EUR/USD is on the back foot amid the dollar’s renewed strength on a March rate hike and political uncertainty in Europe.

Here is their view, courtesy of eFXnews:

President Trump’s administration has taken aim at Germany recently, stating that it was keeping the euro too weak. That’s hard to square with the fact that Germanic members of the ECB continue to argue that monetary policy is too loose and the euro could actually see strength later this year as political risks diminish.

In the near term those political risks will make investors wary of holding the euro.

In the Netherlands, while the far right PVV are set to become the largest party, without coalition partners their leader Geert Wilders won’t be able to become PM. French elections could cause more uncertainty, at least until after the first round of votes on April 23rd, with far right leader Le Pen gaining in the polls. However, a second round of either Macron or Fillon going head-to-head with Le Pen should result in a more centrist victor, and ease downside pressure on the currency from political uncertainty.

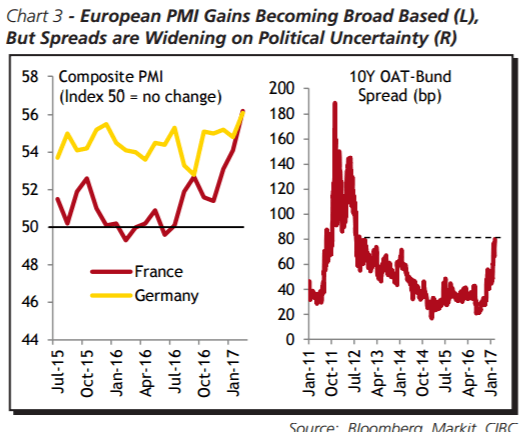

After that, markets should start to focus more on the improving growth and inflation trends within the region. The latest composite PMI reached its highest level since 2011, with indications also that growth is becoming more broad-based across the region.. While GDP growth is fairly moderate still, it’s above the potential growth rate for the region at present. With the 5Y5Y measure of market-based inflation expectations having briefly hit 1.8% as well, it seems likely that the ECB will taper asset purchases further after the end of the year and/or end purchases completely in 2018.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Uncertainty surrounding the French elections could see OAT-Bund spreads widen further towards 100 bps and see the euro re-testing year-to-date lows around 1.04.

However, on the assumption that the French election does not see Le Pen assuming power in May, the euro should perform well in the second half to reach 1.12 by year-end.