- The inverse relation of gold and US yields remains in action.

- Risk aversion amid the new Covid variant helps gold buyers.

- US ADP and NFP reports are due next week that will provide fresh impetus to the market.

The weekly forecast for gold remains mixed as the Covid fears trigger safe-haven demand while rising US yields cap the gains.

The price of gold broke below last week’s trading range and continued to fall into the first half of this week amid a sharp spike in US Treasury bond yields. As a result, the price of XAU/USD dropped to its lowest level since early November on Wednesday at $1,778. XAU/USD rebounded sharply before the weekend, hovering around $1,800, but ended the week in negative territory for the second week in a row.

–Are you interested to learn more about spread betting brokers? Check our detailed guide-

During Monday’s US session, the 10-year US Treasury bond yield rose by over 5%. The yields of two-year government bonds rose further in the absence of high-level macroeconomic data. Joe Biden announced that he had reappointed Fed Chairman Jerome Powell for a second four-year term, reiterating his belief that the Fed may hike rates as early as June 2022.

The US Bureau of Economic Analysis reported Wednesday that the price index for basic personal consumption expenditure (PCE) increased by 4.1% year over year in October. Before Thanksgiving, the dollar remained strong and prevented XAU/USD from recovering its losses. Mary Daly, the head of the San Francisco Fed, said the Fed could accelerate asset cuts, noting that she wouldn’t be surprised if it hiked interest rates twice in the coming year.

Following Thursday’s sluggish market activity, gold prices rebounded on Friday as investors turned their attention to reports about the Coronavirus outbreak.

Before the weekend, a flight to safety was prompted by reports that current vaccines may not protect against a highly mutated variant of COVID found in South Africa. Pfizer said the vaccine would take about 100 days to manufacture, and several countries have decided to temporarily suspend flights from several African countries.

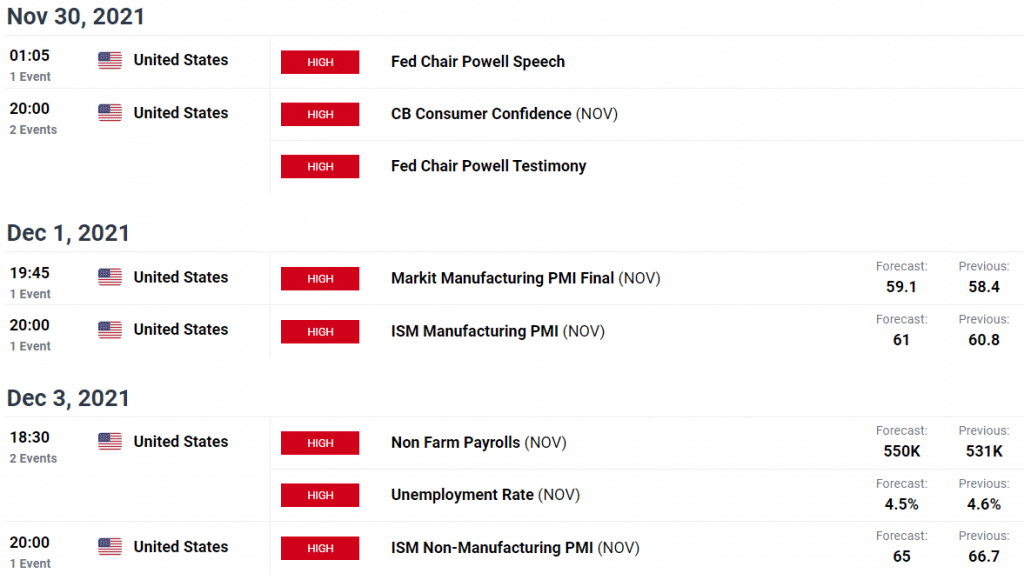

Key data/events for Gold next week

A report on consumer confidence will be released by the Conference Board in the US Business Journal on Tuesday. In addition, the impact of high inflation on consumer sentiment will be scrutinized by investors.

ISM manufacturing PMI and ADP employment changes will be reviewed before Friday’s November employment report. Stronger-than-expected non-farm employment growth could boost the dollar, but vaccine manufacturers may not be able to convince markets to accept the new option.

The comments of FOMC officials will also be critical before the Fed issues power outages on Saturday, December 4th. In the absence of Fed officials expressing patience in the face of new coronavirus fears, US Treasury bond yields may regain momentum and limit XAU/USD upside. However, gold may continue to gain strength if safe-haven inflows continue to dominate financial markets.

–Are you interested to learn more about South African forex brokers? Check our detailed guide-

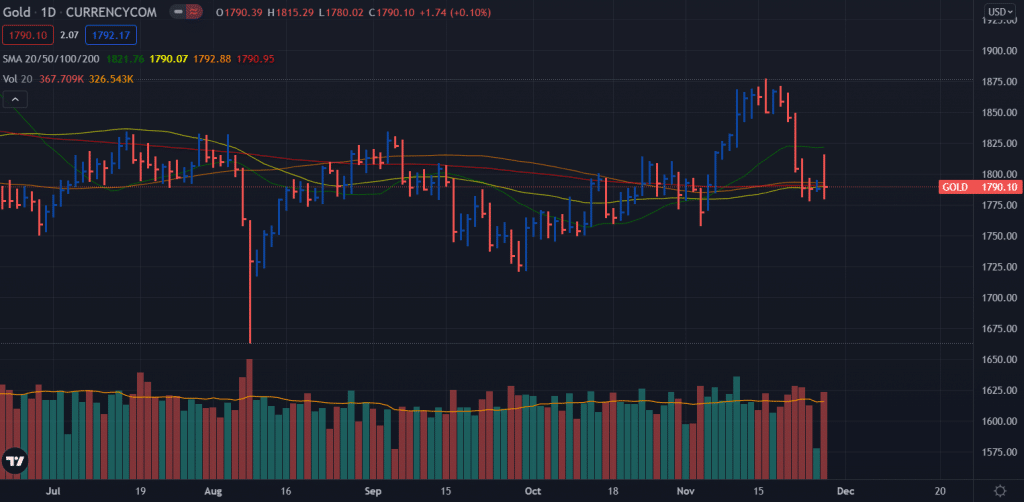

Gold price weekly technical analysis: Key SMAs to pause the bears

The daily chart of gold shows a bearish upthrust bar which indicates that the bulls failed to find acceptance. However, the price is now supported by the key daily SMAs. Breaking below the SMAs may lead towards $1,760 ahead of $1,720. On the upside, the $1,800 mark will be the key resistance ahead of $1,815.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.