Interesting technical patterns are evolving on both cable and euro/yen.

Here is the view from SocGen:

Here is their view, courtesy of eFXnews:

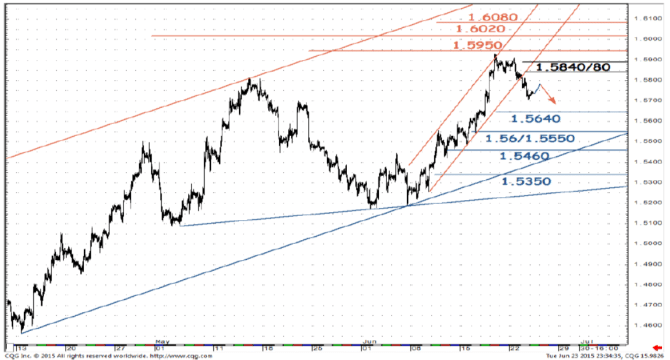

GBP/USD broke above one year descending channel and has crossed above last month highs before a pullback is taking shape, notes SocGen.

“Short term retracement is likely to be cushioned at 1.56/1.5550,” SocGen projects.

“The rebound should continue towards 1.62/1.63, the upper limit of an upward channel and the 61.8% retracement since last year highs,” SocGen adds.

Turning to EUR/JPY, SocGen notes that it has achieved the upper limit of a multi month descending channel at 141 where it has formed a daily shooting star.

“A probable double top at same level suggests possibility of a retracement,” SocGen argues.

“Currently the pair is testing an immediate support at 138/137.50 which happens to be the confirmation level of the pattern and an upward channel encompassing the recovery since April. A break below 138/137.50 will signal possibility of a correction towards the neckline of the inverted H&S at 136.70 which remains a decisive level for a retest of May lows at 133.00,” SocGen projects.

“Only a move past 141 will signal further rebound,” SocGen adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.