A sigh of relief, as it could have been worse given the Markit services PMI. The ISM Non-Manufacturing PMI came out at 53.4 points, within expectations. However, the employment component fell to negative territory: 49.7 points, worse than 52.1 in January. This casts a shadow on the NFP.

The dollar enjoyed some bids, but this was short-lived. The Markit figure triggered a big USD sell-off.

The US ISM Non-Manufacturing PMI was expected to slip to 53.2 points in February. In January, this services sector measure fell to 53.5 and it hurt the dollar quite a lot. This is also a big hint towards tomorrow’s Non-Farm Payrolls.

The US dollar was on the back foot towards the publication.

Data (updated)

- ISM Non-Manufacturing PMI: previous 53.5, expected: 53.2, actual: 53.4, within expectations.

- Employment Component: Falls to 49.7, in contraction territory, quite worrying

- New orders tick down from 56.5 to 55.5

- Business activity is up quite sharply from 53.9 to 57.8.

- Prices are down to 45.5, the lowest since 2009.More here.

- Factory Orders: prev. -2.9%, exp. +2%, actual: +1.6%.

- Markit Final Services PMI: prev. 49.8, exp. 49.8, actual 59.7 – this was a big warning sign for the ISM number.

- Jobless claims (earlier): prev. 272K, exp. 271K, actual: 278L

Currencies

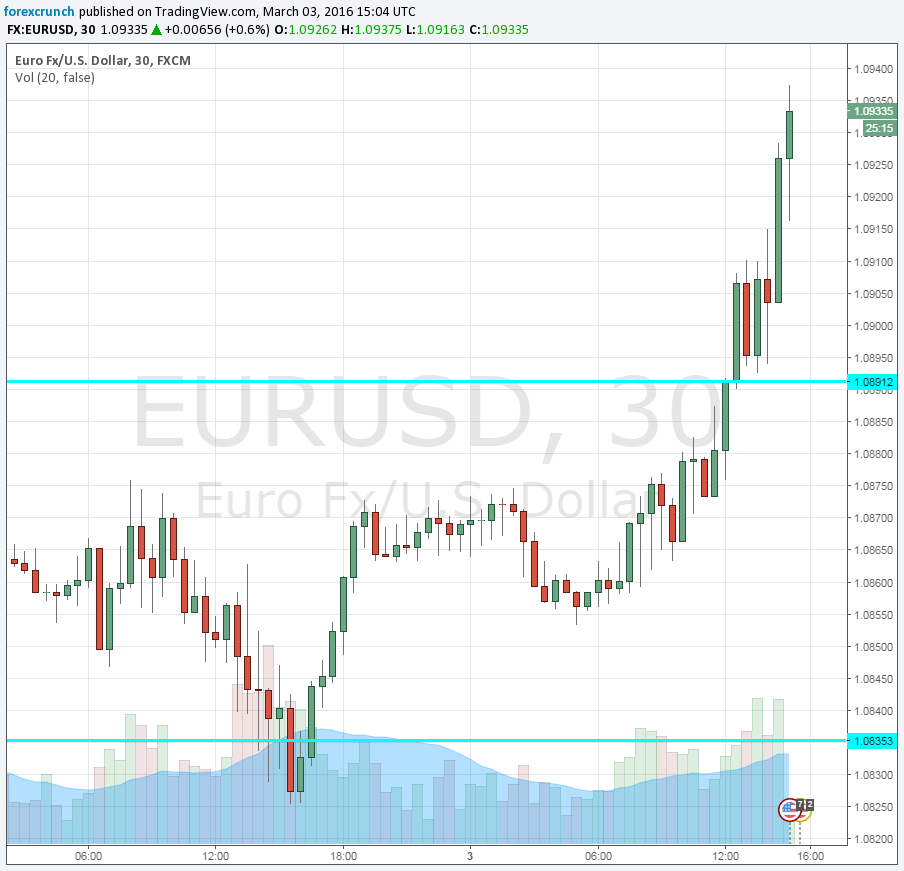

- EUR/USD traded just above 1.0920, rising from the lows seen after the poor inflation figures early in the week.After a dip, EUR/USD extends its gains to 1.0937 and then slides. It’s a messy market out there.

- GBP/USD traded at 1.4130, despite a third disappointing PMI. Cable moves around and slides to 1.4120.

- USD/JPY fell under 114 to around 113.80. In the aftermath it is around 113.60 with choppy trading.

- USD/CAD was around 1.3450 as oil prices slid from the highs. A further slide was halted.

- AUD/USD felt comfortable on high ground, around 0.7340.The pair holds its ground.

- NZD/USD ticked above 0.67. The kiwi is slightly higher.

Tomorrow’s Non-Farm Payrolls report is now the main event.