EUR/USD rallied hard and almost touched 1.14. Was the latter move a correction on the way up? The beginning of a descent? And what levels should we be looking at?

The team at Morgan Stanley explains with 3 charts:

Here is their view, courtesy of eFXnews:

Morgan Stanley picks EUR/USD as its technical FX chart of the week where MS remains medium-term bearish and looks for selling opportunities. MS provides some important levels for this potential trade where traders should consider selling further rebounds and placing their stops or waiting for a clear confirmation on the resumption of the pair’s downtrend.

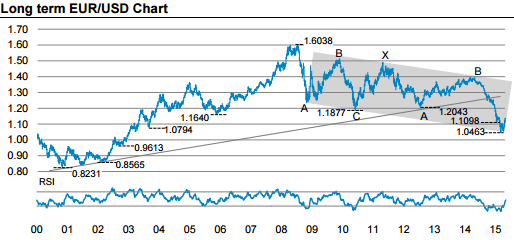

On the long term EUR/USD chart:

“EURUSD has rebounded from the lows around 1.05 and is now trading back in the multiyear trend channel. We remain bearish on the longer term given that the substructure is incomplete. However the longer term bearish picture remains and so, should the downside momentum return, we watch for breaks of the following key levels: 1.0463, 0.9613 then 0.8565,” MS notes.

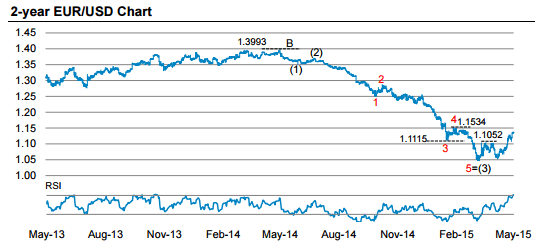

On the 2-year EUR/USD chart

“Having broken through the recent high at 1.1052, the upside momentum remained in EURUSD and we can now see a corrective rebound towards the 1.15 area. The break above the 3 rd wave low at 1.1115 suggested that the longer term (5)-wave structure was not yet complete. We note that a move above 1.16 could open the way towards 1.20 so would put a stop here,” MS adds.

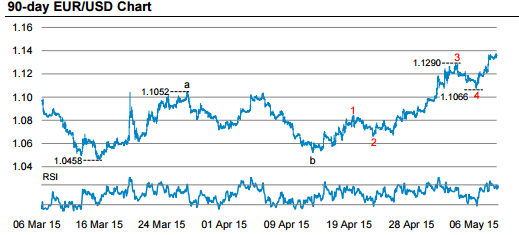

On the 90-day EUR/USD Chart

“In the short term EURUSD is in the 5 th wave of the broader (4)th wave correction. This suggests that EURUSD is likely to continue heading higher but that it remain limited. The move back below the 1.1290 (3-wave top) initially suggests that the 5th wave is complete. A move below the 4 th wave low at 1.1066 would confirm this and suggests EUR short positions,” MS advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.