- For the second week in a row, gold closed higher by more than 2%.

- In addition to rising US T-bond yields, the dollar’s strength could limit XAU/USD’s upside potential.

- A breakout above key resistance would confirm a bullish outlook.

The gold price weekly forecast is bullish as the higher global inflation has raised the demand for yellow metal as a safe-haven asset.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

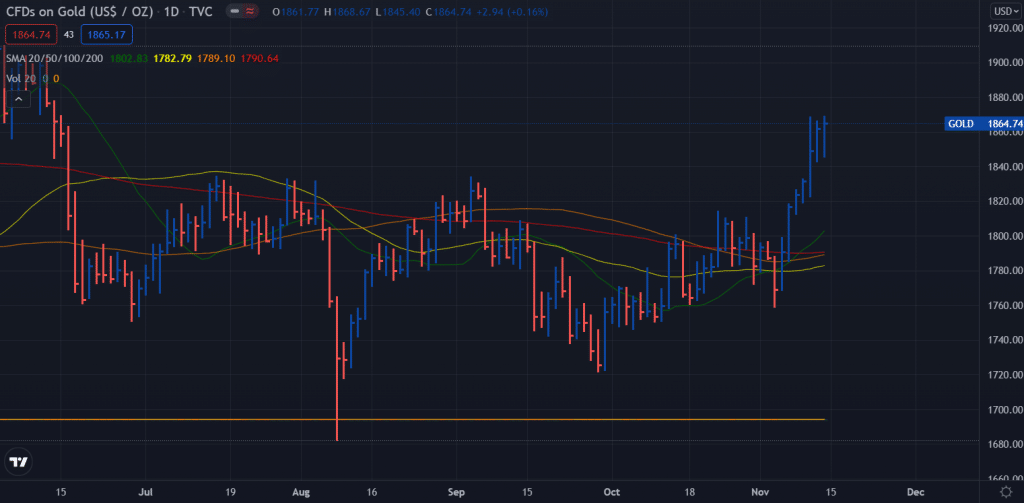

Gold continued to rally on Monday and Tuesday after the previous week’s strong close, but it lost its bullish momentum near $1,830. As US consumer inflation hit its highest level since 1990, XAU/USD rebounded, hitting its highest level since June at $1,868 on Wednesday. Although gold fell from that level, it closed in positive territory on Wednesday and Thursday before entering a consolidation phase on Friday. Gold has gained 2% over the past week.

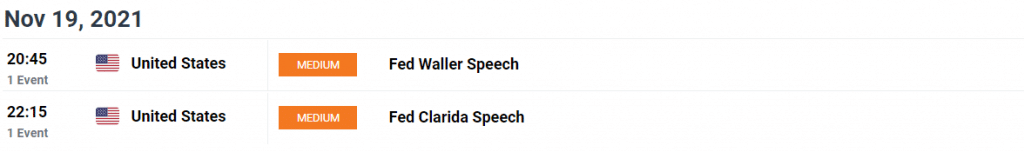

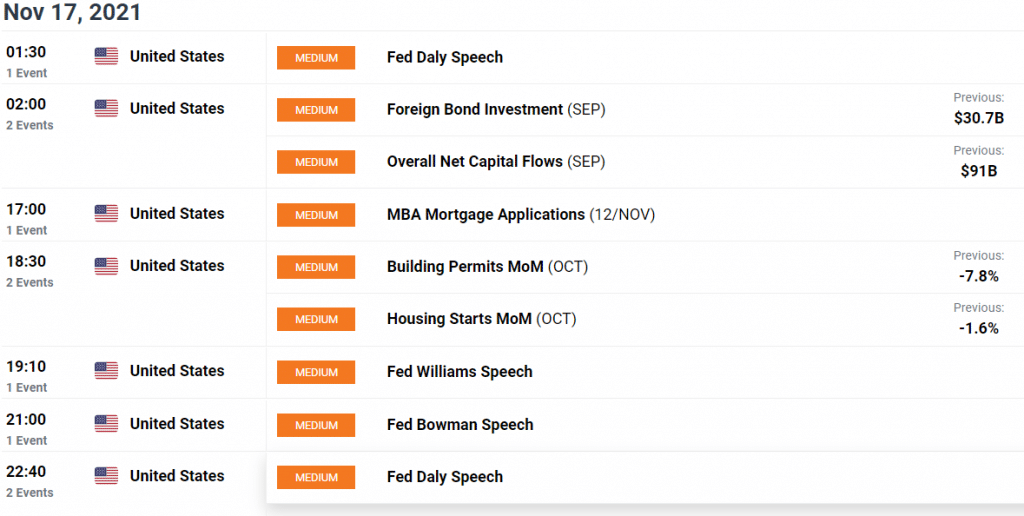

Gold rose earlier in the week when the yield on 10-year US Treasuries fell below 1.5% and fell more than 3% on the day. However, due to mixed comments about the Federal Reserve’s policy outlook, the dollar lost some interest in lacking high-level macroeconomic data. In an interview with Fox Business Network, St. Louis Federal Reserve President James Bullard said two rate increases are expected in 2022. Still, vice-chairman Richard Clarida said the benchmarks for rate increases may be met by the end of next year.

