Will we indeed see helicopter money in Japan? And what is going on with the euro? The team at Barclays has some answers:

Here is their view, courtesy of eFXnews:

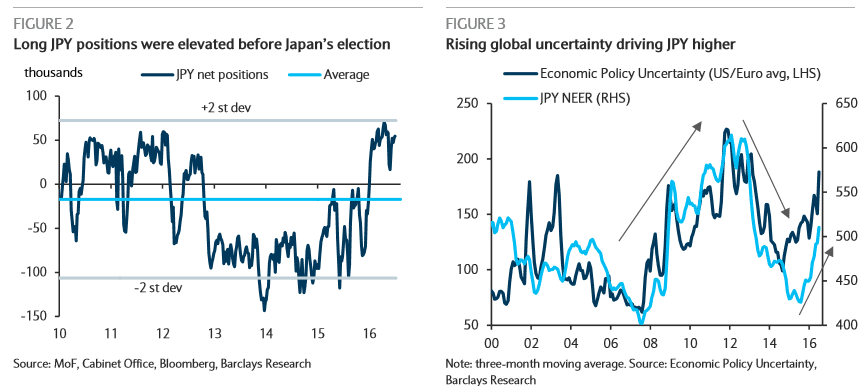

JPY: Helicopter money in Japan is unlikely and would undermine the JPY’s store of value. The risk of disappointment is risingas fundamental drivers of JPY appreciation, including undervaluation; the benefit of the JPY as portfolio risk mitigation amid heightened uncertainty; and strong relative fundamentals, remain inta

Furthermore, a sharp rise in global economic uncertainty is likely to work as a significant headwind to any policy measures to weaken the yen, as was the case in January with the adoption of negative rates, in contrast to 2012-2014 when Abenomics policy worked quite strongly with the tailwind from a favorable global backdrop.

Barclays targets USD/JPY at 92 by the end of Q3.

EUR: While we do not expect any policy easing from the ECB this Thursday, the tone should be dovish and there may be some technical revisions to ensure the current QE programme can continue unrestrained. Overall, we think this is likely to keep downward pressure on the EUR. The message from ECB President Draghi should be consistent with our view that the central bank will announce a time extension to its QE programme to September 2017 from March 2017, in response to the negative growth effect associated with Brexit.

Our economists revised their estimate for 2016 and 2017 euro area GDP growth to 1.4% (previously 1.7%) and 0.4% (previously 1.8%), respectively, and this week’s July euro area “flash” PMIs (Friday) will also be important in informing this view. We project composite output index to fall 0.8 points, to 52.3, its lowest level since 2014, dragged down by manufacturing. We expect services to be slightly more resilient, as international trade dependent firms are likely to be more timorous.

Barclays targets EUR/USD at 1.07 by the end of Q3.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.