GBP/USD lost almost 100 points last week, as the pair closed at 1.2877. This week’s key events are CPI and Retail Sales and Average Earnings Index. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

The Bank of England held rates at 0.50%, but the pessimistic rate statement sent the pound lower. In the US, President Trump’s firing of FBI Director James Comey set off a political firestorm. The controversial move has markets worried that the Administration may have to delay plans for fiscal spending and tax reform. The US dollar lost ground on the news but recovered quickly. On the fundamental side, US CPI and retail sales disappointed and missed the forecasts.

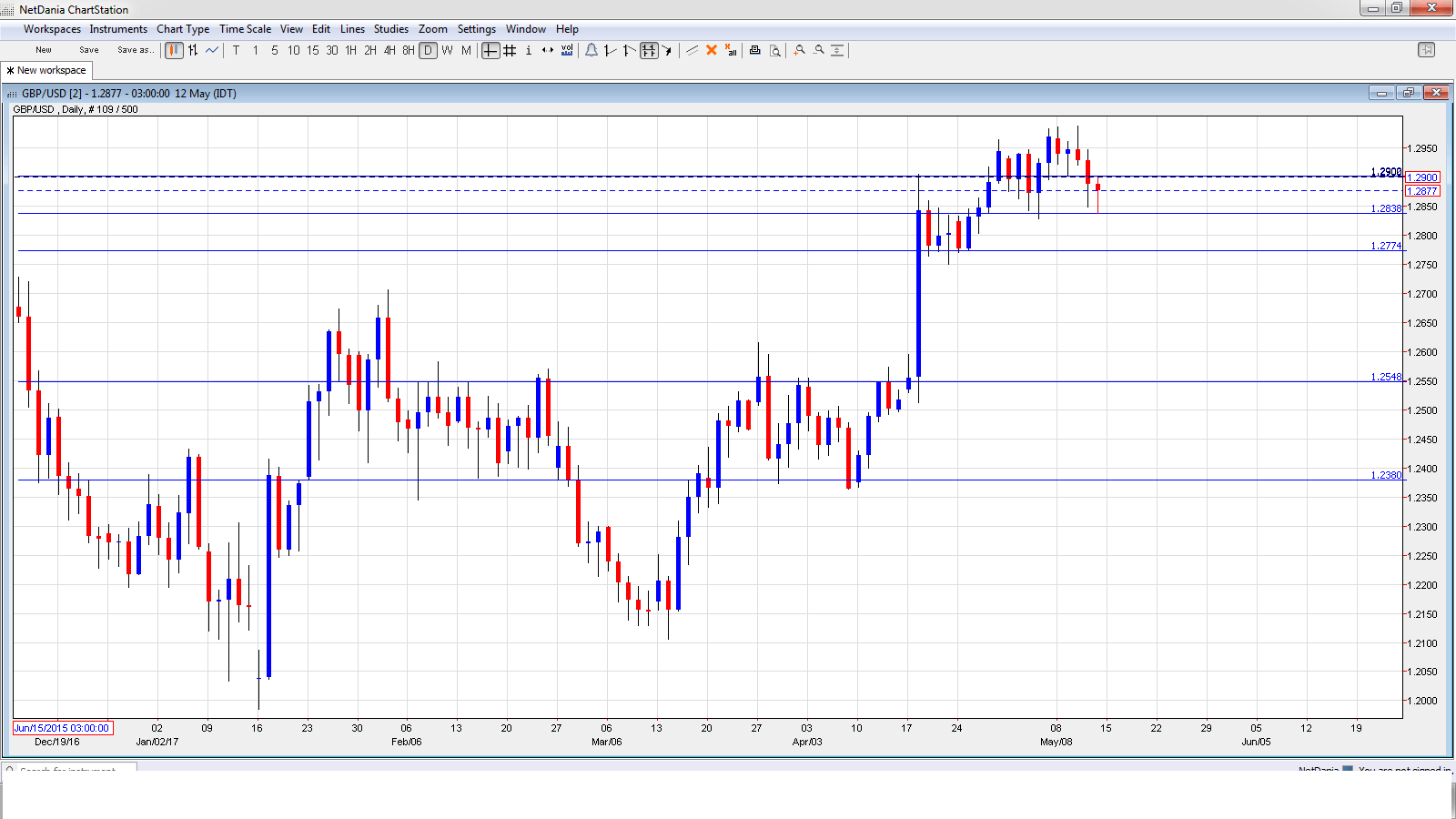

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. This house inflation report helps analysts gauge the strength of the housing sector. The indicator continued to soften in April, with a reading of 1.1%. Will the indicator rebound with a stronger reading for May?

- CPI: Tuesday, 8:30. CPI is the primary gauge of consumer spending. Inflation has been moving upwards, boosted by a weaker pound. The March reading of 2.3% edged above the estimate of 2.2%. The index is expected to jump to 2.6% in the April report.

- PPI Input: Tuesday, 8:30. This indicator measures inflation in the manufacturing sector. In March, the index rebounded with a gain of 0.4% in March, easily beating the forecast of -0.5%. The estimate for April stands at 0.1%.

- RPI: Tuesday, 8:30: RPI excludes housing costs, which are included in CPI. The indicator edged down to 3.1% in March, matching the forecast. The index is expected to post a strong gain of 3.4% in April.

- CB Leading Index: Tuesday, 13:30. This minor event dipped to 0.1% in February. Will we see an improvement in March?

- Average Earnings Index: Wednesday, 8:30. Wage growth edged up to 2.3% in February, beating the estimate of 2.1%. The upward trend is expected to continue, with a March estimate of 2.4%.

- Claimant Count Change: Wednesday, 8:30. Unemployment rolls expanded by 25.5 thousand in March, worse than the forecast of a 10.2 thousand decline. Will we see a decline in the April report? The unemployment rate is expected to remain at 4.7%.

- Retail Sales: Thursday, 8:30. This indicator is the primary gauge of consumer spending and should be treated as a market-mover. The indicator has posted three declines in the past four months, and the March decline of 1.8% was much worse than expected. The markets are expecting a strong turnaround in April, with an estimate of a 1.2% gain.

- CBI Industrial Order Expectations: Friday, 10:00. Manufacturing orders slowed down in April, with a gain of 4 points, well short of the estimate of 9 points. Another reading of 4 points is expected in the May report.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2966. The pair climbed to a high of 1.2988, as resistance held firm at 1.3020 (discussed last week). GBP/USD was unable to consolidate at this level and dropped to a low of 1.2838 late in the week. The pair closed the week at 1.2877.

Technical lines from top to bottom

1.3347 has held in resistance since September 2016.

1.3247 is next.

1.3112 marked a low point in June 2016 as the pound crashed after the Brexit vote.

1.3020 is next.

1.2902 has switched to resistance following losses by GBP/USD. It is a weak line.

1.2775 is providing support.

1.2548 is next.

1.2380 is the final support level for now.

I am bearish on GBP/USD.

The BoE is forecasting a lower standard of living for Britons due to Brexit, and weaker data could send the pound lower. The US economy remains solid, and the Fed is expected to raise rates two more times in 2017, although there is some doubt about a June hike.

Our latest podcast is titled Brexit bites the BOE, volatility evaporates

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.