- Gold prices consolidated losses at a three-month low ahead of key US inflation data.

- Mixed sentiment, DXY pullback reminds buyers, but growth fears weigh on prices, Fed said.

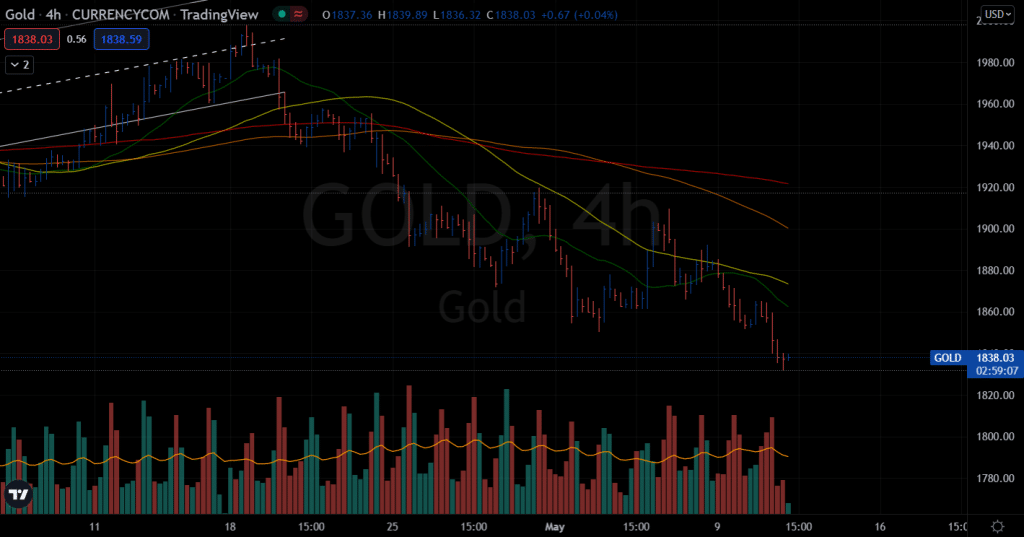

- The formation of a 12-day-old megaphone, a weekly resistance line, also gives hope to the sellers, although a fall in the US CPI could extend the price rally.

In anticipation of key US inflation data set for Wednesday, the gold forecast rebounded from its lowest levels since February. Due to modestly positive equity futures and China’s ability to release a bullish CPI amid ongoing Coronavirus concerns, the metal has revisited its intraday price to $1,838. US Treasury yields and the US dollar could also support the yellow metal.

–Are you interested in learning more about STP brokers? Check our detailed guide-

From a market consensus of 1.8%, China’s consumer price index (CPI) increased by 2.1% y/y, while the producer price index (PPI) exceeded expectations by 7.7%. Despite the Coronavirus lockdown, higher inflation in China is boosting gold demand. As a result, China is among the largest buyers of gold globally.

In Shanghai, local authorities report that the virus has not spread in eight districts, which may also reflect the prices.

Rafael Bostic, Atlanta Fed President, spoke earlier in the Asia session about the strong economy and high demand in the US and a neutral interest rate of 2.0-2.5% expected.

Loretta Mester, president of the Cleveland Fed and member of the FOMC, recalled the market bears, saying, “They do not “rule out 75-bps hike forever”.

Despite efforts by the World Health Organization (WHO) to ease strict restrictions on activities in Shanghai and Beijing, China’s “zero-tolerance” policy for Covid presents another challenge for gold buyers. When inflation fears are high, the lockdown at the largest industrial company in the world poses a serious threat to global growth.

The prospect of a Russo-Ukrainian war and its potentially disastrous consequences also give gold sellers hope. According to recent updates, European gas will have to be rerouted by Russia rather than Ukraine.

What’s next to watch?

The US CPI is predicted to fall to 8.1 percent from 8.5 percent in the next months, and it will be vital to monitoring the new momentum. The US CPI excluding food and energy, on the other hand, is predicted to decline to 6.0 percent on an annualised basis, down from 6.5 percent earlier. If inflation data does not improve in April, the US Dollar will face significant purchasing, pushing XAU/USD to new multi-month lows.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Gold price technical forecast: Recovery capped by $1,850

The 4-hour chart of the gold shows a dismal scenario as the price lies well below the key moving averages. Any upside attempt will find the strong resistance around $1,850 ahead of $1,875 and then $1,900. The volume data also shows no signs of bullish reversal. However, correction may appear after the bearish trend. Contrarily, the bearish trend may continue and hit $1,800.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money