Germany, the largest economy in Europe, saw a growth rate of 0.4% q/q in Q4 2016. Year over year, the growth rate was 1.7%. While this is faster growth when comparing to Q3, the numbers fall short of expectations, which were 0.1% higher. In addition, the growth rate for Q3 was revised down from 0.2% to 0.1%.

The miss on German figures comes amid stronger growth in Germany’s European peers. The initial report euro-zone GDP growth came out at 0.5%. We will get an updated assessment of the whole currency bloc’s growth at 10:00 GMT.

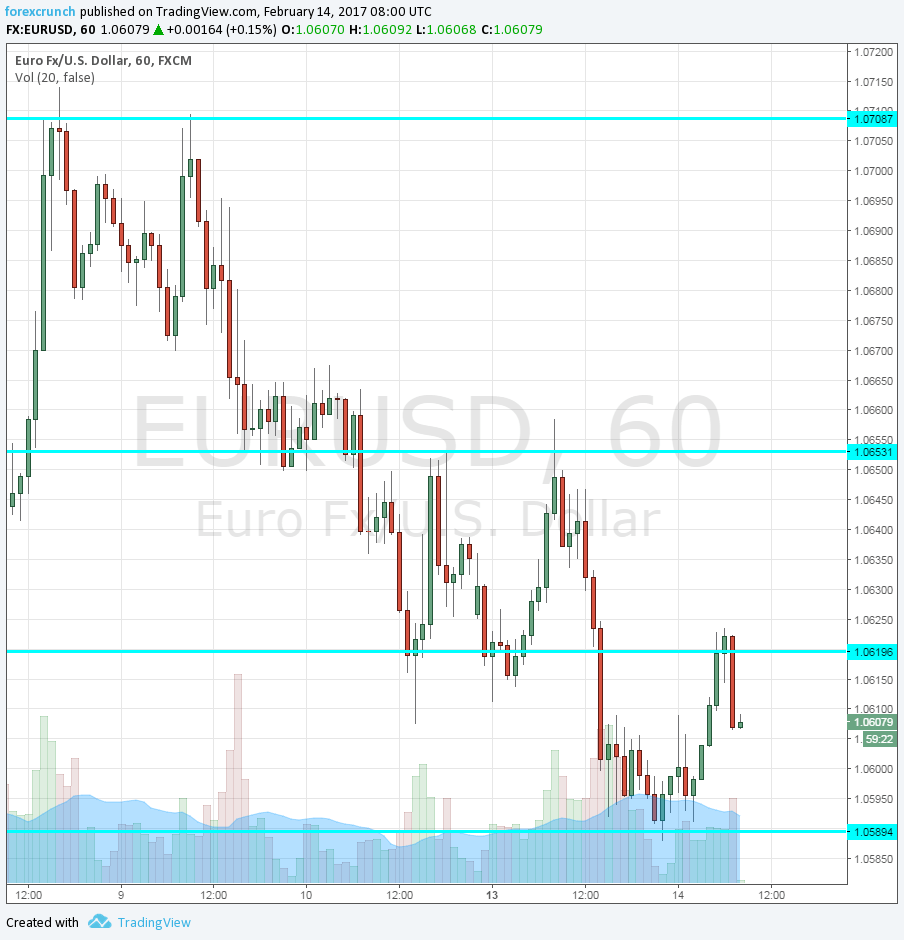

EUR/USD has been on the back foot in recent days, as political worries weighed on it. Fears of Le Pen’s victory chances and her vision to leave the euro, as well as relative stability from Trump’s White House sent EUR/USD to a trough of 10588.

Before the publication, EUR/USD was bouncing off as the USD was experiencing a sell-off of sorts. The high that was reached was 1.0623. One of the reasons for the greenback suffering is the resignation of Trump’s security adviser Michael Flynn. The White House is still not getting its act together.

However, the disappointing German news sends the pair back down. It continues battling 1.06.

More: EUR/USD: Here Is Why It Will Fall N-Term Before Rallying M-Term – Danske