Idea of the Day

The CAD has been the weakest currency on the majors so far this year, USDCAD rising to a 4 and a half year high above the 1.10 level. In two years, we’ve seen US exports of crude and petroleum to Canada double in value terms. That’s a huge shift as the US becomes less dependent on foreign imports for energy. But this naturally threatens Canada’s ability to piggy-back off the better US growth outlook by exporting energy products to its biggest trading partner. So the risks on the loonie are for more weakness near-term and leading to a sustained push above the 1.10 level on USDCAD. The BoC aren’t seen shifting their stance today, but statement and press conference could offer some clues on the potential for a shift later this year.

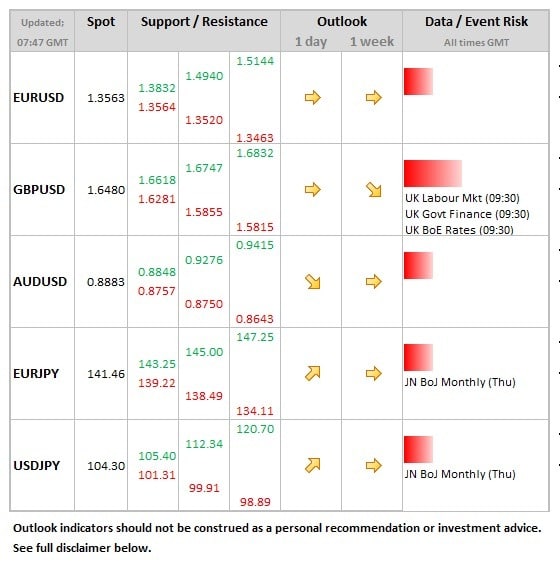

Data/Event Risks

GBP: The labor market data a key focus gave the far sharper fall in the unemployment rate (down to 7.4%) seen recently. The BoE are expected to revise their 7.0% ‘intermediate threshold’ in next month’s inflation report, but sterling would still likely be supported by further fall in rate (expected at 7.3%) if seen today.

CAD: Rate decision at 15:00 GMT. No change expected, but a greater focus on the potential for a shift in tone in the statement given the recent weakening of economic prospects.

Latest FX News

AUD: A spanner in the works for Aussie bears, with inflation stronger than expected at 2.7% in Q4. Both underlying measures (trimmed and weighted means) were also firmer, both rising from 2.3% to 2.6%. This goes against the grain of recent softer domestic data. The Aussie jumped to near 0.89, from 0.88 prior to the release.

GBP: Sterling still favoured in a weaker dollar environment as the Bank of England has been caught short in terms of its forward guidance. This has allowed cable to largely maintain the uptrend, even though we’ve seen a more consolidative tone so far this year. EURGBP is the more solid downtrend for now.

Further reading: