GBP/USD had a mixed week amid big events. The upcoming week may be calmer but still, consists of important events. The trade balance and industrial output stand out. Here are the key events and an updated technical analysis for GBP/USD.

The BOE sent the pound tumbling down. While a wide majority of 7:2 supported a hike, this was fully priced in and the prospects for the future were very dovish. The BOE foresees only two hikes in the next three years, redefining the meaning of “gradual”. In addition, Carney expressed concerns about Brexit uncertainty. The BOE’s impact easily outweighed the better than expected PMIs as the jump in the services PMI only served as a savior from the 1.30 level, for now. In the US, current Fed Chair Yellen left rates unchanged as predicted and one of her governors, Powell, has been nominated as the new Fed Chair, as fully expected as well.

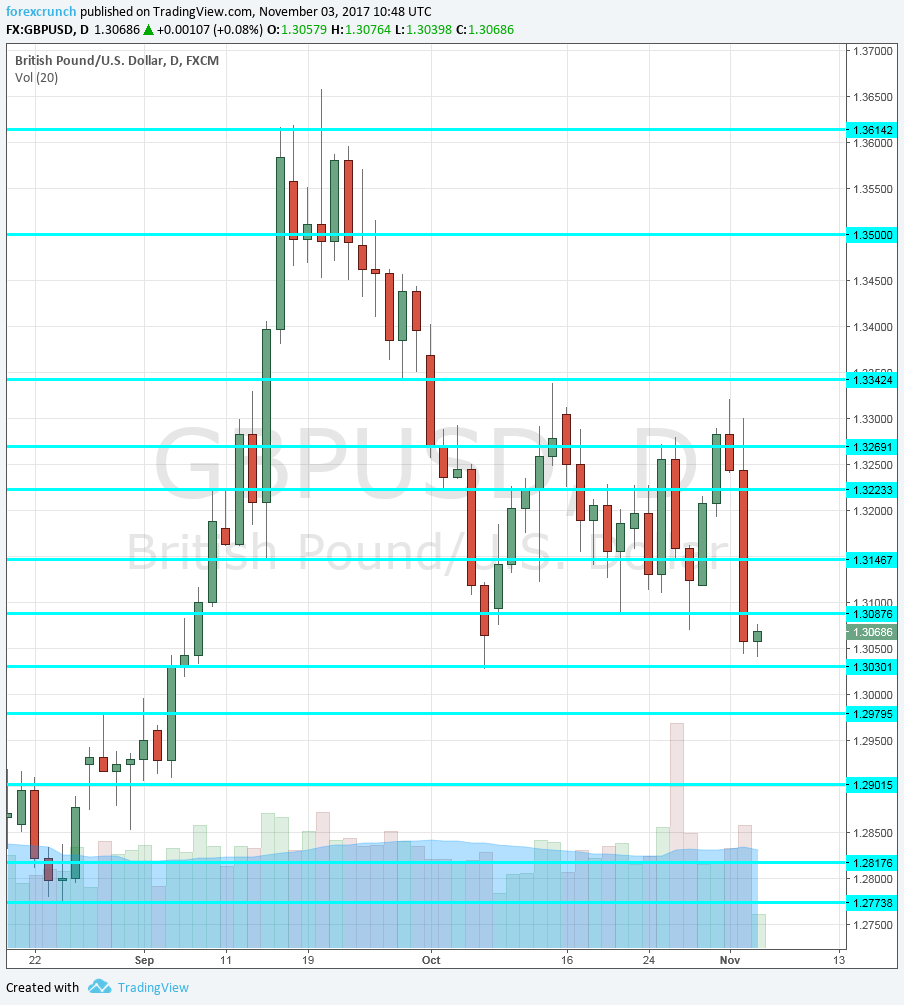

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Tuesday, 00:01. The British Retail Consortium has shown a rise of 1.9% y/y in September, up from 1.3% in August. While this does not reflect all spending in the economy, it serves as an indicator of interest.

- Halifax HPI: Tuesday, 8:30. The RBS has reported three consecutive months of rises in house prices, with a surprisingly robust rise of 0.8% in September. A more modest advance is likely this time: +0.2%.

- RICS House Price Balance: Thursday, 00:01. The diffusion index has almost dipped to negative ground but bounced back and stood at 6% in the past two months. A drop to 4% is on the cards.

- NIESR GDP Estimate: Thursday, 13:00. This Think tank has shown a bump up in the growth of late: 0.4% in the three months that ended in September, exactly what the official GDP showed. We now receive the growth rate for August to October.

- Manufacturing Production: Friday, 9:30. Manufacturing output has risen by 0.4% in August and in July, beating expectations. The wider industrial output figure advanced by 0.2%. Exporters in the manufacturing sector enjoy the weaker pound which makes their goods more attractive. A small increase of 0.3% is predicted.

- Goods Trade Balance: Friday, 9:30. The trade deficit expanded to 14.2 billion pounds in August, the highest in many years. It could squeeze a bit down in September. A narrower deficit of 12.9 billion is on the cards.

- Construction Output: Friday, 9:30. The construction sector is under a bit of pressure since Brexit, but still expanded by 0.6% in August, above expectations and the first rise after four months of drops. A slide of 0.6% is forecast.

GBP/USD Technical Analysis

Pound/dollar was initially capped at the 1.3225 level (mentioend last week) but then made a temporary break to the upside. It then collapsed and fell to find some comfort around 1.3030.

Technical lines from top to bottom:

The recent cycle high of 1.3620 serves as strong resistance. 1.35 was the post-Brexit high and remains the top level.

It is followed by 1.3370 which capped the pair several times in 2016. The previous 2017 high of 1.3270 is the next barrier. 1.3225 was the high point of September.

It is followed by 1.3180, which capped the pair in July. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I remain bearish on GBP/USD

Our latest podcast is titled New normal NFP, reluctant rate rise

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!