The US dollar was suffering badly before the publication, on dovish comments and despite good data and now it is suffering even more on bad data. What falls on good data crashes on bad data.

Update: Dollar Dives – Updates on EUR, JPY, GBP, CAD, AUD, NZD

The ISM Non-Manufacturing PMI came out at 53.5 points, worse than 55.1 expected and 55.8 seen last month. An ominous sign comes form the employment component, which totally crashed from 56.3 to 52.1 points. New orders are slightly down to 56.5 points.

The services sector is the largest in the US, and this top-tier purchasing managers’ indicator is a highly regarded indicator for the jobs report. We may still have an OK NFP, but the feeling is that eventually jobs will catch up with reality: poor growth.

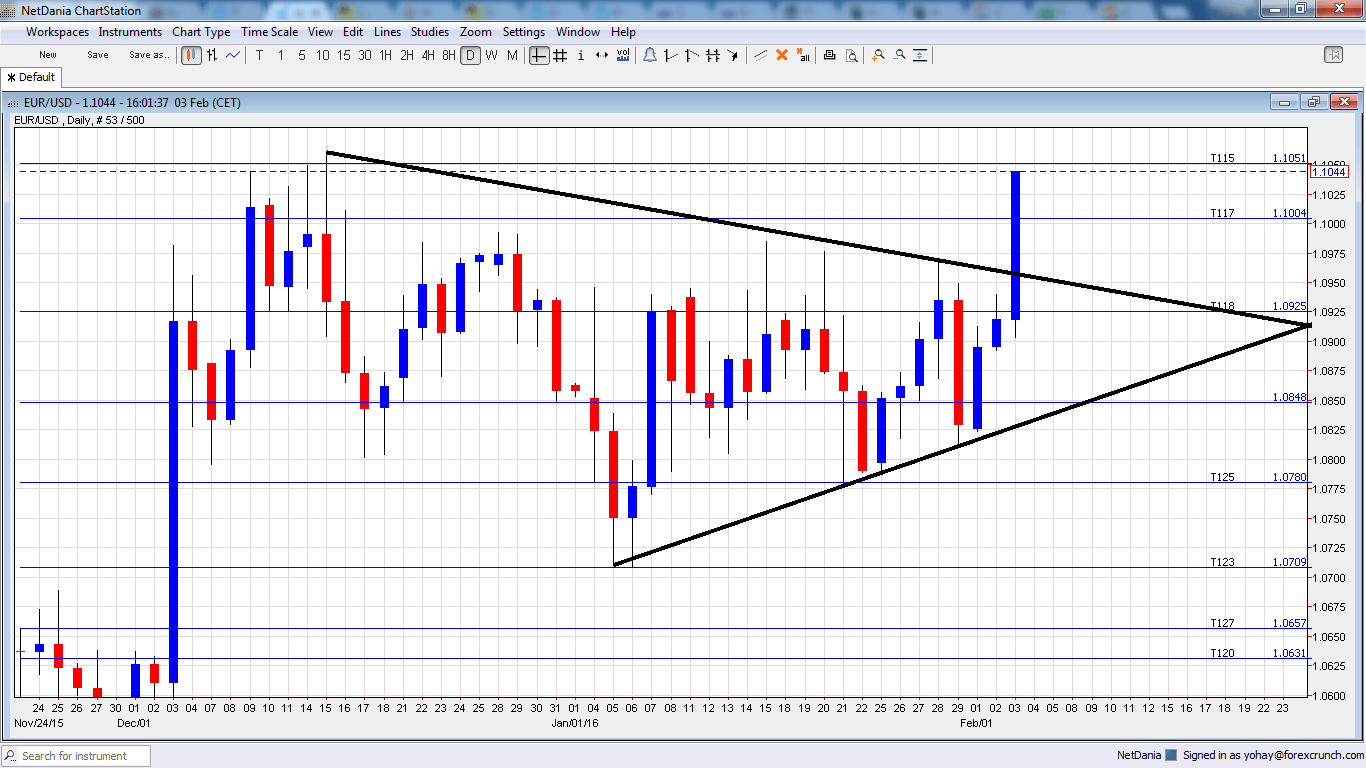

Just look at EUR/USD, which is extending its gains after breaking above downtrend resistance.

Also other currencies are making nice gains against the dollar. USD/CAD is a clear example, with the lowest in a month and around 900 pips down from the highs seen a few weeks ago. Also the kiwi, enjoying a strong employment report, is surging ahead with over 0.66. Only the Aussie is lagging behind, trading under 0.71. Silver stands out with new highs while gold is also showing some strength.

Also the pound and yen are running higher against the greenback. It seems that a rate hike in March is all but dead.

More: Making sense of turbulent markets – MM #88