- With the decline in Chinese stock, gold prices seem to be higher while triggering risk aversion.

- Beijing restricted the ed-tech firms from going public which spoiled market expectations.

- Spotlight now turns to the FOMC meeting this week when the US Dollar is offering conflicting influences.

The gold price is stable near the $1800/oz figure and the traders apparently caught among contrasting influences. First, there is a bit of risk aversion that reduces the bond yields. Second, reduction in bond yields is offering relative support to non-yielding bullion that drove sanctuary interest for the US Dollar. That risk undercut the allure against the fiat alternatives.

–Are you interested to learn about forex bonuses? Check our detailed guide-

The trend was considered recovering last week but this dynamic turned around. The quotes sharply rose while the yield bend steepened where the US dollar retrace its way. However, that news was not considered for looking at gold prices as it delivers another set of contrasting capital flows. So, it is not surprising that the Gold is still stuck in its natural region.

Now people are looking forward to the FOMC meeting this week. Naturally, the business sector is eager to sectionalize the Fed’s guide to understand the upshift in circumstances of stimulus withdrawals. But, unfortunately, the rise in prices overshoots the forecasts and threatens the buying power of the consumers. That’s why it’s becoming stickier and worrisome than the authorities had expected.

Hence, it’s a quiet day as the economic calendars are concerned with no major trend development. However, minor lasting liquidity can boost the US Dollar and cap the gold gains. As Beijing has restricted education technology firms opening up to the world, there is a sharp decline in the Chinese shares. It is more likely to be a culprit for making a profit or raising capital. The sector is valued at nearly $100 billion.

–Are you interested to learn more about forex options trading? Check our detailed guide-

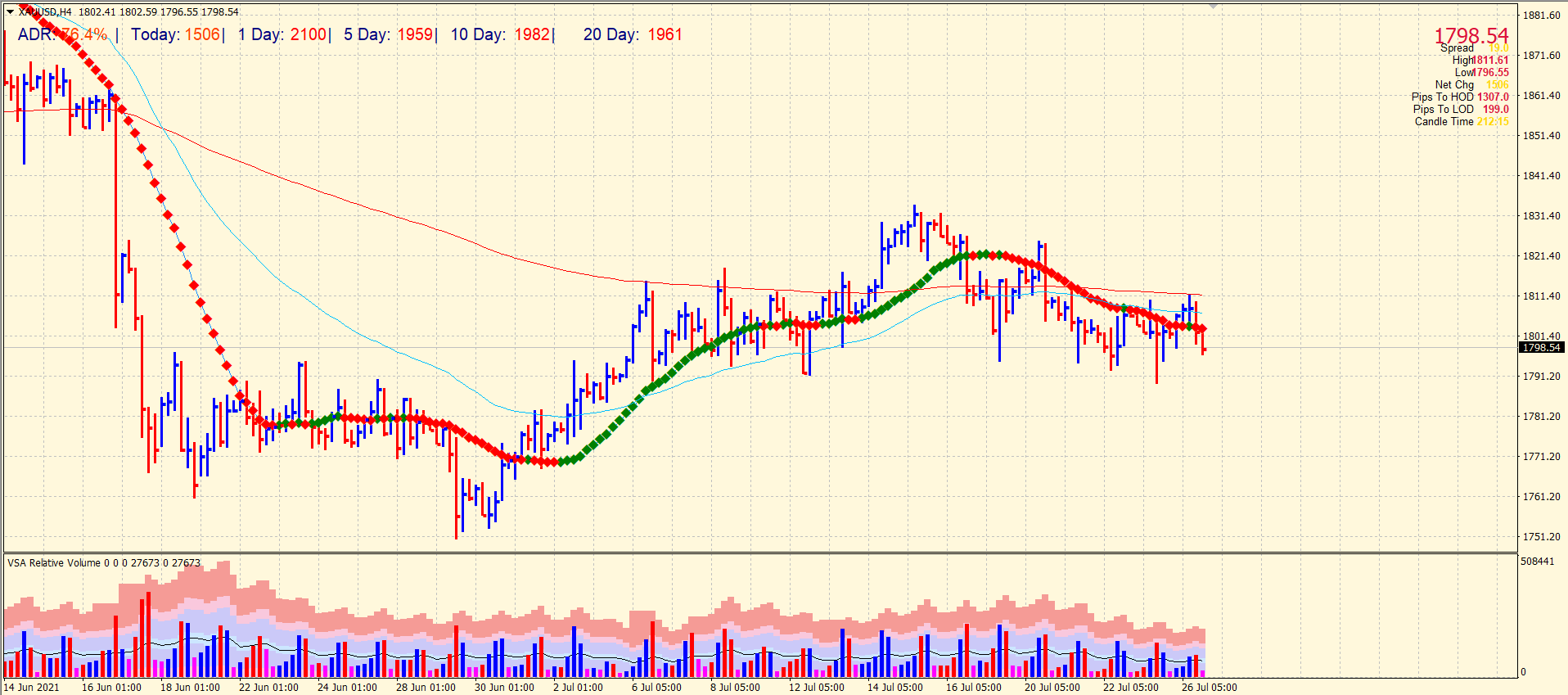

Gold price technical analysis: Bears’ strength looks limited

The prices of Gold are facing a decline after forming a bearish Evening Star Candlestick Pattern. But the break of near-term support in the 1797.63-1808.40 zone is unpredictable at the moment. An infringement is confirmed on regular terms that might be visible at 1755.50-64.73 area next.

Having an overlook, a strict resistance sits above the latest swing top, and it has attained a sharp rise to 1870.75. If the gold prices manage to maintain their foothold above the resistance, there is a chance of a rise to June’s high at 1916.53 probably.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.