Stanley Fischer, Yellen’s Vice Chair, made some hawkish statements and the dollar reacted. The permanent voter on the FOMC suggested that the Fed is getting closer to its jobs and inflation targets.

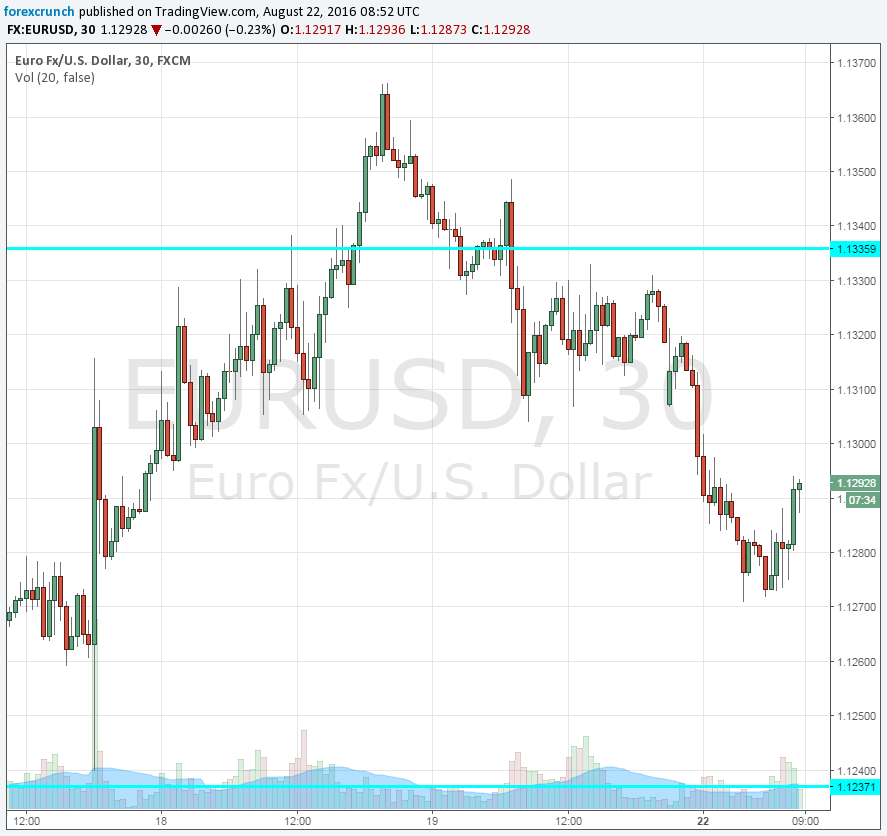

EUR/USD dropped back under 1.13, erasing some of the hard fought gains seen last week. However, there are reasons to fade Fischer.

First, he is a known hawk. Even before his appointment, the former Governor of the Bank of Israel was somewhat skeptical of over-dovishness. He is more of a hawk in comparison to both Fed Chair Janet Yellen and the Fed’s No. 3, New York Fed President Bill Dudley. As we know, the doves are firmly in control.

Secondly, it seems that markets got a bit carried away with last week’s dollar sell-off, and his words may be an opportunity for some profit taking. We will get some more information about the Fed’s intentions in the upcoming Jackson Hole Symposium, but it is hard to believe that the Fed will act before the US elections. Interest rates could rise in December, but September seems too soon.

So will the dollar resume its falls after this move? Not necessarily. The greenback remains the cleanest shirt in the dirty pile.

EUR/USD is currently trading at 1.1290, down from the highs of 1.1365 seen last week but still above the initial post-Brexit high of 1.1190. It remains basically in the middle.

More: Rising Libor – another reason to be bullish on EUR