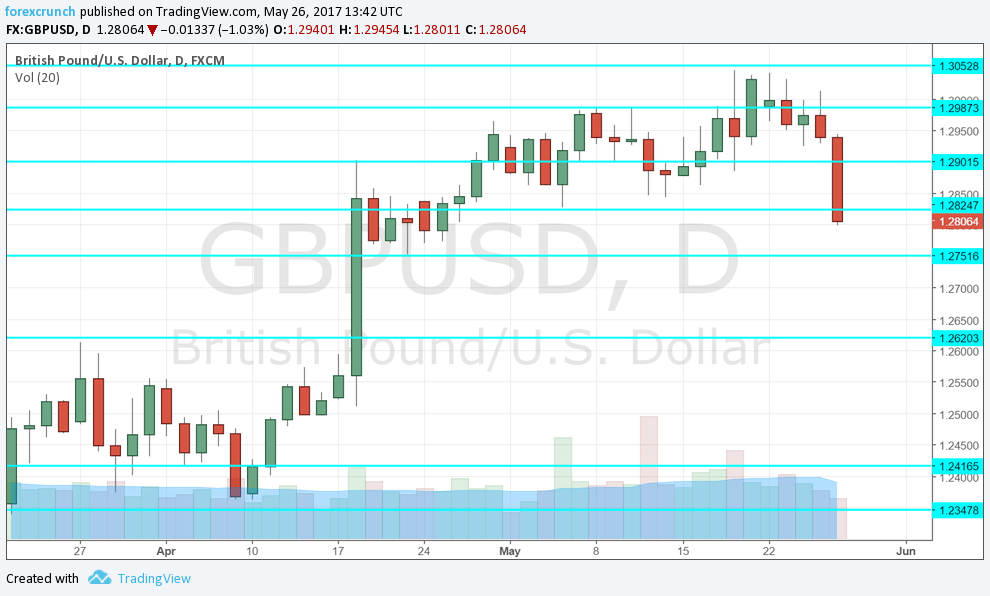

GBP/USD is struggling to hold onto the 1.28 level after hitting a new low of 1.2790, the initial post-Brexit low This is already a drop of over 250 pips from the cycle highs seen earlier in May and at the lowest level since April 26th, a full month.

There are three reasons for the downfall of cable as it approaches a critical level. Here goes:

Why GBP/USD is tumbling down

- Opinion polls: The horrific terror attack in Manchester, the mourning that followed and the critical level of alert have put the elections on the backburner in terms of public attention. Pollsters have also paused their work in respect to the victims. Nevertheless, polls released before the attack as well as those published after campaigning had resumed all showed a clear picture. The Labour Party is on the rise and narrowing the gap against the Conservatives. The elections were supposed to enlarge the majority for Theresa May’s party and she may have a harder time winning them. While she is still on course for an absolute majority, having a government dependent on hard Brexiteers is not what markets want. A big mandate for PM May would allow her to soften her position. In addition, the specter of a Labour victory also worries markets. This is not Tony Blair’s New Labour but rather a hard-left version. So, the pound is worried about being stuck between a Rocky Brexit or a Hard Left.

- UK economy: Last week, we learned that real wages have turned negative. Nominal wages are rising at a slower pace than inflation. The weaker pound is taking its toll on the standard of living of Brits. And while consumer spending did bounce in April, it could be related to an “Easter effect”. The latest disappointment came from the GDP release: it was revised to the downside: only 0.2% in Q1 2017. All in all, the British economy has seen more optimistic days.

- US growth: The latest driver of the greenback came from the release of GDP. Contrary to Britain, growth was revised to the upside: 1.2% against 0.7% originally reported and 0.9% expected. These are all annualized figures. Converting them to quarterly numbers, the US is now growing at 0.3%. With these revisions, the US is now growing at a faster rate than the UK, different from the data we had two days ago.

GBP/USD levels to watch

If the pair loses the 1.28 level, we can open our eyes for 1.2750, the post-elections announcement low. The level was recorded on April 24th. Further below, we find 1.2620, a pre-election announcement high.

Even lower, support only awaits at the pivotal line of 1.2415, followed by 1.2350. Both were last seen in the spring.

To the upside, we find 1.29, 1.2980 and 1.3050. All were recent levels of resistance during the month of May.

More: Can GBP/USD stay up or has it peaked?