- Gold remains positive on the day amid Greenback’s weakness.

- US NFP posted dismal figures that aided the precious metal bulls.

- S&P500 index hits all-time highs.

The gold price forecast is bullish as the new week begins. Despite low activity on Monday, the slide could be temporary and may find buyers ahead.

Gold prices fell from the previous week, currently trading below $1,830 on Monday. The dollar’s weakness helped push prices closer to $1,835 on Friday. The slump in the US dollar was aided by lower nonfarm payrolls (NFP), which came in at 235K, well behind market expectations of 750K, which was a serious setback.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

As investors expected the Fed’s plan to reduce bond-buying to be delayed, they set aside USD. The unemployment rate fell from 5.4% to 5.2% in August, despite the US NFP’s failure to reach critical levels. US bond yields increased, making precious metals less attractive. As concerns over COVID-19 and slowing growth in China grow, prices are expected to trade regionally.

On Friday, traders are observing gold around $ 1,830, having broken through resistance ($ 1,831), following a sharp drop in nonfarm US jobs. Following a drop to a nearly 4-week low of 91.94, the US dollar index (DXY) looks to maintain bids above 92.00.

At the end of the New York trading session, risk appetite shifted despite a weaker dollar.

Currently, the S&P 500 futures are trading at 4532, down 0.06%, and 10-year bonds are yielding 1.326% more.

US nonfarm payrolls fell by 235,000 versus an expectation of 750,000 on Friday. In addition, a revision to July’s data showed the unemployment rate dropping from 5.4% to 5.2%.

The US dollar index, which measures the dollar’s strength against a basket of six major currencies, fell to a four-week low of around 91.94 as jobs data was released.

Despite consolidating in a tight range between $1809 and $1820, gold jumped to $1834, near a two-month high.

Last week, Federal Reserve Chairman Jerome Powell said that tapering could start ahead of schedule if the labor markets grow.

A rate hike would be considered only if inflation is beyond the 2% target in the US and other countries.

Federal Reserve’s massive asset-buying program will wait longer before it is abandoned, according to investors.

As long as the Fed maintains a cautious tone, the tapering announcement could be pushed back to December or early 2022.

The US dollar index may continue to decline, pushing gold towards $1,850.

Meanwhile, investors took profit after hitting another all-time high for the S&P 500 at 4551 on Friday as the market dipped.

Due to Labor Day, US and Canadian markets saw a quiet day on Monday.

This week’s ECB rate decision is now dominating the market’s attention.

A restrictive stance from the central bank could contribute to a rebound in gold’s price towards $1,850 by putting further pressure on the DXY.

–Are you interested to learn more about forex signals? Check our detailed guide-

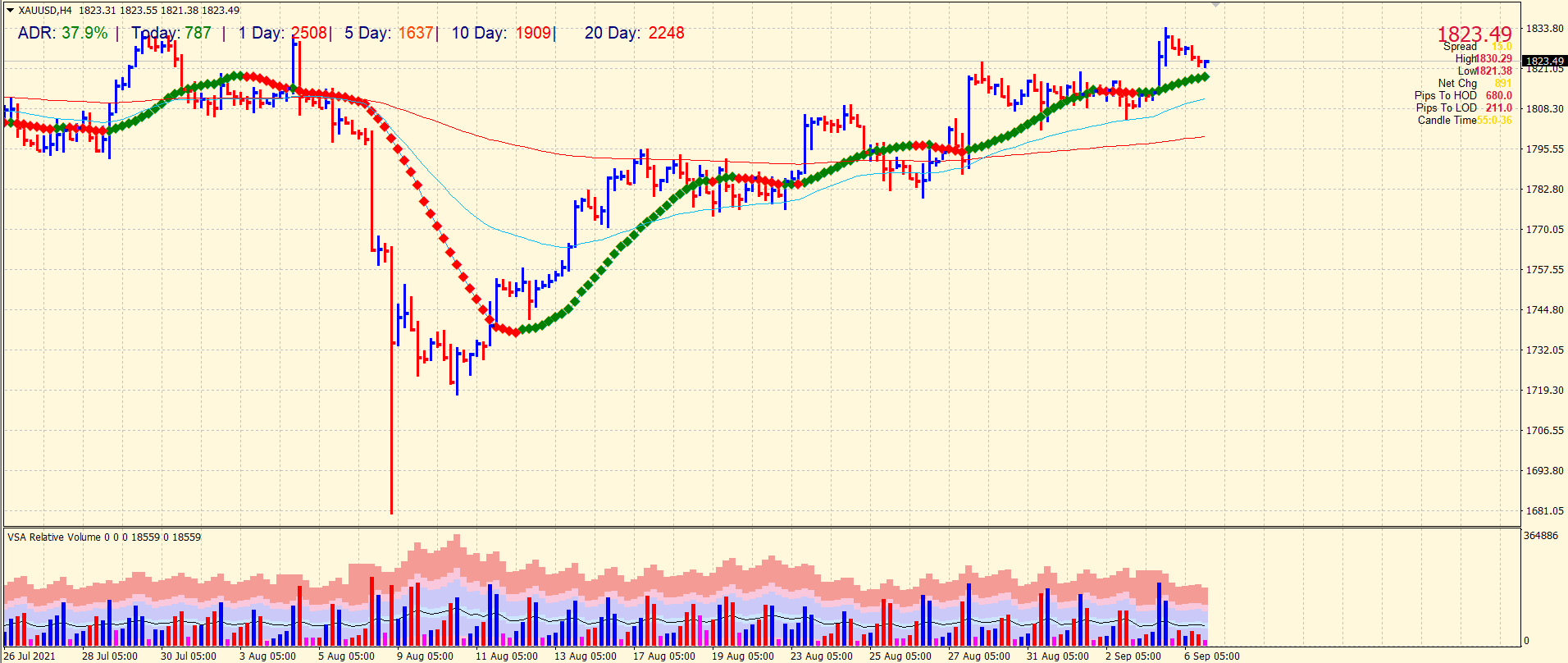

Gold price technical forecast: Temporary slide around 20-SMA

The gold price slipped to the 20-period simple moving average around $1,820 area. The asset covered only 37% average daily range, which indicates low activity on the day. The price can find further respite around $1,800. On the upside, $1,835 may provide resistance ahead of $1,850.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.