There are two schools of thought with regards to the dollar and the US shutdown. The first is that this is the way things work in the US, it may appear strange to outsiders, but invariably things work out in the end. The second is that markets are being very complacent about the risks, given that not only is the US government effectively shut-down, but the US is also around ten days from default given that there is no approval on the raising of the US debt ceiling.

The measure of equity market implied volatility (a measure of uncertainty) has risen to near 4 month highs. But a similar measure for FX (CVIX from Deutsche) is near the lows of the range seen over the past 6 months. This contrasts with the summer of 2011, when the two measures were a lot more tightly correlated. So FX markets appear to be fairly complacent about the risks in comparison to equities, or could be thinking that the FX implications are limited, but with the dollar bullish set-up once again undermined, the uncertainties in FX look to be far greater now vs. 3 months ago.

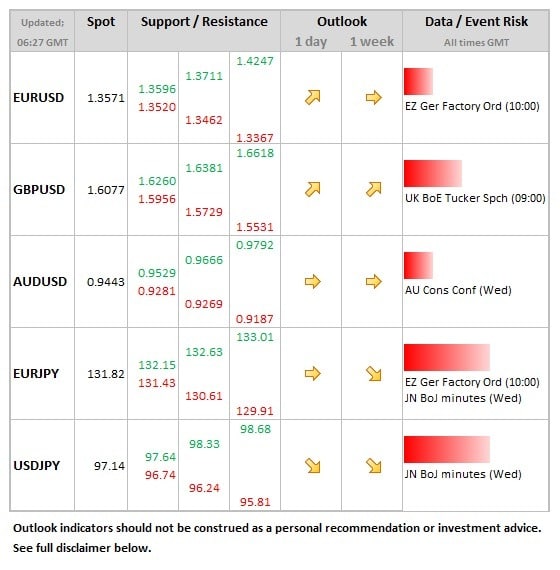

Data/Event Risks

EUR: Just German factory orders data today, but this is a low risk event for the single currency.

GBP: Worth keeping an eye on BoE deputy governor who appears before parliament this morning, but likely to be more focused on financial stability issues, so low risk for sterling.

Latest FX News

JPY: The yen continues to be the primary beneficiary from the deadlock being seen in the US, so trading a lot more like the safe haven currency that has been the norm in recent years.

EUR: Tight ranges have continued for EURUSD, but EURJPY continues to head south as the yen benefits from its safe haven status, currently near a 1-month low at 131.15.

AUD: A sign of the shifting dynamics of FX markets is the fact that the Aussie has held up so well in the face of the uncertainties surrounding the US, having kept pace with the yen’s gain. This is the opposite of what we could have expected in the risk-on/risk-off world of last year.

Further reading:

Financial markets surprisingly calm despite US default threat