According to the US Bureau of Labor Statistics, the consumer price index (CPI) inflation rose 6.2% in October, the highest level since 1990. The core CPI, which does not include volatile food and energy prices, increased 4.6%, the highest level in three decades. Investors responded by raising rates earlier than expected, causing US Treasuries to rise in yield. Gold was in high demand as a traditional inflation hedge, so the inverse correlation between precious metals and US Treasury yields weakened.

Moreover, bullish momentum intensified after the key resistance area at $ 1,830 failed, and the XAU / USD pair reached a five-month high of around $ 1,870.

According to the University of Michigan, the consumer sentiment index fell to 66.8 on Friday, the lowest level since November 2011. According to the publication, one out of four consumers reported a decline in their living standards due to inflation in November, with lower incomes and older consumers having the greatest impact.

Key events/data for gold next week

The world’s second-largest economy is expected to report another slowdown in retail sales and industrial production on Monday. However, gold demand will rise if market sentiment deteriorates early in the week.

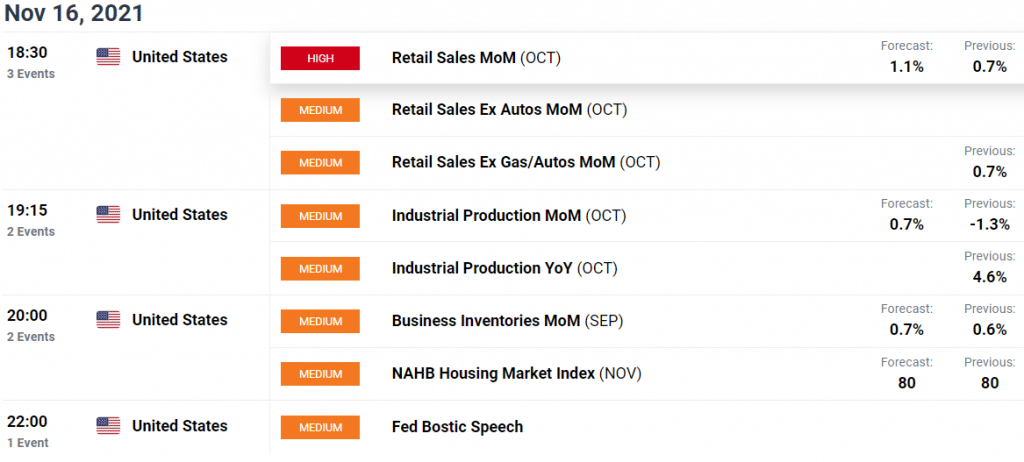

Retail sales data for October were released by the US Census Bureau on Tuesday. A weaker-than-expected inflation outlook could raise consumer concerns about inflation, leading to an increase in gold prices. However, a positive value could limit the upside potential of XAU/USD and help risk flows return to the markets.

Wednesday and Thursday will bring data on the consumer price index of the UK and the eurozone. Although data from Europe usually has no discernible effect on gold prices, it can highlight political divergence and pressure XAU/USD, strengthening the dollar against other major currencies. However, gold may remain resilient against the dollar if the CPI data show that price pressures are stronger than expected.

In summary, market participants will continue to focus on inflation and its implications for major central banks’ short-term policy outlook. Inflation control will be prioritized over economic support based on comments from FOMC executives. Despite unwelcome inflation, gold should continue to be a welcome asset, but the unwavering strength of the dollar is likely to allow XAU/EUR and XAU/GBP to perform better than XAU/USD.

–Are you interested to learn more about forex signals? Check our detailed guide-

Gold weekly technical forecast: Broken double top

The gold price weekly forecast is bullish after it broke the double top at $1,836 and formed fresh highs around the $1,865 area. This is a strong resistance area where the gold price is wobbling for now. If the price breaks the level, it may test highs of June 21 around $1,920. On the downside, the broken double top can provide immediate support to the metal.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.