- The XAU/USD could jump higher if it stays above the weekly pivot point of 1,956.

- Only a new lower low validates more declines.

- The US data could change the sentiment later today.

The gold price dropped after reaching $1,974 yesterday. The precious metal is trading at $1,961 at the time of writing.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

Fundamentally, the XAU/USD plunged in the short term as the US JOLTS Job Openings came in better than expected, at 10.10M versus 9.41M estimated and above 9.75M in the previous reporting period. Furthermore, the Canadian GDP came in better than expected as well.

Today, the CPI Flash Estimate rose by 6.1% versus the 6.3% expected. Core CPI Flash Estimate reported a 5.3% growth, beating the 5.5% growth forecasted, while the Unemployment Rate remained steady at 6.5%.

Later, the US economic data should bring high volatility on all markets and now only on the XAU/USD. The ADP Non-Farm Employment Change is expected at 173K in May versus 296K in April. Unemployment Claims could jump to 236K in the last week from 229K in the previous reporting period, while ISM Manufacturing PMI could drop from 47.1 to 47.0 points.

Furthermore, the ISM Manufacturing Prices, Construction Spending, Wards Total Vehicle Sales, Final Manufacturing PMI, Revised Unit Labor Costs, and Revised Nonfarm Productivity data will be released as well.

Tomorrow, the yellow metal should be again driven by the US data as the NFP, Average Hourly Earnings, and Unemployment Rate represent high-impact events.

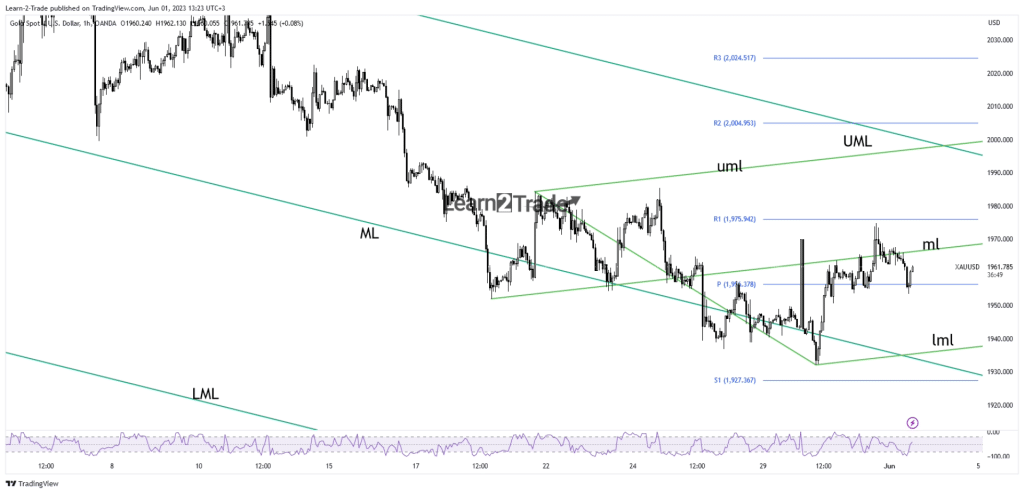

Gold price technical analysis: Downside pressure

As you can see on the hourly chart, the price dropped a little. However, the metal has found support right below the weekly pivot point of $1,956.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

As long as it stays above this level, XAU/USD could approach at least the minor ascending pitchfork’s median line (ml). This stands as a dynamic resistance.

A valid breakout through this obstacle activates further growth towards yesterday’s high of 1,974 and up to the R1 (1,975). Only staying below the median line (ml) and making a new lower low activates an important drop.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.