GBP/USD continued to move higher last week, closing at 1.2944. This marked the highest weekly close since September 2016. This week’s key events are the PMI reports. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

The pound ignored a weak GDP report, as UK Preliminary GDP softened to 0.3%, shy of the estimate of 0.4%. In the US, GDP grew by an annualized rate of 0.7% in the first quarter, weaker than expected and the lowest in three years.

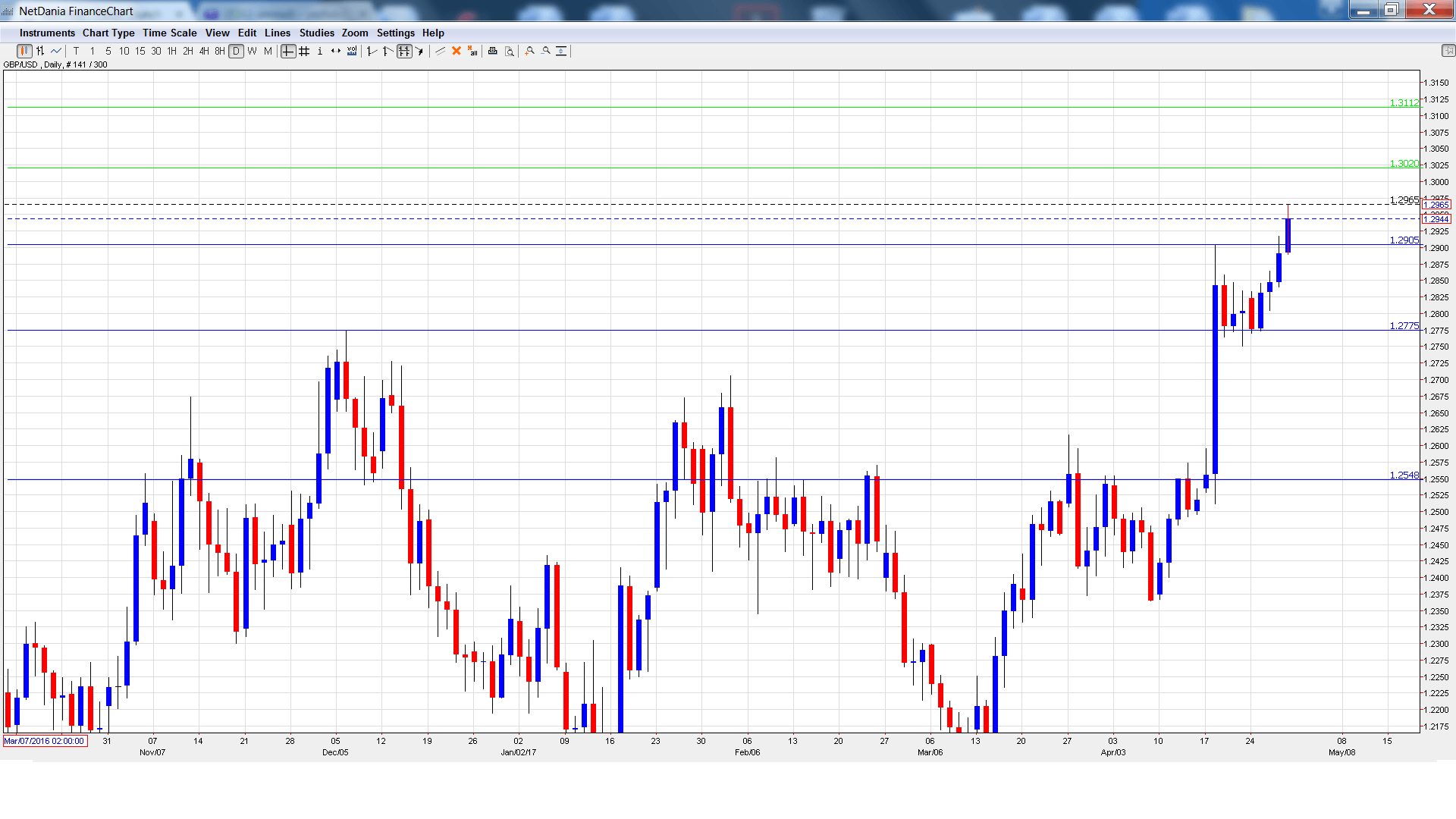

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Tuesday, 8:30: This is the first of three PMIs this week, which are important gauges of the strength of the British economy. Manufacturing PMI numbers have softened in Q1, but continue to indicate expansion. The estimate for March stands at 54.0 points.

- BRC Shop Price Index: Tuesday, 23:01. This indicator measures consumer inflation in BRC shops. The index came in at -0.8% in March, its smallest decline since December 2013.

- Construction PMI: Wednesday, 8:30. The indicator dipped to 52.2 in March, within expectations. Little change is expected in the April report.

- Services PMI: Thursday, 8:30. Services PMI improved to 55.0 in March, above expectations. The forecast for April stands at 54.6 points.

- Net Lending to Individuals: Thursday, 8:30. Consumer credit levels are linked to consumer spending, a key component of economic growth. The indicator edged up to GBP 4.9 billion in March, matching the forecast. The markets are expecting a weaker reading in April, with an estimate of GBP 4.5 billion.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2823 and quickly dropped to a low of 1.2770, testing support at 1.2775. It was all uphill from there, as the pair climbed to a high of 1.2965 (discussed last week). GBP/USD closed the week at 1.2944.

Technical lines from top to bottom

1.3347 has held in resistance since September 2016.

1.3247 is next.

1.3112 marked a low point in June 2016 as the pound crashed after the Brexit vote.

1.3020 is a weak resistance line.

1.2902 has switched to a support role.

1.2775 is the next support level.

1.2548 is the final support level for now.

I am bullish on GBP/USD.

The US economy has round into some turbulence, underscored by a weak GDP reading last week. Trump’s first 100 days have been rocky, so sentiment over the dollar could weaken.

Our latest podcast is titled No more dovish Draghi and diagnosing the Donald

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.