All German figures fall below expectations: m/m CPI and HICP rise by only 0.3% each. Y/y CPI slides to 1% and HICP dips to 0.9%. German year over year CPI inflation was expected to slide from 1.2% to 1.1% in March in the preliminary reading. The HICP was expected to remain unchanged at 1%. Month over month, both were expected to rise by 0.4%. Early indications from the various German states showed a slowdown in price rises, so a miss is not surprising.

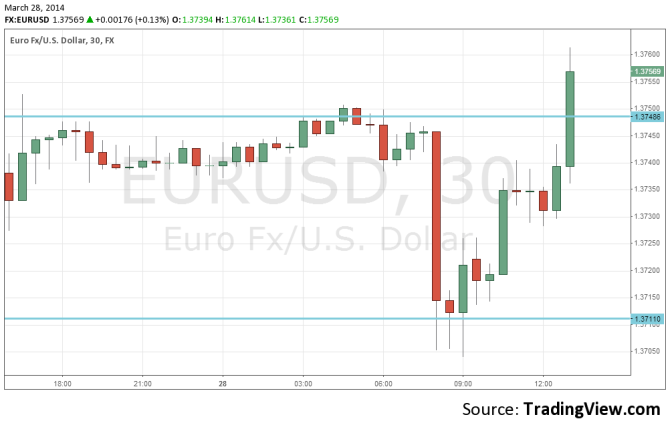

EUR/USD was attempting a recovery towards the publication, rising from the lows of near 1.37 to 1.3740. The pair continues to recover in the aftermath, in what looks like a “sell the rumor, buy the fact” reaction based on early state data.

The reaction to Monday’s data will probably be different. Very different.

The German inflation numbers carry a lot of weight in the flash CPI estimate for the whole euro-zone published on Monday, and this has a big impact on the ECB decision.

The ECB upped the ante with its dovish tone earlier in the week, further opening the door to QE and to a negative deposit rate. This sent the euro to a double bottom and then below this line.