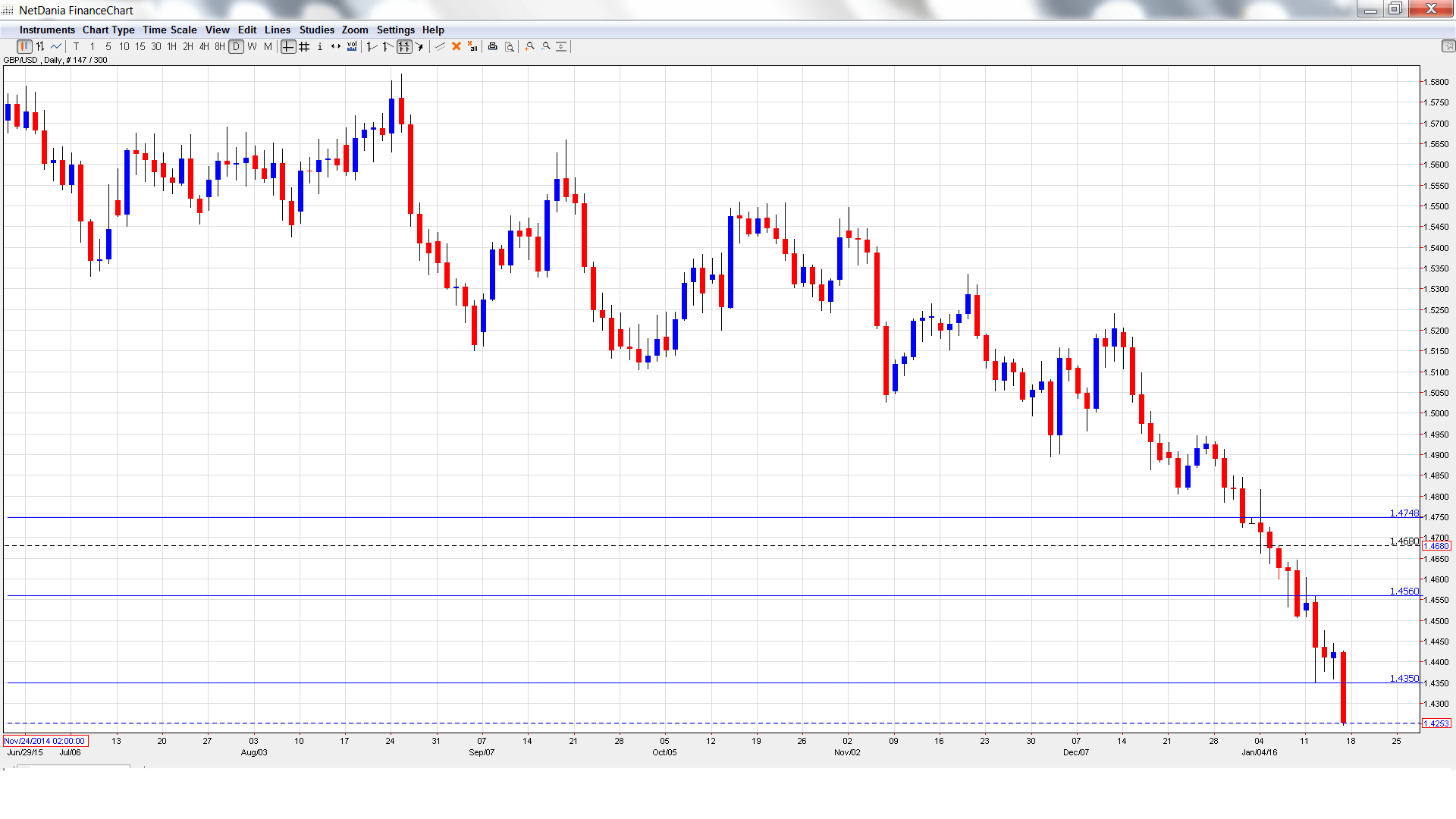

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Rightmove HPI: Monday, 00:01. This housing inflation indicator provides a snapshot of the health of the activity of the UK housing sector. The index has struggled, posting two straight declines.

- CPI: Tuesday, 9:30. This is the first key event of the week. Inflation levels remain weak, and CPI posted a small gain of 0.1% in November, matching the forecast. The estimate for the December report stands at 0.1%.

- PPI Input: Tuesday, 9:30. This index measures inflation in the manufacturing sector. In November, the indicator dropped 1.6%, a sharper drop than the estimate of -1.0%. Another decline is expected in December, with a forecast of -1.4%.

- RPI: Tuesday, 9:30. RPI includes housing costs, which are excluded in the CPI report. The index posted a strong gain of 1.1% in November, beating the estimate of 0.9%. Another solid gain is expected in December, with an estimate of 1.0%.

- Average Earnings Index: Wednesday, 9:30. This key event is a leading indicator of consumer inflation. The index softened to 2.4% in October, within expectations. The downward trend is expected to continue in the November report, with an estimate of 2.1%.

- Claimant Count Change: Wednesday, 9:30. This event is one of the most important indicators, and an unexpected reading can have a sharp impact on the movement of GBP/USD. The indicator improved to 3.9 thousand in November, well above the forecast of 0.9 thousand. The markets are expecting the upswing to continue, with an estimate of 4.1 thousand. The unemployment rate is expected to remain at 5.2%.

- RICS House Price Balance: Thursday, 00:01. This index is based on surveyors reporting a price increase in their area. The index has been steady at 49% for the past two months, and the December forecast stands at 50%.

- Retail Sales: Friday, 9:30. Retail Sales is the primary gauge of consumer spending, a critical driver of economic growth. The indicator rebounded in November with a strong gain of 1.7%, crushing the estimate of 0.6%. The markets are braced for a downturn in the December report, with an estimate of -0.1%.

- Public Sector Net Borrowing: Friday, 9:30. The public sector deficit ballooned to GBP 13.6 billion in November, compared to the estimate of GBP 11.9 billion. Will we see an improvement in December?

- MPC Member Jon Cunliffe Speaks: Friday, 12:30. Cunliffe will speak at an event in Brussels. The markets will be listening for any clues regarding future monetary moves by the BOE.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.4523 and quickly touched a high of 1.4604. The pair reversed directions and dropped sharply during the week, touching a low of 1.4247, as support held firm at 1.4227 (discussed last week). GBP/USD closed the week at 1.4253.

Technical lines from top to bottom

With the pound sustaining sharp losses, we begin at lower levels:

There is resistance at 1.4752.

1.4562 has strengthened following sharp losses by GBP/USD.

1.4346 is the next resistance line. It was a cushion in June 2010.

1.4227 is providing support.

1.4135 marked a low point in December 2001.

The symbolic level of 1.40 is the next line of support.

1.3809 was a cushion in February 2009.

1.3678 is the final support line for now.

I am bearish on GBP/USD.

The US dollar continues to enjoy broad strength, as nervous investors flock to the safe-haven currency. With speculation about another Fed rate hike, the US dollar will be even more attractive to investors.

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.