As teh Fed is about to say its word, the team at Bank of America Merrill Lunch shifts its focus from EUR/USD to gold.

Here is an explanation with a chart:

Here is their view, courtesy of eFXnews:

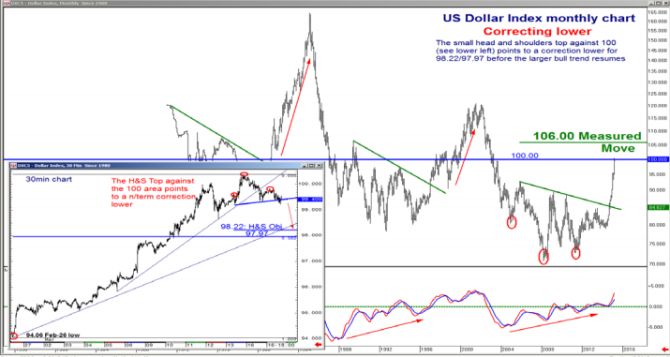

While Bank of America Merrill Lynch remains bigger picture USD bulls targeting 106 in the Dollar Index (DXY), and targeting 1.0283, potentially below) in EUR/USD, in the very near term BofA warns that evidence points to a USD correction in the DXY and against the EUR.

As such, BofA now advises clients to temporarily move to the sideline on EUR/USD.

“NOW, risk/reward is shifting against the USD. Specifically, EUR/USD has broken above key near term resistance in the form of the 20 period moving average on 240min charts (now 1.0568),” BofA clarifies.

“This moving average defined the downtrend since late Feb and its shift from resistance to support points to a near term turn in trend. Further supportive of the € is the fact that €/ £ has begun an impulsive advance from its Mar-11 low of 0.7014, pointing to further gains towards 0.7280 and potentially as far as 0.7405/0.7429,” BofA adds.

Turning to Gold, BofA notes that the stalling USD, the potentially completed “flat” correction from 1307 (Jan-22 high) and bullish momentum divergences all point to a base.

“A break of 1175 would confirm a base, while an impulsive break of 1200/1213 (intra-day channels & trendlines) targets 1307 and potentially beyond,” BofA argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.