- The downside pressure remains high, so this could be only a temporary rebound.

- The US data could be decisive later today.

- After its strong drop, a rebound was natural.

The gold price rallied in the last hours, trading at $1,957 at the time of writing. The precious metal has been well above the daily low of $1,932. The metal has erased yesterday’s losses.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

However, the downside pressure still persists. The XAU/USD edges higher as the Dollar Index slipped today after reaching 104.53. DXY’s correction should weaken the USD. That’s why Gold turned to the upside.

Fundamentally, Switzerland’s GDP rose by 0.3%, beating the 0.1% growth estimated, while Spanish Flash CPI reported a 3.2% growth versus the 3.6% growth predicted.

Still, the most important event of the day is represented by the United States CB Consumer Confidence, which could drop from 101.3 points to 99.1 points.

Poor US data should weaken the greenback and may lift the XAU/USD. In addition, the HPI and the S&P/CS Composite-20 HPI indicators will be released as well.

Tomorrow, the US JOLTS Job Openings, Canadian GDP, German Prelim CPI, Australian CPI, and the RBA Gov Lowe Speaks represent high-impact events. These could really shake the markets.

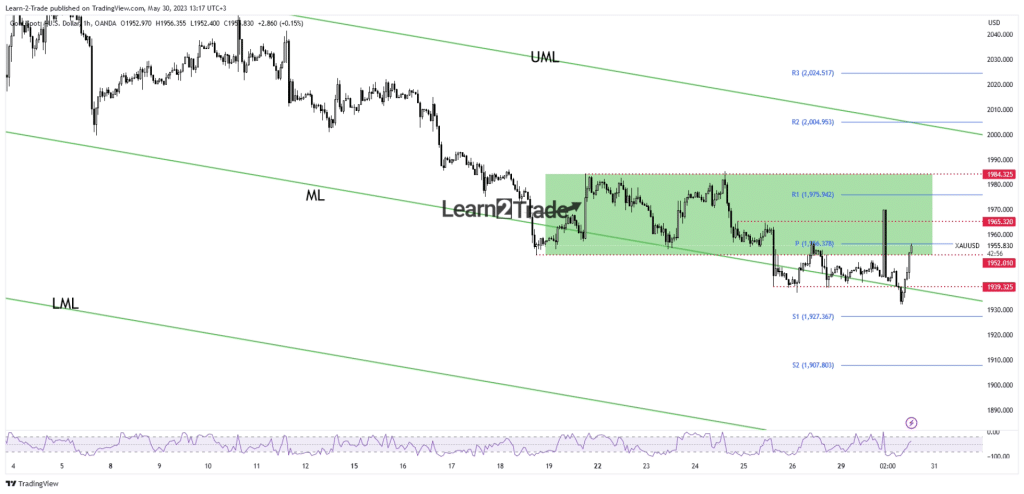

Gold price technical analysis: Rebounding to the old range

From the technical point of view, the XAU/USD dropped once again below the median line (ML). However, it has failed to stay there. The yellow metal has registered a new false breakdown below $1,939, and now it challenges the $1,952 and the weekly pivot point of $1,956.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

Failing to stay below the median line (ML) announced exhausted sellers. After its strong downside movement, the yellow metal tries to recover. The $1,965 and $1,984 represent upside obstacles as well. Still, talking about a larger rebound is premature as the selling pressure remains strong in the short term.

Gold could retest the near-term resistance levels before turning to the downside. Temporary rebounds could bring new short opportunities.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.