GBP/USD struggled once again due to hardships in Brexit negotiations but enjoyed an upbeat GDP figure. What’s next? The Bank of England’s Super Thursday is clearly the big event of the week, but also the PMIs could shake the pound. Here are the key events and an updated technical analysis for GBP/USD.

The British economy grew by 0.4% in Q3, better than expected. This seems to cement the rate hike. On the other hand, Brexit negotiations are not going anywhere fast. In the US, the ousting of Yellen as Fed Chair sent the dollar higher, as she is the most dovish candidate. In addition, the US GDP also came out above expectations.

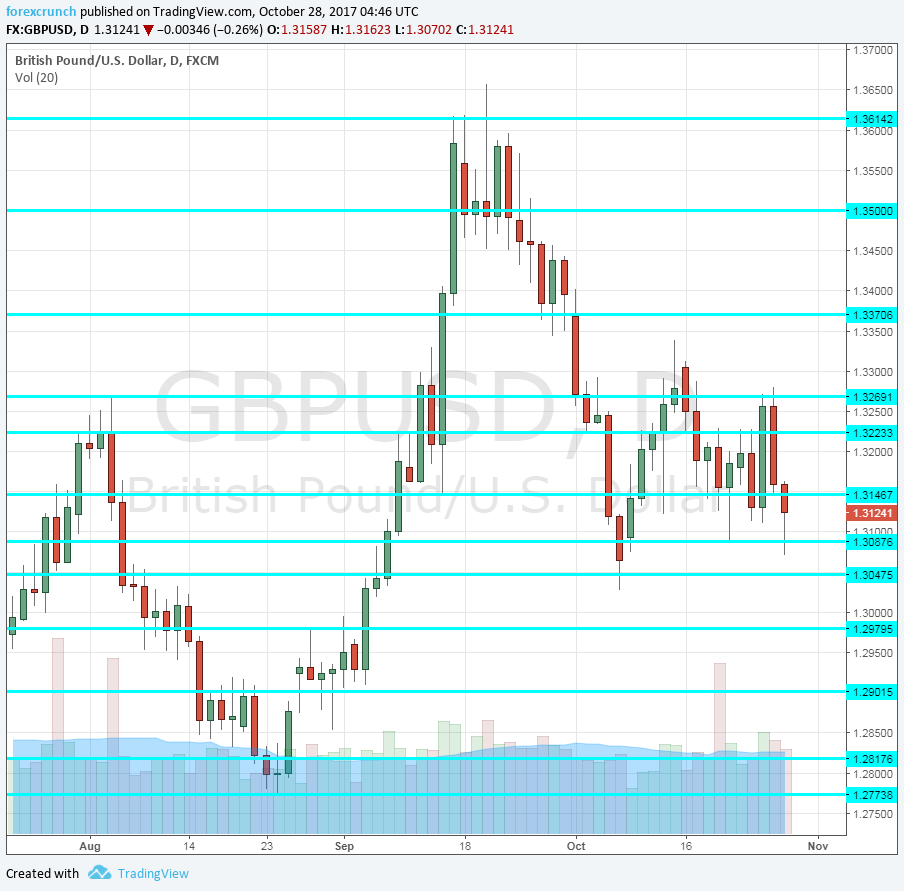

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Net Lending to Individuals: Monday, 9:30. Expanding credit reflects growth in economic activity. Net lending increased by 5.6 billion in August and a similar figure is likely for September. A level of 5.5 billion is expected.

- M4 Money Supply: Monday, 9:30. The amount of money in circulation rose at an accelerated pace of 0.9% in August, showing a potential for higher inflationary pressures. A slightly slower rate of 0.7% is on the cards.

- Mortgage Approvals: Monday, 9:30. The official measure of mortgage approvals has been quite steady in recent months, standing at 67K in August, slightly below 68K seen in July. A small drop to 66K is on the cards.

- GfK Consumer Confidence: Tuesday, 00:01. According to GfK’s 2000-strong survey, consumers are more confident, but they remain somewhat pessimistic. The measure rose to -9 points in September. Any score under 0 reflects pessimism and implies lower consumer spending. Consumer confidence is predicted to retreat to -10 points.

- BRC Shop Price Index: Wednesday, 00:01. The British Retail Consortium’s measure of inflation, using its members’ stores, dropped by only 0.1% y/y, up from much bigger drops seen beforehand. It serves as another gauge of inflation.

- Manufacturing PMI: Wednesday, 9:30. The first of Markit’s purchasing managers’ indices dropped to 55.9 points in September, slightly below expectations. The manufacturing sector enjoys the weaker pound that makes its exports more attractive. The same score of 55.9 is forecast.

- Construction PMI: Thursday, 9:30. The construction PMI fell below the 50-point threshold in September, meaning that the sector is experiencing a contraction, at 48.1 points. This is a worrying sign. The publication for October is slightly overshadowed by the BOE decision coming up. A bounce to 48.9 is estimated.

- Rate decision: Thursday, 12:00. The Bank of England will probably raise the interest rate from 0.25% to 0.50%, reversing the post-Brexit hike of August 2016. In the previous meeting and in consequent speeches, the Bank of England gave heavy hints that they are going to raise the rates due to higher inflation (reached 3% y/y) and also on worries about rapidly expanding credit. However, one member cast doubt about the timing of the hike while Governor Carney seemed unenthusiastic about further hikes. In case the BOE surprises with a no-change, the pound will crash, but the chances are low. In case they hike but hint it is only a one-off, the pound will likely wobble but no go anywhere fast. In case it is the beginning of a tightening cycle, the pound will leap. This is a “Super Thursday” meeting, that also consists of the Quarterly Inflation Report in addition to the rate decision and the meeting minutes. The QIR consists of inflation forecasts that could provide some prospects about the next moves while the meeting minutes could show if there were dissenters against the decision. The event will surely trigger high volatility.

- Services PMI: Friday, 9:30. The last of the PMIs is the most important one, as the services sector is the biggest one. A score of 53.6 was recorded in September, below expectations and showing slower growth. A similar score of 53.3 is expected.

GBP/USD Technical Analysis

Pound/dollar remained pressured early in the week, slipping to support at 1.3110 (mentioned last week).

Technical lines from top to bottom:

The recent cycle high of 1.3620 serves as strong resistance. 1.35 was the post-Brexit high and remains the top level.

It is followed by 1.3370 which capped the pair several times in 2016. The previous 2017 high of 1.3270 is the next barrier. 1.3225 was the high point of September.

It is followed by 1.3180, which capped the pair in July. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I remain bearish on GBP/USD

The Bank of England will find it hard to cheer up the pound and the dollar looks stronger now. There is no reason to think cable can recover now.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!