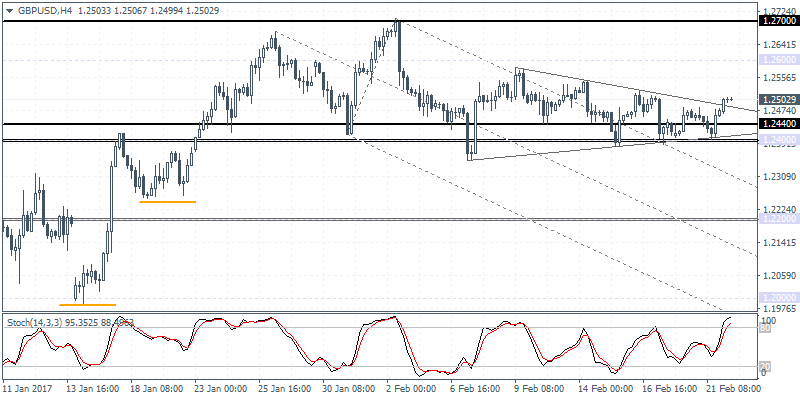

GBPUSD intra-day analysis

GBPUSD (1.2502): GBPUSD has been repeatedly consolidating near the 1.2400 – 1.2440 handle but the recent break out to the upside from here and from the triangle pattern indicates a continuation to the upside, with the next target seen at 1.2600. However, failure to rally towards 1.2600 and a continued consolidation below this level could increase the likelihood of a breakdown below the support level at 1.2400 and could invalidated the bullish outlook. The currency can be at risk today with the UK’s Office for national statistics set to release its second revision on the fourth quarter GDP numbers.

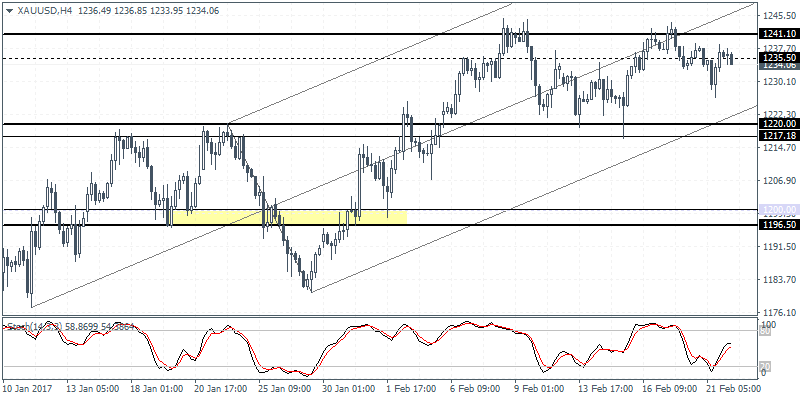

XAUUSD intra-day analysis

XAUUSD (1234.06): Gold prices were particularly choppy in yesterday’s trading as the precious metal was seen trading weak for the most part of the day, only to reverse loses and post a strong gain towards the U.S. trading session. Still, the outlook for gold remains to the downside with $1220.00 being the first target to the downside, en route to $1200.00. On the 4-hour chart, despite yesterday’s surprise pullback to the declines, gold prices have failed to break out above $1240 which could see a continuation to the downside with the FOMC likely to be the catalyst in the short term.

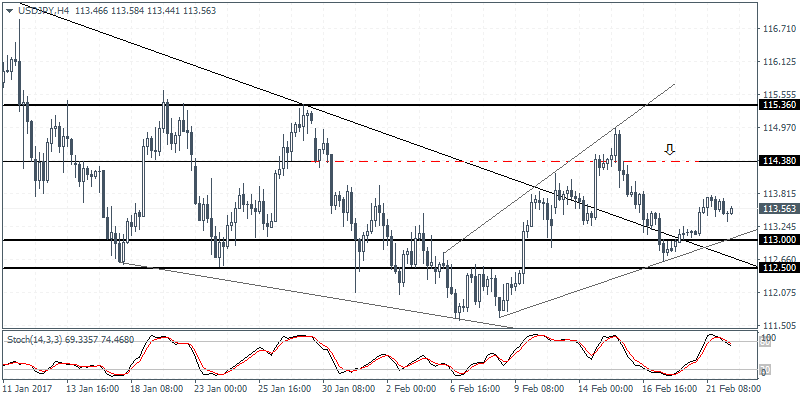

USDJPY intra-day analysis

USDJPY (113.56): USDJPY managed to maintain gains to the upside following the breakout from the falling trend line. Price action is now a few pips below testing the resistance at 114.00 which previously held up pushing prices to the lows near 112.80. With the upside breakout from the inside bar, USDJPY will need to make a bullish close above 114.00 to confirm further upside in prices. The resistance level of 114.00 – 114.38 will be one to watch as the broadening wedge pattern within which USDJPY is trading in could signal a potential reversal back to 113.00.