Germany’s manufacturing PMI slipped 0.2 points to 53.6 points, marginally above 53.5 expected and basically in line with expectations. However, the services PMI dropped 1.1 points to 53.3 and this is already a more significant miss.

EUR/USD slips a few pips from the highs.

Markit was expected to report a small drop in Germany’s manufacturing PMI: from 53.8 as the final figure for July to 53.5 in this preliminary release for August. The services PMI was projected to remain unchanged at 54.4 points.

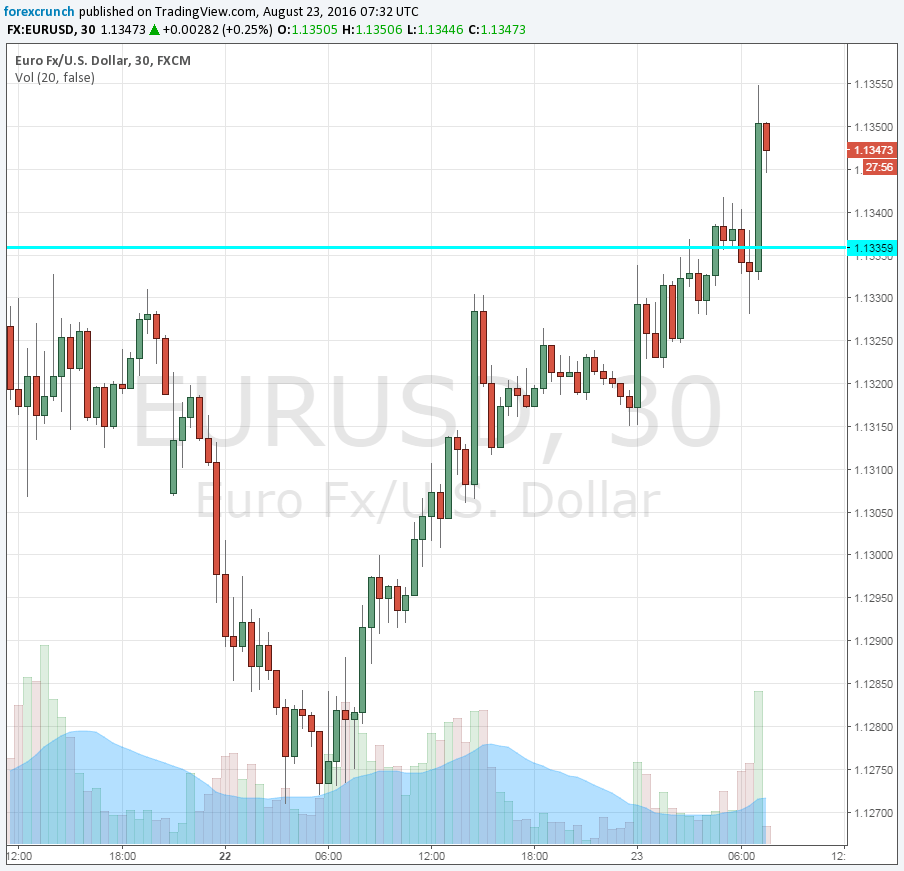

EUR/USD traded around 1.1350, rising back towards the highs after yesterday’s dip. We had doubts about the upwards move, due to the reason behind the fall: hawkish comments from the Fed, something that does not have a real basis.

Earlier, French PMIs came out mixed and showed a growing divergence between the manufacturing and services sectors in the continent’s second largest economy: manufacturing disappointed with a drop to 48.5 while services advanced to 52 points. The 50 point threshold separates growth from contraction.

Here is the EUR/USD chart. Note the small slip after the release. All in all, the trend remains to the upside. Resistance awaits at 1.1420, the post-Brexit high, while some support is ready at 1.1335. The all-European flash PMI is unlikely to rock the boat too much. In the US, the main release is the new home sales publication, at 14:00 GMT.

More: Has EUR/USD topped? Elliott Wave Analysis