GBP/USD had a quiet week, closing at 1.5178. The upcoming week is a busy one, with 11 events on the schedule. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

In the UK, Construction PMI beat expectations but manufacturing missed, in line with disappointing manufacturing numbers worldwide. The notion that the BOE is waiting for the Fed and the Fed will never act serves to weaken the pound. In the US, the NFP report was a huge disappointment, ending the trading week on a sour note. This helped the weak pound hold its own last week.

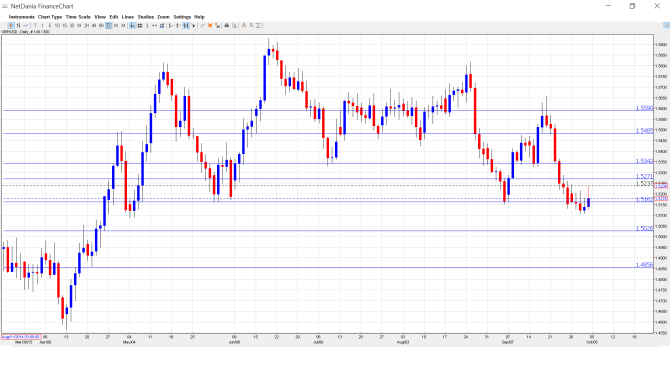

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Services PMI: Monday, 8:30. This key indicator has lost ground in the past 2 months, and came in at 55.6 points in the August release, short of the estimate of 57.6 points. The markets are expecting better news in September, with an estimate of 56.4 points.

- Halifax HPI: Tuesday, 6th-9th. This housing inflation indicator provides a snapshot of the level of activity in the housing sector. The index surprised the markets with a surge of 2.7% in August, its sharpest gain in over a year.

- Housing Equity Withdrawal: Tuesday, 8:30. This minor housing indicator is released on a quarterly basis. The indicator remained steady at -13 billion pounds in Q1, weaker than the forecast of -12.1 billion. The estimate for Q2 stands at -12.5 billion pounds.

- BRC Shop Price Index: Tuesday, 23:01. This indicator measures the change in consumer inflation recorded in BRC shops. The indicator has been steady, posting two consecutive declines of 1.4%.

- Manufacturing Production: Wednesday, 8:30. This key event should be treated by traders as a market-mover. The indicator was a disappointment in July, posting a sharp decline of 0.8%. The markets had expected a small gain of 0.2%. The forecast for August stands at +0.5%.

- NIESR GDP Estimate: Wednesday, 14:00. This monthly indicator helps analysts track GDP, which is only released each quarter. The indicator dipped to 0.5% in August, marking a 4-month low.

- RICS House Price Balance: Wednesday, 23:01. This minor housing event continues to improve, and climbed to 53% in August, well above the forecast of 46%. The upward trend is expected to continue, with the forecast for September standing at 56%.

- MPC Official Bank Rate: Thursday, 11:00. The BOE is expected to hold the benchmark interest rate at 0.50%. The central bank will also release the vote on the September rate decision, which is expected to remain at 8 members in favor of holding the current rate level, and one member in favor of raising rates. The BOE will also release a Monetary Policy Summary, and the markets will be looking for clues regarding the BOE’s future monetary policy.

- Asset Purchase Facility: Thursday, 11:00. The BOE is expected to hold QE at 375 billion pounds. The vote of the previous QE decision will also be released. It is expected to remain unanimous, with all 9 members voting in favor of maintaining the current level.

- BOE Governor Mark Carney Speaks: Thursday, 18:00. Carney will speak at the IMF meeting in Lima. Analysts will be listening closely for any hints as to the BOE future plans concerning monetary policy.

- Trade Balance: Friday, 8:30. The trade deficit swelled in July, hitting GBP 11.1 billion pounds, which was much higher than the estimate of GBP 9.5 billion. The markets are expecting an improvement in the August report, with an estimate of GBP 10.0 billion pounds.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.5201 and quickly touched a high of 1.5241. The pair then reversed directions, dipping to a low of 1.5106, as it tested support at 1.5163 (discussed last week). The pair closed the week at 1.5178.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

We start with resistance at 1.5590.

1.5485 was a cap in the first half of September.

1.5341 is providing strong resistance.

1.5269 was an important support level in March.

1.5163 continues to be busy, and remains a weak resistance line.

1.5026 has provided support since April and is the first line of support. It is protecting the symbolic line of 1.50.

1.4856 is the next support level. This is followed by support at 1.4752.

1.4667 is the final support line for now. This line marked the start of a pound rally in April which saw the pound climb close to the 1.55 line.

I am neutral on GBP/USD.

Despite awful job numbers out of the US and a strong British Construction PMI, the pound couldn’t make any headway against the US dollar. The negative effect of the weak US Nonfarm Payrolls could extend into next week, but monetary divergence continues to favor the US dollar.

In our latest podcast we discuss the Nightmare NFP, Judge Japan and Natural Gas:

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.