- As investors await the outcome of the truth talks between Russia and Ukraine, gold prices hover around $1,930.

- According to Powell’s statement, the Fed should hike rates by 25 basis points in March.

- As a result of the collapse of the Russian economy and the negative impact on Ukraine, Russia may be forced into a ceasefire.

The gold price outlook remains neutral to bearish as the firm US dollar keeps the gains in yellow metal limited amid geopolitical woes and rate hike bets.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

Despite renewed worries about global economic growth and rising energy prices, gold prices are trading in a tight range of around $1,930. In addition, the Ukraine crisis caused oil prices to rise sharply, increasing inflationary risks. While gold’s upside potential continues to be limited by the overall strength of the US dollar, it continues to be a safe-haven asset amid a 25 basis point rate hike that Fed chair Jerome Powell has hinted at for next week.

Should risk aversion continue to strengthen, gold prices may drop back into the red if the dollar continues its recent bullish trend. Currently, all attention is focused on the Ukraine-Russia peace talks and US business publications.

The price of gold (XAU/USD) is trading in a tight range of $1,924.70-$1,933.42 as investors await the upcoming Russia-Ukraine peace talks on Thursday.

As investors anticipated that Russia’s economy would collapse under sanctions from Western leaders, some offers of around $1950 for the precious metal on Wednesday. Ukraine also strongly resisted Russian military incursions. Gold has not been helped by the strength of the US dollar, as risk aversion momentum has rebounded.

On Wednesday, Fed Chair Jerome Powell endorsed a 25-basis point (bp) rate hike at the March monetary policy meeting. While this reduced the likelihood of aggressive policy tightening, the door is still open to a 50-basis point rate hike. A 25-basis point rate hike was expected to propel gold prices higher, but investors’ increased risk appetite dampened gold’s strength against the US dollar, leaving gold prices around $1,930.

The US Dollar Index (DXY) opened with a bullish gap on Thursday. In response to the Fed’s push for a rate hike of 25 basis points, gold yields rose sharply on Wednesday.

Investors will also pay attention to the US Initial Jobless Claims and the ISM Services PMI due later this week and talks between Russia and Ukraine.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

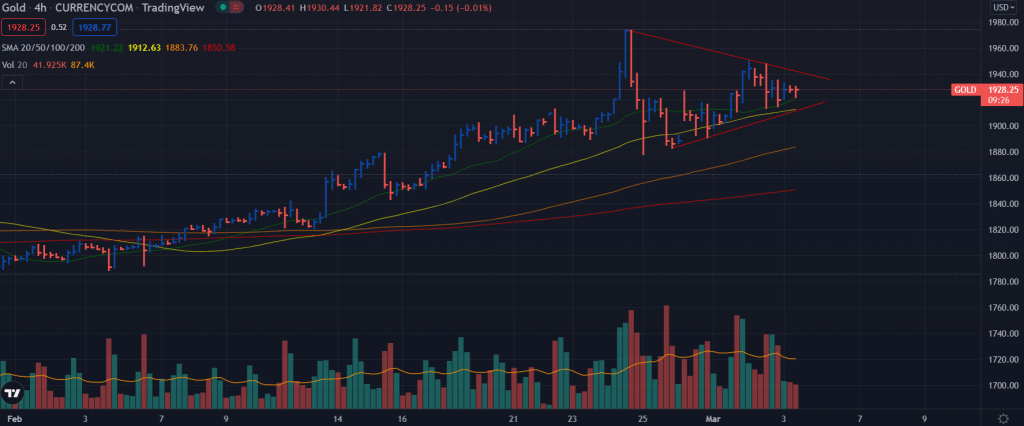

Gold price technical outlook: Bulls shy to move up

The gold price is wobbling above the 20-period SMA on the 4-hour chart. However, the outlook is shaky as the price is quite below the weekly highs. Moreover, the metal lacks directional strength at the moment. Any fall below the 50-period SMA and the ascending trendline will trigger the bearish trend. On the downside, $1,900 remains a key level to watch ahead of $1,875. On the upside, $1,950 remains a key hurdle for the bulls ahead of $1,970.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money