The pound is on the back foot. GBP/USD began the week with a weekend gap under 1.30. While the gap was closed relatively quickly, cable still trades on lower ground.

There are two main reasons for the slide, but both seem quite minor. Is there a buy opportunity here?

Trimming Tory lead

Brits go to the polls on June 8th. The snap election announced by PM Theresa May sent the pound leaping higher. The assumption was that she could sweep a landslide victory and receive a fresh mandate. With this mandate, some believed that she could strive for a softer Brexit.

At the time, back in mid-April, the polls showed her Conservative Party leading Labour with gaps of 15 to 20 points. The opposition seemed to be in tatters as leader Jeremy Corbyn failed to unite the party. The notion was strengthened after local elections on May 4th favored May’s party.

Since then, all the parties have been on the campaign trail and have also presented their manifestos. Latest opinion polls have shown a narrowing gap and growing support for Labour. Some polls show a single-digits lead for the Tories.The Corbyn manifesto includes higher taxes and also a nationalization of some services. Markets do not like that.

However, it is natural for such a huge gap to narrow once the campaigns are underway. The gap still remains wide and with the UK’s first past the post, the Conservatives are still expected to win an absolute majority. In addition, opinion polls underestimated the vote for the conservatives in 2015.

More: 5 reasons why the UK elections should be pound positive

Brexit talks to break up?

The second reason for the pound’s plunge came from a talk about the Brexit talks. David Davis, the Brexit Secretary, threatened to quit the talks if his country receives a massive bill. Talks are set to begin on June 19th, after the elections.

A break up of talks before they begin? This is not a good start and points the hardest possible Brexit, one without a deal whatsoever.

Yet we can frame the tough talk in the context of the upcoming elections. Similar to the “Brexit dinner” May had with Juncker, these noises could be linked to the campaign. The European Union also presented relatively tough lines for the negotiations.

This is probably just the beginning and negotiators will eventually reach a deal behind closed doors.

More: Trader’s perspective on trading in the aftermath of Brexit

GBP/USD buy opportunity?

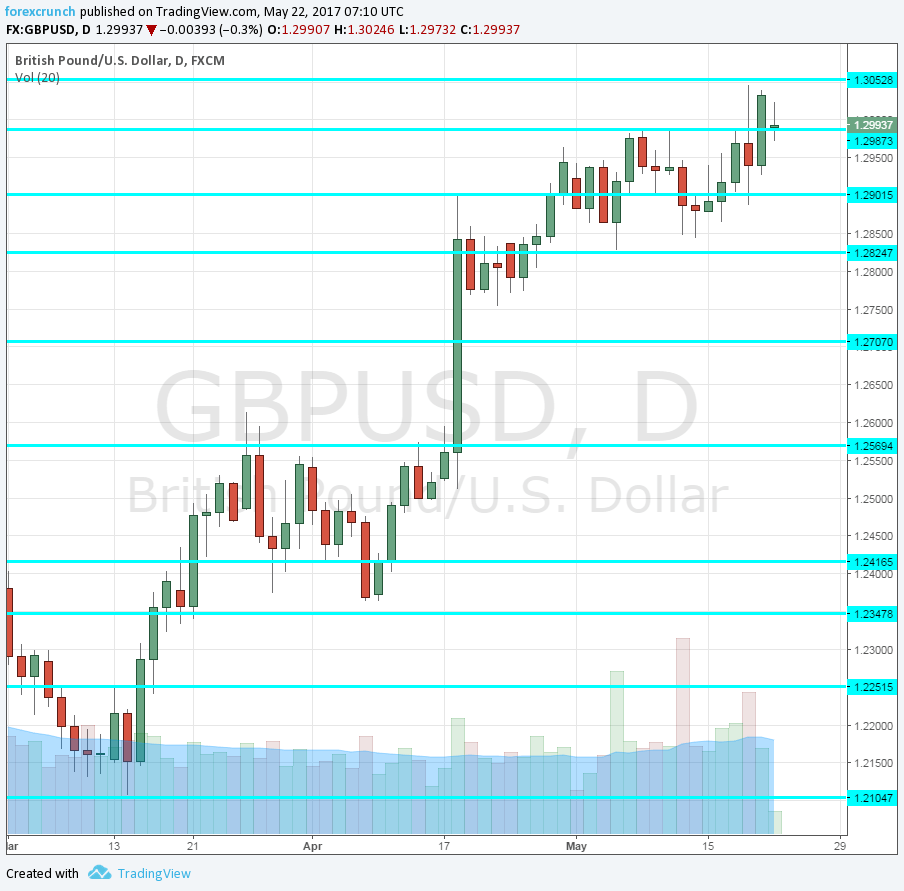

Given these conditions, the slip of the pound under 1.30 may serve as a buying opportunity. The recent retail sales data from the UK came out above expectations and US data has been mediocre.

Resistance awaits at 1.3050 which is the cycle high. It is followed by 1.3130 and 1.32. All in all, we are back to the range seen last summer, and the limit is 1.35.