Businesses in Germany are not really optimistic. The ZEW Economic Sentiment remains unchanged at 0.5. Current Conditions are at 55.1, both below expectations. Employment is up 0.4% q/q in Q2, on top of an upwards revised 0.4% for Q1. Year over year, the figure is at 1.4%.

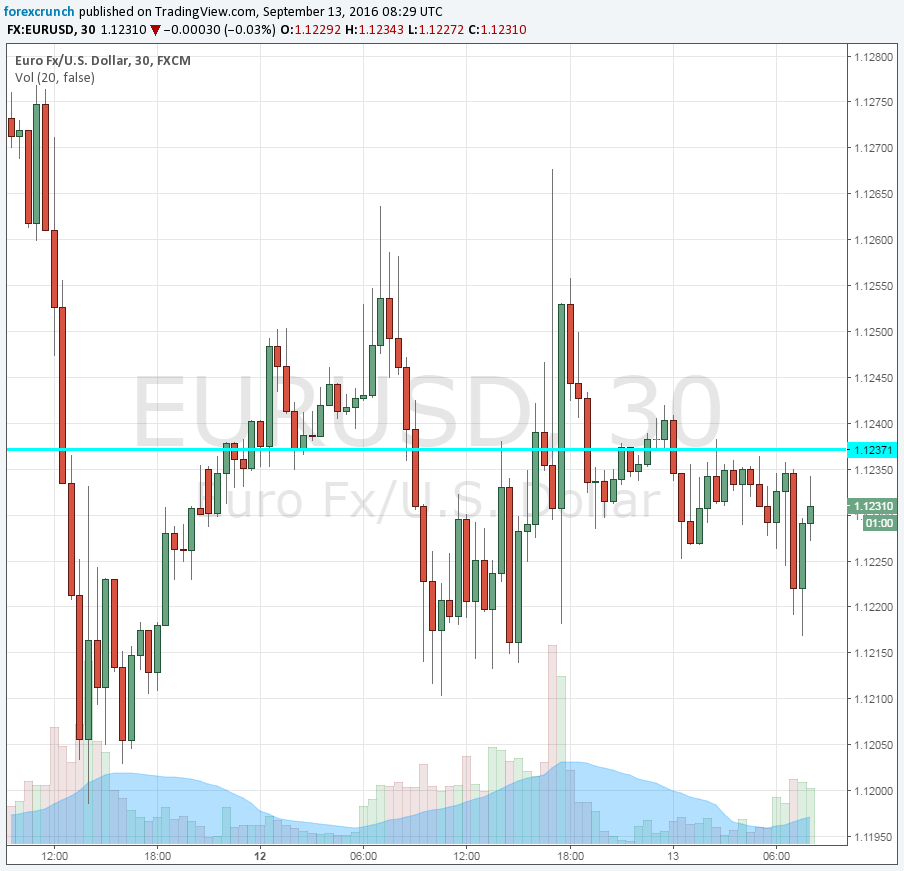

EUR/USD seems unmoved, awaiting Draghi.

ECB President Mario Draghi is speaking in Trento, in northern Italy, at the Alcide De Gasperi Award. At the same time, the German ZEW institute releases its business sentiment figures for September. Draghi hinted that QE would be adjusted, but was short in details in the last meeting. Quarterly unemployment data for Q2 were also published.

The German ZEW economic sentiment was expected to rise from 0.5 in August to 2.8 now. The all-European figure carried expectations for a rise from 4.6 to 6.7 points. The Current Conditions figure was expected to tick down from 57.6 to 56 points.

More: EUR/USD: En-Route To 1.08 As ECB Passes Baton To The Fed – BNPP

EUR/USD traded around 1.1230 ahead of the double-feature release. The bigger mover in the pair in recent days was the US dollar. In a public appearance yesterday, FOMC voter Lael Brainard more or less buried the chances of a rate hike in September.