- After bouncing off a three-week low, gold grinds upwards around the intraday top.

- During slow market conditions, a corrective pullback occurs from key support levels near-term.

- Wednesday’s inflation data failed to cheer yields despite hawkish Fed Minutes.

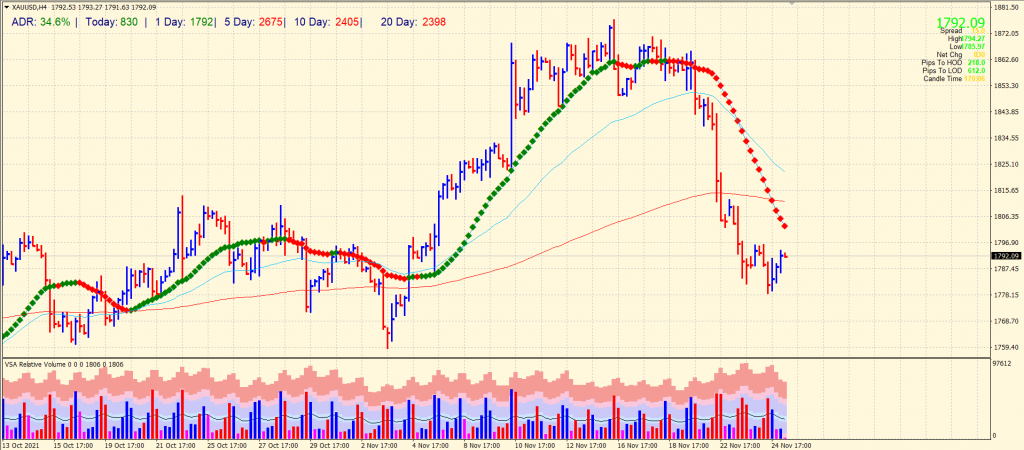

The gold price forecast remains bearish despite the marginal daily gains as the metal has not yet triggered a clear uptrend. Early Thursday, gold (XAU/USD) gained 0.25% intraday, around $1,792, despite a five-day downtrend.

–Are you interested to learn more about forex signals? Check our detailed guide-

It fell to its lowest level since November 4th the previous day before rebounding off $1,778. Pullbacks in US Treasury yields were probably triggered by a rebound in gold, but strong technical support around $1,780 also contributed to a corrective pullback. Asia’s recovery moves, however, remain sluggish since the US markets are closed for Thanksgiving, and there are no major releases from other countries.

Ten-year US Treasury Bonds fell 2.2 basis points (bps) to 1.64% despite the minutes of the Open Market Committee (FOMC) stating, “Some participants said a faster rate reduction might be justified.” In addition, FOMC member Mary Daly, who, according to Reuters, sees arguments for expanding QE cuts and expects rate hikes later this year, has also portrayed a hawkish bias at the Fed.

The US Personal Consumer Expenditure Index, which measures prices, was also at its highest point in 30 years, which should have also helped profitability. In October, the announced inflation indicator jumped to 5.0% y/y, beating the previously expected indicators of 4.6% and 4.4%.

Bond buyers may have been holding back because inflation expectations are subdued in the US, as measured by a 10-year break-even rate under the St. Louis Federal Reserve System (FRED). From Wednesday’s low, the indicator has increased from 2.61% to the previous day.

Inflation problems today are unlikely to have new catalysts. Still, gold traders should keep an eye on the latest Covid issues, which, if escalating, could lead the commodity back to vital support. Several warnings about lifting the quarantine in Germany followed record-high cases in Austria and the Netherlands.

The number of Coronavirus infections in Europe broke records on Wednesday, inflicting travel restrictions and pushing health professionals to administer booster vaccinations, reports Reuters.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Gold price technical forecast: $1,800 to cap gains

Although the gold price gained slightly, the volume data does not support it. Hence, the trend lacks follow-through momentum. The upside momentum may find a hurdle at 20-period SMA around $1,800 ahead of 200-period SMA around $1,815. However, the resumption of bears may go for a test of $1,760 support area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.