The Bank of England continues providing volatility. Last week, the MPC saw three votes for a rate hike, boosting the pound. Then we had Carney clearly stating it is not the time for a rate hike amid high political uncertainty.

And now comes Andrew Haldane. He said that removing some stimulus could become appropriate in the second half of the year. Is he about to vote for a rate hike? In this case, the pressure is mounting to a full-scale “hawkish revolt” against Carney. The second half of 2017 is just 10 days away.

Had he voted last week to raise rates, the result would have been 4:4. The previous governor of the BOE, Mervyn King, was sometimes in a minority. IT did not happen to Carney. Not yet.

GBP/USD is already 100 pips off the lows seen earlier when it remained unclear if May can form a coalition. A deal with the DUP is far from completion. The Queen’s Speech went through without a government. The vote of confidence comes next week.

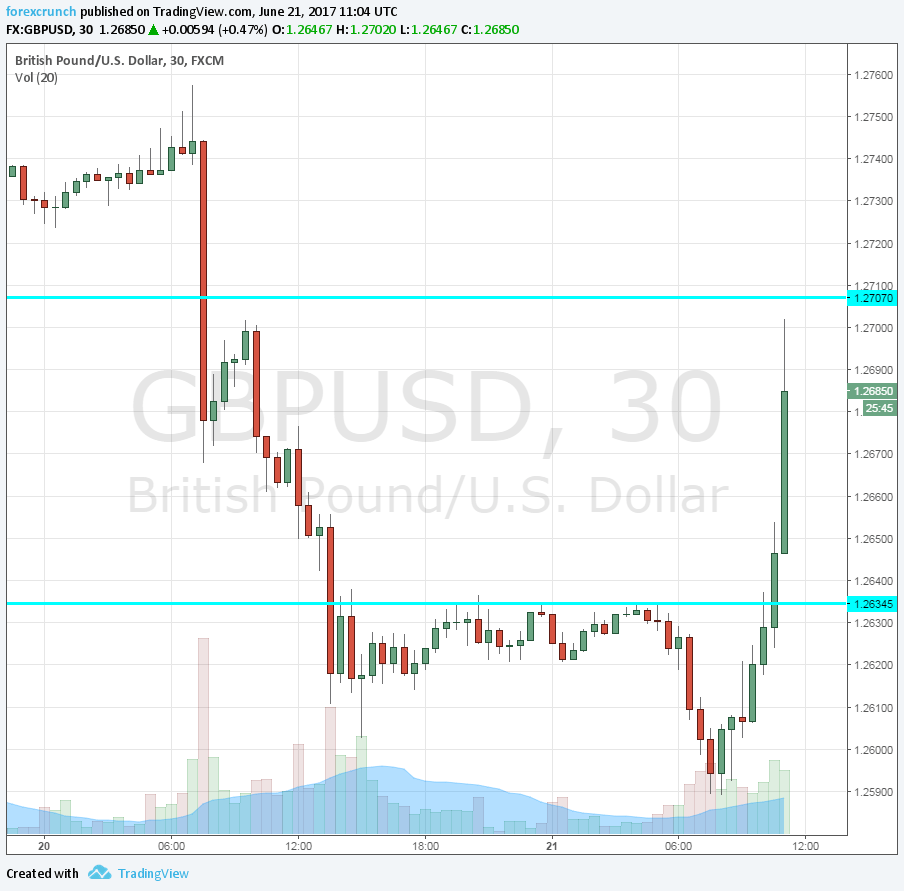

GBP/USD breaks high resistance

Pound/dollar reached a high of 1.2702, around the line of resistance at 1.27. On the way, the pair broke above the 1.2640 line of resistance, a line which was a low last week. Further resistance awaits at 1.2770.

Update: after temporarily halting at 1.2702, the pair continues higher and reaches a fresh high of 1.2708.

Here is how it looks on the 30-minute chart.