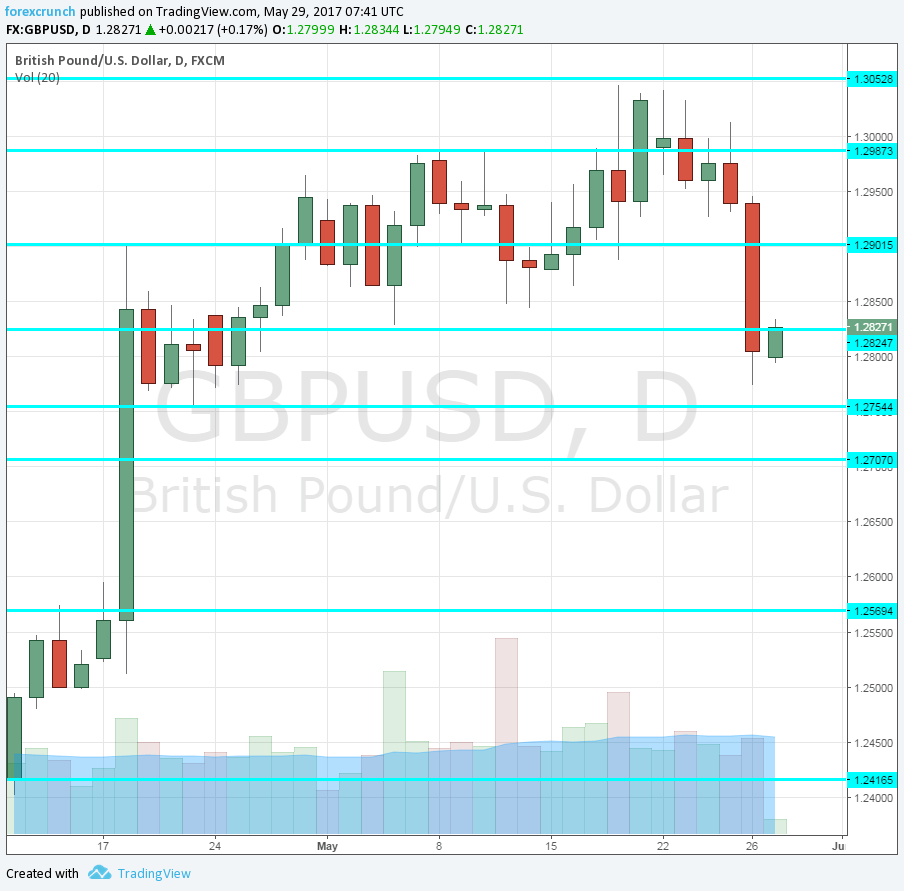

Pound/dollar is trading around 1.2825 after dipping under 1.28 and hitting a new low of 1.2775 on Friday. Before the weekend, we discussed the three reasons for the fall of the pound. Cable had reached the lowest in a montn. One of the drivers was the tightening of opinion polls in the UK.

Quite a few new polls have been released over the weekend and they paint a mixed picture.

Latest UK polls

- ICM continues showing a wide lead for PM Theresa May’s Conservatives: 46% to 32% for Labour. The same 14% margin remains intact.

- YouGov shows a tightening with 43% for the Tories and 36% for Jeremy Corbyn’s party.

- Opinium showed a lead of 10% against 13% beforehand.

- ComRes showed 12% after 18% in a previous poll.

- ORB showed the narrowest gap of only 6% after 12% previously.

All in all, the Conservatives maintain a solid lead, but it is somewhat narrowing according to some opinion polls, but not all of them.

In general, the polls showing a larger lead for the Tories rely on previous voting patterns, whereas older people turn out to vote more than youngsters. This is what happened in 2015 and in the Brexit referendum and favors PM May’s party. The polls showing a narrower gap rely on the massive last-minute registration of youngsters to vote.

The pound and the elections

Markets clearly prefer a landslide victory for the Tories. They are still seen as the pro-market party despite some interventionist rhetoric from May. The alternative, the Labour Party, broke to the hard left under its current leader Jeremy Corbyn.

And what about Brexit? While May has adopted a tough line on the issue, the assumption is that she will soften after the vote, after receiving a full mandate.

After the gap had narrowed, the latest opinion polls do not all go in one direction. Has Labour’s momentum stalled? Or is it just a correction after the big fall?

Another explanation is that the move to the upside is related to the bank holiday in the UK. Current trading on thin liquidity does not reflect what is really going on and the downtrend could resume afterward.

More: GBP: What Would A Labor Win Mean For GBP? – Nomura

GBP/USD levels

In any case, GBP/USD is currently trading at 1.2826, up some 50 pips from the trough seen on Friday. Resistance awaits only at 1.29, followed by 1.2980 and 1.3050. Support is at 1.2750 and 1.27.