As EUR/USD trades below 1.07, the question is: where now? Can we expect a bounce, that has been elusive so far, or a continued fall.

The team at BNP Paribas analyzes:

Here is their view, courtesy of eFXnews:

BNP Paribas’ consistent bearish EUR stance has been massively paying off for sometime now with BNPP hitting target in early January on its EUR/USD short from 1.2520 at 1.1820 and again today on its EUR/USD short from 1.1450 at 1.08. But BNPP doesn’t seem to have enough yet of this short trade.

Here is BNPP’s latest view on the direction of EUR/USD going into next week’s FOMC along with the details of its current short EUR/USD position.

‘Patient’ To Go Next Week:

“The dollar is likely to remain well supported on pullbacks now, with market participants increasingly anticipating the Fed may drop its “patient” language at next week’s FOMC meeting, setting the stage for a hike in June or September”, says BNPP.

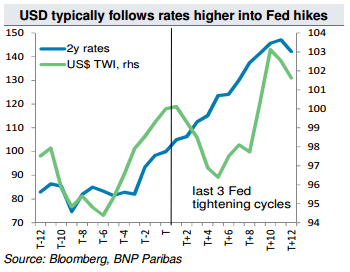

USD Set To Follow Rates higher:

Thus, as the USD has typically followed US front-end rates higher in the months heading into the start of a Fed rate hike cycle, BNPP believes that real yield differentials will move against the EUR and in favour of the USD during 2015, thus further weakening EURUSD.

“A breakdown of the real yield components reveals that rising inflation expectations in both the US and the eurozone are the key drivers of 2y real yields. At the same time, nominal yields in the two regions have diverged, as eurozone 2y rates hit new lows. This divergence likely reveals the different market implications of higher inflation in the US vs the eurozone,” BNPP clarifies.

Prescribed ‘Cocktail’ For Weaker EUR/USD:

“Amid this environment, rising inflation expectations merely have the effect of taking real yields more negative, thus weakening the EUR,” BNPP adds.

All in all, BNPP argues that the combination of these two factors (rising US yields and EZ inflation expectations) is ‘the prescribed cocktail that will push the EURUSD even weaker’.

EUR/USD: The Trade.

BNPP maintains short EUR/USD from 1.1450, extending the target today on this trade to 1.05 from 1.08 and trailing the stop to 1.10 to lock in roughly 4% gains.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.