The British pound suffered from the European debt crisis, but an amazing comeback eventually sent it to a higher close. A very busy is ahead with inflation and employment figures in the limelight. Here is an outlook for the upcoming events, and an updated technical analysis for GBP/USD.

Britain’s trade deficit leaped to almost 10 billion and weighed on the pound. On the other hand, manufacturing was OK, at least during September. Conditions are expected to worsen later on.

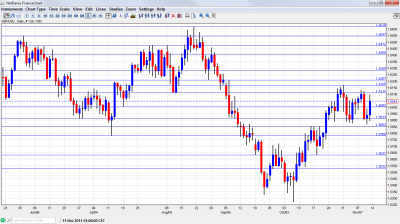

GBP/USD chart with support and resistance lines on it. Click to enlarge:

- Nationwide Consumer Confidence: Publication time unknown at the moment. This highly regarded survey has shown a small slide in confidence among consumers. The figure unexpectedly dropped from 48 to 45 points last month. Another small dip is likely.

- CPI: Tuesday, 9:30. Headline inflation, as measured in the Consumer Price Index, surprised with a leap to 5.2%. This doesn’t deter the central bank, which sees rising unemployment and prospects of falling inflation. CPI will probably slide ro 5.1% this time. The Retail Price Index (RPI) which is also an important measure of inflation, rose to 5.6% and will likely remain at these levels. Core CPI, which ticked to 3.3%, is predicted to remain unchanged now. Mervyn King is set to write a letter to the Chancellor of the Exchequer, George Osborne, to explain the high inflation.

- Employment data: Wednesday, 9:30. The number of jobless claims, as represented by Claimant Count Change, is on the rise for the past 7 months. An eighth month of rises is predicted now. A rise of 20.8K is expected to follow September’s 17.5K rise. Also the unemployment rate, which lags the jobless claims release by one month, is on the rise. It reached 8.1% in August and will likely tick up once again to 8.2% now.

- BOE Inflation Report: Wednesday, 10:30. Once a quarter, the Bank of England produces a detailed report about inflation, employment and growth prospects. This highly regarded report is accompanied by a press conference held by BOE governor Mervyn King and some of his colleagues. The pound usually shakes after the publication of the report and continues to move upon comments of the central bankers.

- Retail Sales: Thursday, 9:30. Contrary to a few other indicators, the volume of sales surprised with a nice rise in September: +0.6%. A drop of 0.3% is likely now. Any result will rock the pound.

* All times are GMT.

GBP/USD Technical Analysis

Cable made a big drop earlier in the week, falling off the round number of 1.60 (mentioned last week). After bottoming out above the 1.5850 line, the pair climbed and closed at 1.6044.

Technical levels from top to bottom

1.6617 was a peak in August and remains the high line this week. It is followed by 1.6550 that capped the pair through May. The next line was very stubborn afterwards, during July, 1.6470, and also capped the pair in August.

1.64, which was a pivotal line recently and resistance at the beginning of the year. 1.6285 follows with a similar role. It was also support at one point.

The round number of 1.62 worked in both directions during many months of range trading and wasn’t approached now. 1.61665 joins the chart after capping the pair in October. It is still minor.

1.6110 is another significant line that served better as support than resistance and has weakened lately. The round number of 1.60 was fought over and provides immediate, yet weak support. Also this line worked well in both directions during 2011. 1.5910, was eventually broken and now remains support, the same role it had in June.

1.5850 proved to be a tough line of resistance before the recent break higher and now works as very strong support. It is followed by the swing low of 1.5780, a minor resistance in 2010, which is minor support now.

1.5633 worked as support during September was only very temporarily breached in October. It is followed by 1.5530 which was the bottom line of the recent range, and had a similar role back in 2010. It now turns into support.

I remain bearish on GBP/USD.

While British yields have distanced themselves from continental European counterparts (including France), the situation in Britain remains dire. Another leg up in unemployment can push the pair lower.

If you are interested in GBP/JPY and technical setups for this pair with binaries, see this week’s GBP/JPY binary technical setup.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.