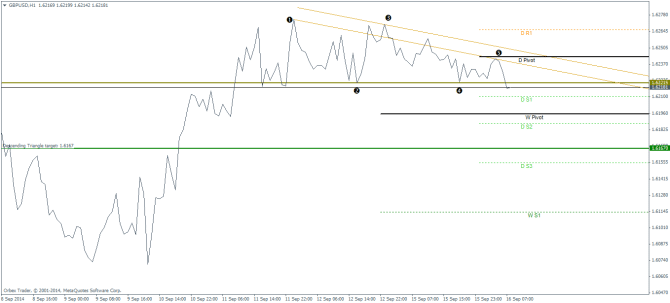

The intra-day charts of GBPUSD show the support level being established at 1.622 on the hourly charts, forming what seems to be a descending triangle pattern giving a good trading opportunity for intra-day scalpers.

Update: UK inflation slides to 1.5% as expected

This is clearly observed when switching to the line charts as shown in the chart below.

The descending triangle, although not your typical textbook pattern does seem to have bounced off the falling resistance trend line with a clear support being established at 1.622, giving a downside target to 1.6167. For stops, look for price levels above the daily pivot level of 1.6243 with 1.6258 proving to be an ideal place for stops as a move above this reversal swing point could invalidate the short trade idea.

As an alternative scenario, a move to the upside breaking 1.6258 could possibly see a minor move towards the support at 1.622 before prices resume higher.

Fundamentally, the inflation data that is due to be released today at 11:30AM (GMT+3) is expected to show a weaker inflation data. It is a known fact that the falling British Pound has influenced a softer inflation data as was seen by the previous month’s print where inflation dropped to 1.6%, below the forecasted 1.8% and down from the previous reading of 1.9%. Today’s inflation data is expected to drop to 1.5% and this decline seems to have been priced in. Therefore, for potential downside moves in the GBPUSD, we would expect the CPI reading for this month to drop even further to see any significant downside moves.

From a larger time frame, GBPUSD is range bound and seems to be more influenced by the opinion polls on the Scottish referendum and as long as fundamental data comes in line with expected, we could possibly see a muted reaction. Any upside risks could well be capped by the continued onslaught of various opinion polls in the run up to the Scottish vote on the 18th.

The only other key risk to the GBPUSD comes from the US PPI data due to be released during the US trading session. A better than expected data could see the GBPUSD extend its losses.

To trade the descending triangle, look for a potential break out and enter on a retest of support at 1.622. In the event the declines are far too much, look to enter on pullbacks to target 1.6167. Ahead of the descending triangle target, we have the weekly pivot level at 1.6195 which could provide a short term support. Therefore successful shorts should most likely cover their risks once GBPUSD draws closer to the weekly pivot levels.

At the time of writing, the Stochastics oscillator is pointing downwards on the H1 charts with H4 confirming a move to the downside. The Stochastics on the daily and weekly charts however are in the oversold levels, potentially point to an upside correction. But given that these are from the larger time frame, we could expect an upside move (if it happens) over the next few days.